- Belgium

- /

- Healthcare Services

- /

- ENXTBR:FAGR

Brazilian M&A Clearances and Q3 Results Might Change The Case For Investing In Fagron (ENXTBR:FAGR)

Reviewed by Sasha Jovanovic

- Fagron reported solid third quarter results, with 6.4% revenue growth and a confirmed full-year outlook, and announced Brazilian competition authority clearance for the acquisitions of Purifarma and Injeplast, advancing its M&A strategy in Latin America.

- The regulatory clearance and operational improvements, including completed corrective actions at the Wichita facility, position Fagron to expand its product range and enhance profitability across its global operations.

- We’ll examine how the addition of Purifarma and Injeplast, now cleared in Brazil, may reshape Fagron’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Fagron Investment Narrative Recap

To be a Fagron shareholder, you need to believe in the company’s ability to drive long-term growth through international expansion and operational improvements, while managing supply chain and regulatory risks. The recent clearance of its Brazilian acquisitions supports the most important short-term catalyst, integration of new assets to lift profitability, but does not significantly change the biggest current risk: the expected decline in North American momentum now that temporary GLP-1 drug shortages have eased.

Among recent company developments, the regulatory clearance for Purifarma and Injeplast in Brazil is particularly relevant, as it enables Fagron to immediately broaden its product range and customer base in Latin America, a key catalyst for potential revenue and profit growth as short-term tailwinds subside.

However, with FX volatility in core non-EU markets still a concern, investors should be aware that currency swings may affect reported results…

Read the full narrative on Fagron (it's free!)

Fagron's outlook anticipates €1.1 billion in revenue and €141.6 million in earnings by 2028. This scenario assumes a 7.4% annual revenue growth rate and a €55.9 million earnings increase from the current €85.7 million.

Uncover how Fagron's forecasts yield a €24.84 fair value, a 22% upside to its current price.

Exploring Other Perspectives

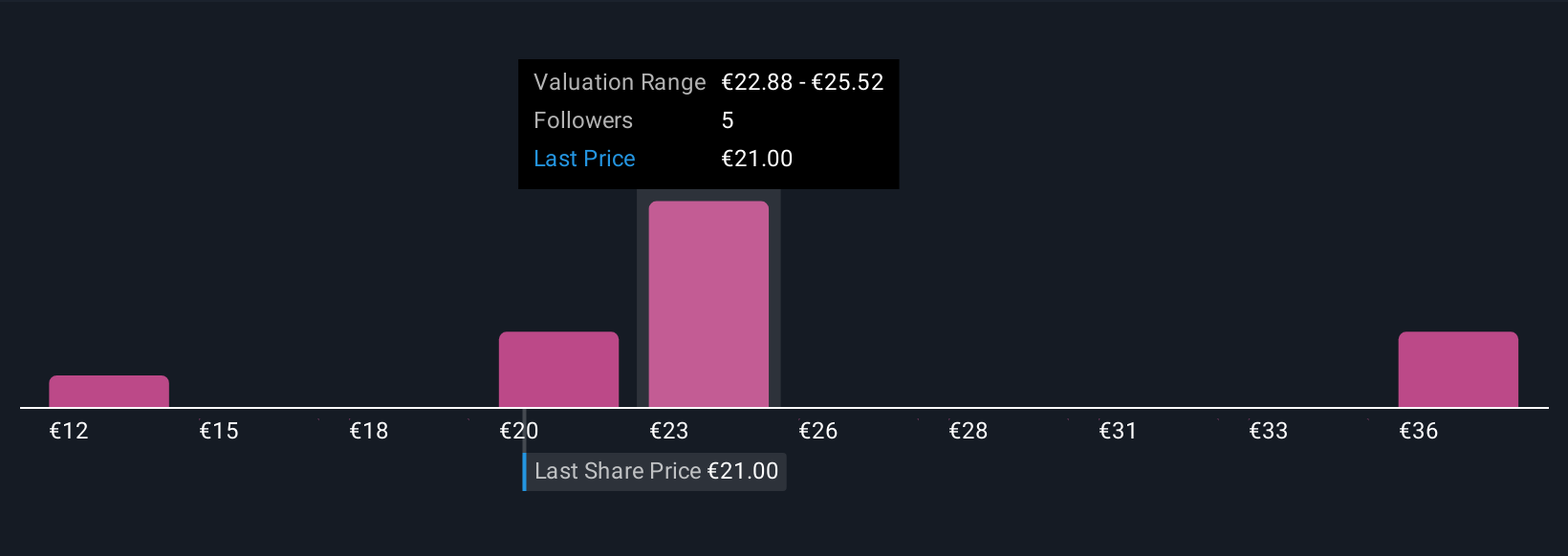

Fair value estimates from 5 Simply Wall St Community members range from €12.30 to €57.34 per share. As you weigh these diverse views, keep in mind that successful integration of recent acquisitions could be crucial for Fagron’s future profitability and market perception.

Explore 5 other fair value estimates on Fagron - why the stock might be worth 40% less than the current price!

Build Your Own Fagron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fagron research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fagron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fagron's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:FAGR

Fagron

A pharmaceutical compounding company, delivers personalized pharmaceutical care to hospitals, pharmacies, clinics, patients, and worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives