Assessing Solvac (ENXTBR:SOLV) Valuation After Recent Share Price Uptick

Reviewed by Simply Wall St

Solvac (ENXTBR:SOLV) has found itself on the radar lately, with its shares nudging upward in recent weeks. While there is no single event behind this shift, the move might catch investors' attention and raise questions about whether something is brewing beneath the surface. Sometimes, when a stock starts gaining ground without a headline-driving event, it signals changing perceptions or subtle developments within the company or industry.

This uptick follows a stretch where Solvac’s longer-term track record has been fairly steady, though not without some setbacks. Shares are up nearly 2.6% in the past month and have gained 7.5% over the past 3 months, though the one-year figures still show a slight decline. Compared to three and five-year total returns, which remain positive, recent momentum could suggest a possible turning point or a renewed look by the market at Solvac’s fundamentals.

Now that shares are gaining some steam again, the question is whether this price action points to an undervalued opportunity or if the market is already anticipating future growth.

Price-to-Earnings of 16.1x: Is it justified?

Based on the price-to-earnings (P/E) ratio, Solvac currently trades at 16.1 times its latest earnings. This is lower than both its European chemicals industry peers, which average 20.8x, and the broader peer average of 16.5x. This suggests the stock may be attractively valued compared to companies in the same sector.

The P/E ratio compares a company's share price with its annual net earnings, providing a snapshot of how much investors are willing to pay today for a euro of earnings. It is a widely used metric, especially for established businesses with stable profits, and helps investors determine whether a share is expensive or a bargain relative to industry trends and growth prospects.

With Solvac's P/E below the industry and peer benchmarks, the market may be underpricing the company's recent sharp profit growth and improved earnings quality. This could reflect lingering caution or overlooked positive momentum in its fundamentals.

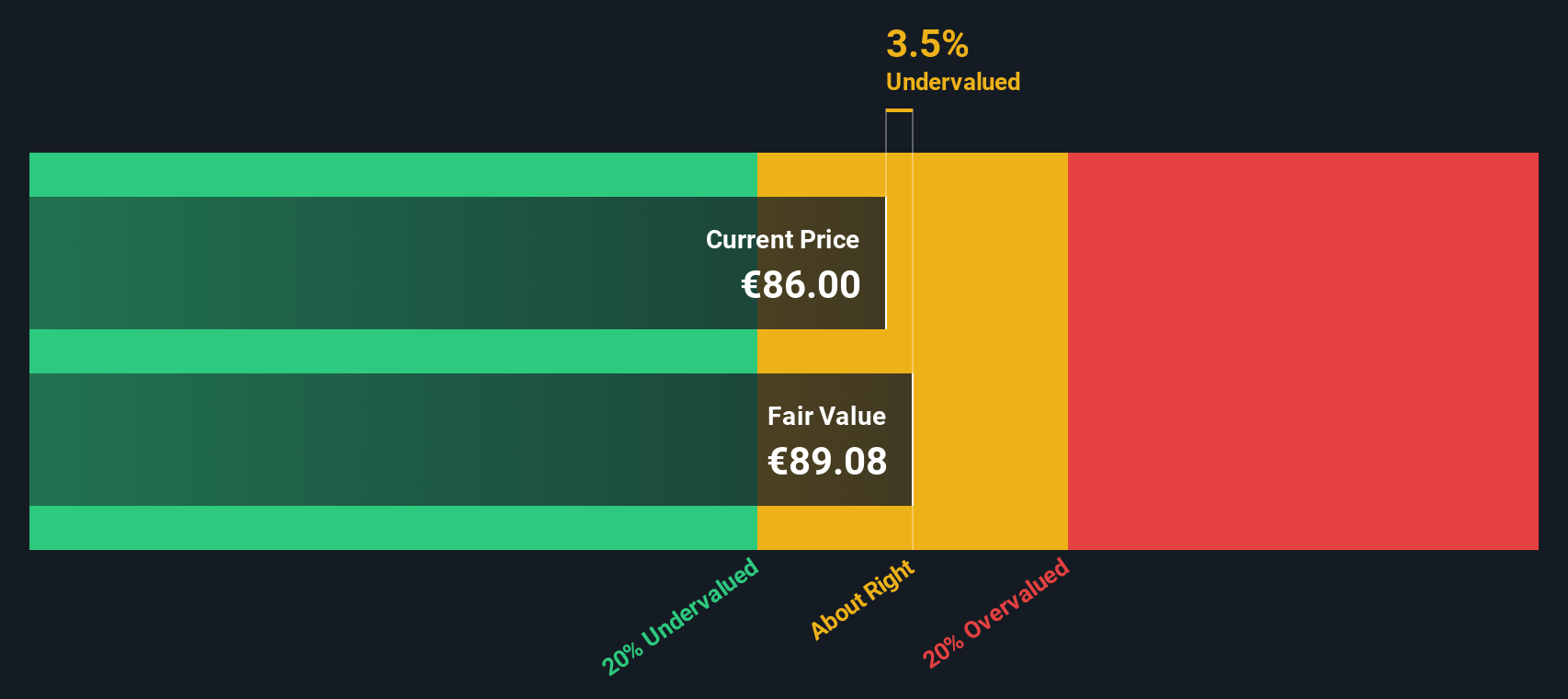

Result: Fair Value of €94.8 (ABOUT RIGHT)

See our latest analysis for Solvac.However, risks remain if profit growth slows or if broader market sentiment weakens. Either of these factors could cap further gains in Solvac’s share price.

Find out about the key risks to this Solvac narrative.Another View: Discounted Cash Flow Perspective

Looking at Solvac from the standpoint of our SWS DCF model provides another angle, suggesting that shares may actually sit slightly above fair value. Does this mean the market sees more upside, or is it getting ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Solvac Narrative

If you see things differently or want to draw your own conclusions, you can dive into the data and craft your perspective in just a few minutes. Do it your way.

A great starting point for your Solvac research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your investment strategy to just one company when opportunities are popping up all around you. Get ahead of the crowd and position yourself for smarter, better-informed decisions by checking out these handpicked market themes:

- Unlock potential with companies offering robust yields and consistent payouts by checking out dividend stocks with yields > 3%.

- Tap into emerging industries by screening for standout businesses at the forefront of artificial intelligence with AI penny stocks.

- Stay a step ahead and hunt for stocks trading below their intrinsic worth using our tool for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTBR:SOLV

Solvac

Operates as an advanced materials and specialty chemicals company in Belgium.

Solid track record and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)