- Belgium

- /

- Healthcare Services

- /

- ENXTBR:FAGR

Fagron NV's (EBR:FAGR) CEO Will Probably Find It Hard To See A Huge Raise This Year

Key Insights

- Fagron will host its Annual General Meeting on 13th of May

- Total pay for CEO Rafael Padilla includes €539.9k salary

- The total compensation is similar to the average for the industry

- Fagron's three-year loss to shareholders was 1.7% while its EPS grew by 5.3% over the past three years

In the past three years, shareholders of Fagron NV (EBR:FAGR) have seen a loss on their investment. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 13th of May could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Fagron

How Does Total Compensation For Rafael Padilla Compare With Other Companies In The Industry?

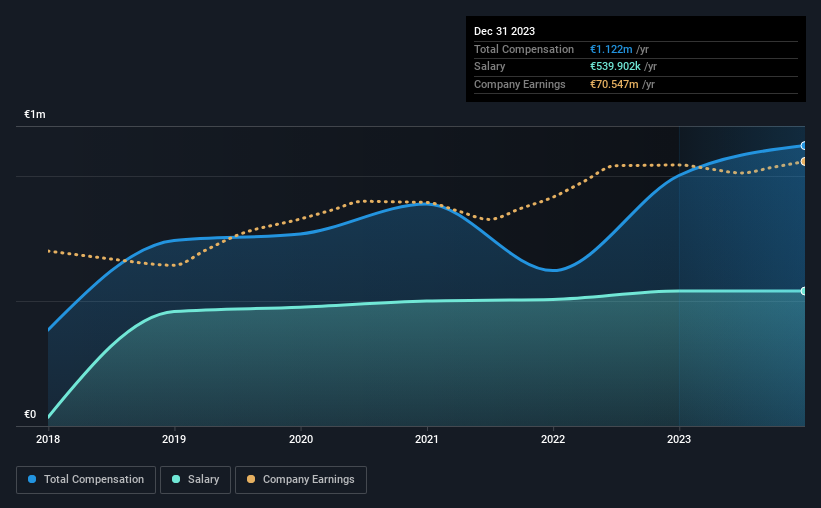

According to our data, Fagron NV has a market capitalization of €1.3b, and paid its CEO total annual compensation worth €1.1m over the year to December 2023. Notably, that's an increase of 12% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €540k.

In comparison with other companies in the Belgium Healthcare industry with market capitalizations ranging from €929m to €3.0b, the reported median CEO total compensation was €1.3m. From this we gather that Rafael Padilla is paid around the median for CEOs in the industry. Moreover, Rafael Padilla also holds €1.8m worth of Fagron stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €540k | €540k | 48% |

| Other | €582k | €462k | 52% |

| Total Compensation | €1.1m | €1.0m | 100% |

Talking in terms of the industry, salary represented approximately 54% of total compensation out of all the companies we analyzed, while other remuneration made up 46% of the pie. Fagron sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Fagron NV's Growth

Fagron NV has seen its earnings per share (EPS) increase by 5.3% a year over the past three years. Its revenue is up 12% over the last year.

We think the revenue growth is good. And the modest growth in EPS isn't bad, either. So while performance isn't amazing, we think it really does seem quite respectable. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Fagron NV Been A Good Investment?

Given the total shareholder loss of 1.7% over three years, many shareholders in Fagron NV are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Fagron that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:FAGR

Fagron

A pharmaceutical compounding company, delivers personalized pharmaceutical care to hospitals, pharmacies, clinics, patients, and worldwide.

Very undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)