Anheuser-Busch InBev SA/NV (EBR:ABI) Has Fared Decently But Fundamentals Look Uncertain: What Lies Ahead For The Stock?

Anheuser-Busch InBev's (EBR:ABI) stock up by 7.6% over the past three months. However, we decided to study the company's mixed-bag of fundamentals to assess what this could mean for future share prices, as stock prices tend to be aligned with a company's long-term financial performance. Specifically, we decided to study Anheuser-Busch InBev's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Anheuser-Busch InBev

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Anheuser-Busch InBev is:

9.0% = US$7.6b ÷ US$84b (Based on the trailing twelve months to December 2022).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each €1 of shareholders' capital it has, the company made €0.09 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Anheuser-Busch InBev's Earnings Growth And 9.0% ROE

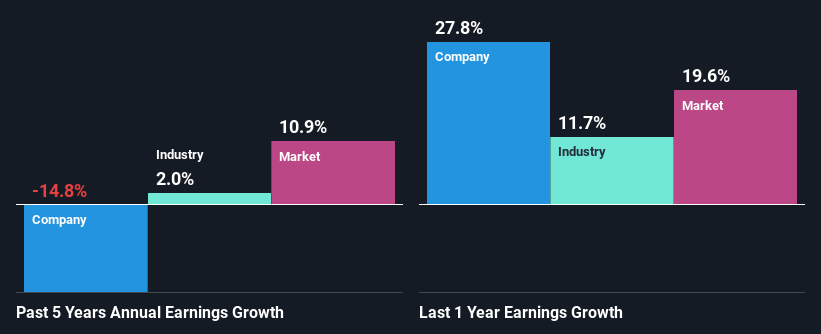

When you first look at it, Anheuser-Busch InBev's ROE doesn't look that attractive. Yet, a closer study shows that the company's ROE is similar to the industry average of 11%. But Anheuser-Busch InBev saw a five year net income decline of 15% over the past five years. Bear in mind, the company does have a slightly low ROE. Hence, this goes some way in explaining the shrinking earnings.

That being said, we compared Anheuser-Busch InBev's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 9.2% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. What is ABI worth today? The intrinsic value infographic in our free research report helps visualize whether ABI is currently mispriced by the market.

Is Anheuser-Busch InBev Using Its Retained Earnings Effectively?

Anheuser-Busch InBev's low three-year median payout ratio of 23% (implying that it retains the remaining 77% of its profits) comes as a surprise when you pair it with the shrinking earnings. The low payout should mean that the company is retaining most of its earnings and consequently, should see some growth. So there might be other factors at play here which could potentially be hampering growth. For instance, the business has faced some headwinds.

Additionally, Anheuser-Busch InBev has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Looking at the current analyst consensus data, we can see that the company's future payout ratio is expected to rise to 39% over the next three years. Regardless, the ROE is not expected to change much for the company despite the higher expected payout ratio.

Summary

Overall, we have mixed feelings about Anheuser-Busch InBev. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:ABI

Anheuser-Busch InBev

Produces, distributes, exports, markets, and sells beer in North America, Middle Americas, South America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)