- Belgium

- /

- Electrical

- /

- ENXTBR:CENER

Market Still Lacking Some Conviction On Cenergy Holdings SA (EBR:CENER)

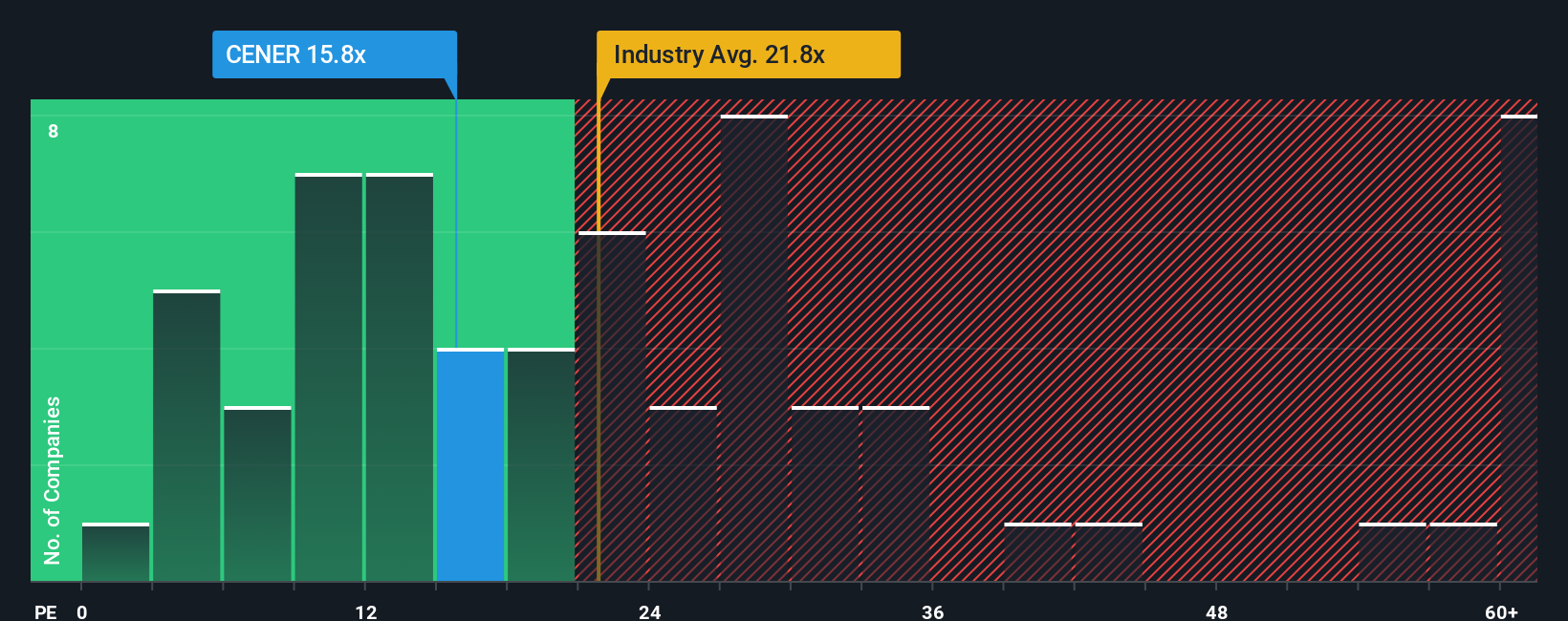

It's not a stretch to say that Cenergy Holdings SA's (EBR:CENER) price-to-earnings (or "P/E") ratio of 15.8x right now seems quite "middle-of-the-road" compared to the market in Belgium, where the median P/E ratio is around 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Cenergy Holdings certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Cenergy Holdings

How Is Cenergy Holdings' Growth Trending?

The only time you'd be comfortable seeing a P/E like Cenergy Holdings' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 86% last year. The latest three year period has also seen an excellent 466% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 16% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Cenergy Holdings' P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Cenergy Holdings currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Cenergy Holdings, and understanding should be part of your investment process.

If you're unsure about the strength of Cenergy Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:CENER

Cenergy Holdings

Manufactures and sells aluminium, copper, cables, steel and steel pipes, and other related products in Belgium, Greece, Other European Union countries, Other European countries, the United States, and internationally.

Outstanding track record and undervalued.

Market Insights

Community Narratives