- Belgium

- /

- Oil and Gas

- /

- ENXTBR:EXM

Undiscovered Gems in Europe to Explore December 2025

Reviewed by Simply Wall St

As European markets navigate mixed performances, with Germany's DAX showing gains while the UK and France face slight declines, investors are closely monitoring economic indicators and central bank policies for potential opportunities. In this dynamic environment, identifying promising stocks often involves looking at companies that can thrive amidst economic resilience and shifting interest rate expectations.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Rosetti Marino (BIT:YRM)

Simply Wall St Value Rating: ★★★★★★

Overview: Rosetti Marino SpA, along with its subsidiaries, operates in the energy, energy transition, and shipbuilding sectors across Italy, the rest of the European Union, and internationally with a market capitalization of €1.04 billion.

Operations: Rosetti Marino generates revenue primarily from its Oil & Gas Business Unit (€422.52 million) and Renewables and Carbon segment (€248.67 million), with smaller contributions from Shipbuilding (€16.17 million) and Various Services (€0.73 million).

Rosetti Marino, a notable player in the energy services sector, showcases impressive growth with earnings surging 293.7% over the past year, significantly outpacing the industry's 10.9%. The company has reduced its debt to equity ratio from 44.5% to 39.3% over five years and holds more cash than total debt, suggesting financial stability. Recent earnings reveal a net income of €11.67 million for the half-year ending June 2025, an increase from €7.87 million previously reported. Additionally, Rosetti Marino announced a €20 million fixed-income offering this December to bolster its financial strategy further.

- Click here and access our complete health analysis report to understand the dynamics of Rosetti Marino.

Evaluate Rosetti Marino's historical performance by accessing our past performance report.

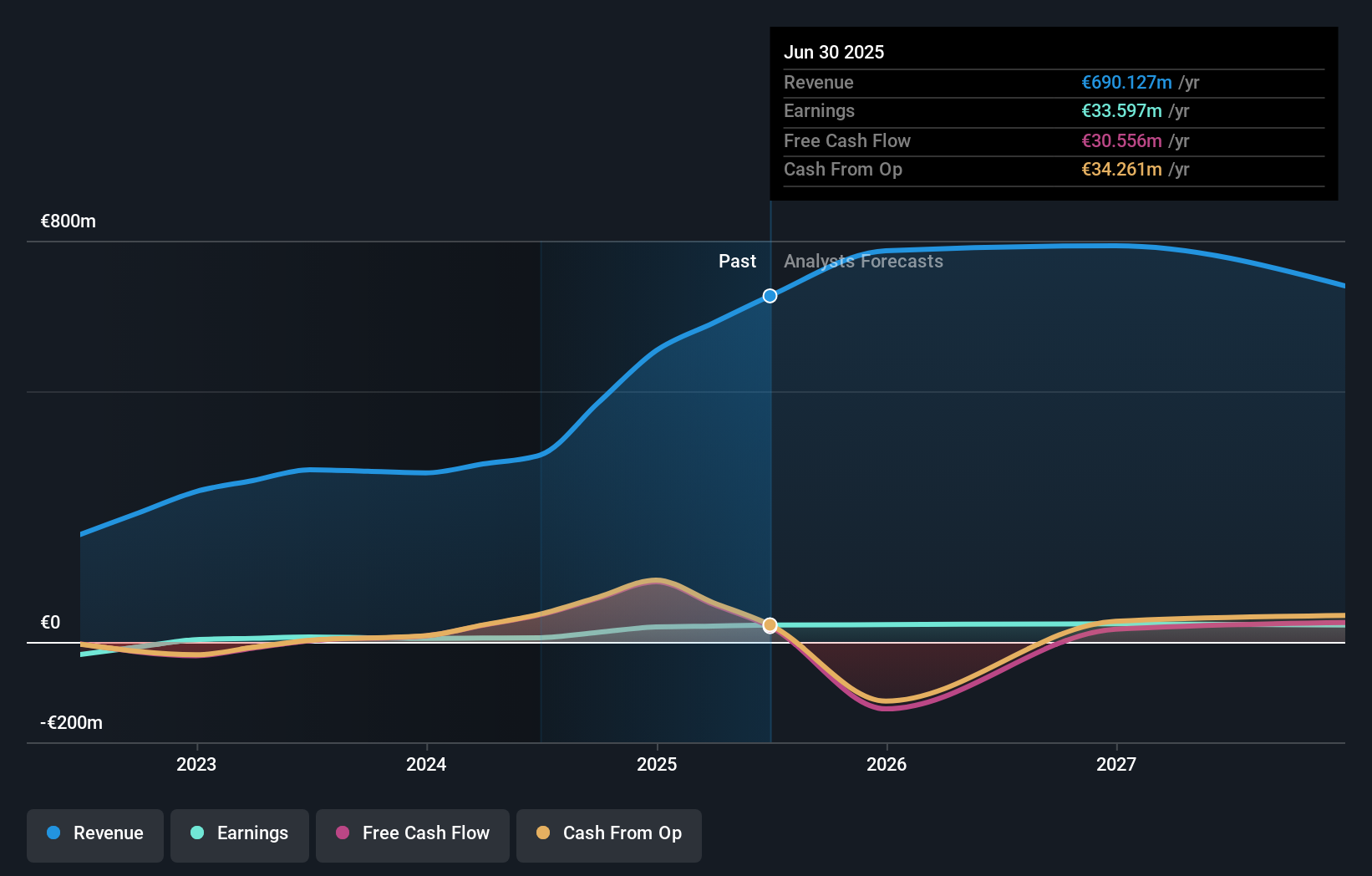

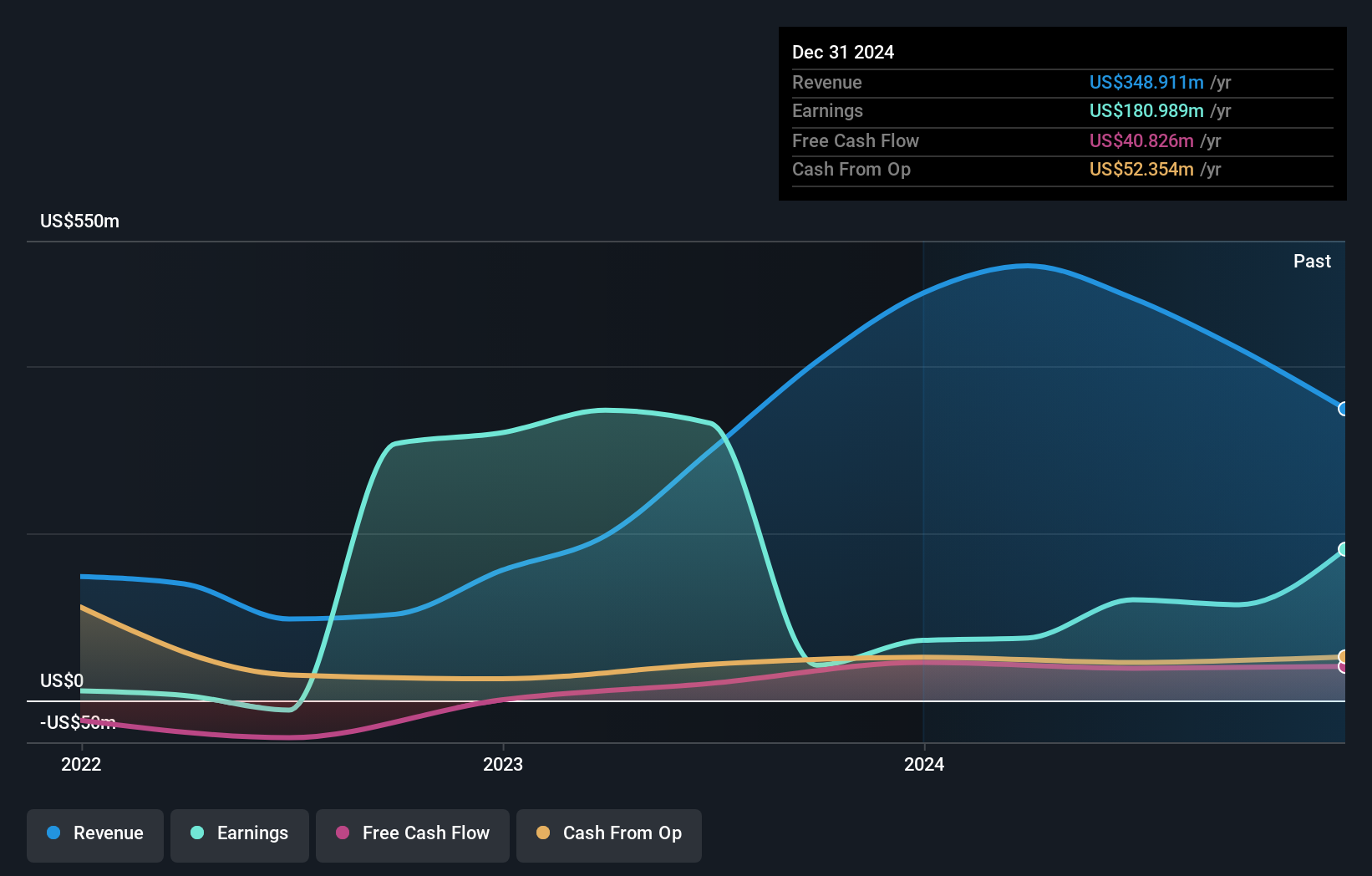

Exmar (ENXTBR:EXM)

Simply Wall St Value Rating: ★★★★★★

Overview: Exmar NV provides shipping and floating infrastructure solutions globally, with a market capitalization of €817.43 million.

Operations: Exmar NV generates revenue primarily through its Shipping segment ($141.51 million) and Infrastructure segment ($145.34 million), complemented by Supporting Services ($90.12 million).

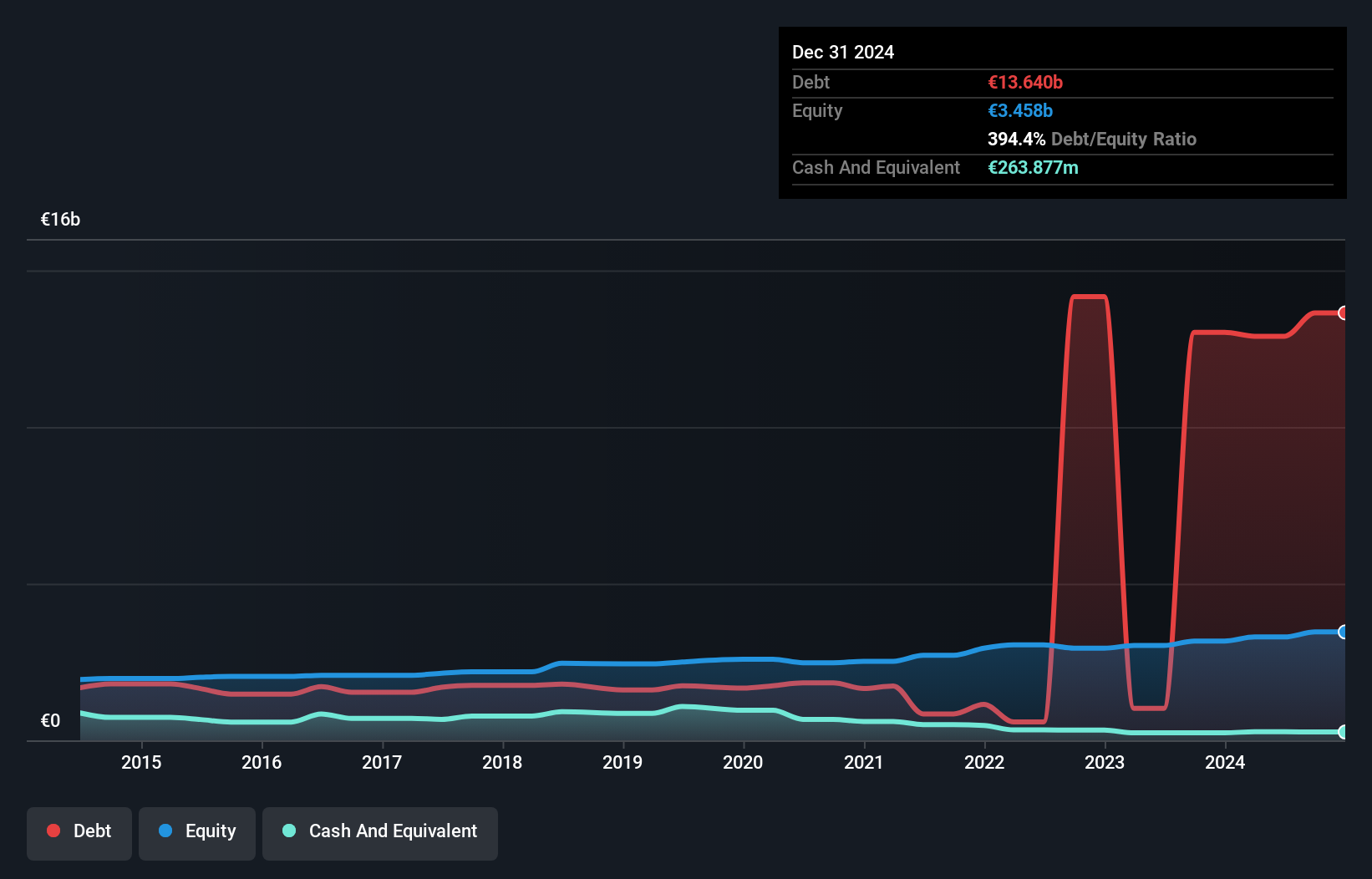

Exmar, a small player in the energy sector, has shown notable financial resilience. Over the past five years, its debt to equity ratio improved from 76.2% to 44.5%, reflecting better financial management. Recent earnings growth of 29.4% outpaced the broader Oil and Gas industry decline of 15.2%, showcasing its competitive edge. However, a significant one-off gain of $81.7M skewed recent results, indicating potential volatility in earnings quality. Trading at a substantial discount of 81% below estimated fair value suggests potential upside for investors willing to navigate this complexity while benefiting from well-covered interest payments with EBIT covering them by 7 times.

- Navigate through the intricacies of Exmar with our comprehensive health report here.

Gain insights into Exmar's past trends and performance with our Past report.

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative (ENXTPA:CRAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative operates as a provider of banking products and services in France, with a market capitalization of approximately €930 million.

Operations: Crédit Agricole Alpes Provence generates revenue primarily from its retail banking segment, amounting to €457.98 million. The company's financial performance is influenced by its net profit margin, which reflects the efficiency of its operations and profitability relative to total revenue.

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence, with assets totaling €26.8 billion and equity of €3.7 billion, stands out for its robust financial health. The bank's earnings growth of 12.9% over the past year notably outpaced the broader banking industry, which saw a -0.3% change. Despite 60% of its liabilities being funded through higher-risk external borrowing, it manages an appropriate level of bad loans at 1.6%, supported by a sufficient allowance covering 113%. Trading at nearly a quarter below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this sector.

Seize The Opportunity

- Access the full spectrum of 310 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Exmar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:EXM

Exmar

Engages in the provision of shipping and floating infrastructure solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)