- Australia

- /

- Electric Utilities

- /

- ASX:ORG

Origin Energy (ASX:ORG) Is Up 6.0% After Signaling Possible Eraring Coal Plant Extension – Has the Bull Case Changed?

Reviewed by Simply Wall St

- Origin Energy recently reported full-year earnings for the period ended June 30, 2025, with sales rising to A$17.22 billion and net income increasing to A$1.48 billion compared to the previous year, alongside commentary on the ongoing challenges of the energy transition.

- An interesting insight is the company’s indication that its Eraring coal-fired plant may remain operational beyond 2027 amid a slower and costlier than expected shift toward renewables, signaling a pragmatic approach to balancing supply stability and net zero ambitions.

- We'll now explore how Origin Energy's acknowledgment of higher transition costs and a potential extension of coal operations impacts its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Origin Energy Investment Narrative Recap

To be a shareholder in Origin Energy, you need to believe in the company's ability to balance reliable energy supply with its transition toward renewables, even as this shift proves slower and more expensive than predicted. The recent news on Eraring’s potential coal extension does not materially change the core near-term catalyst: managing energy transition costs while maintaining earnings stability. The biggest short-term risk remains pressure on net margins from elevated capital expenditures and operational uncertainty as Origin invests in new infrastructure.

Of the recent announcements, the full-year earnings result stands out as most relevant: revenue and net income both increased year over year, suggesting resilience amid transition headwinds. However, the company’s acknowledgment of higher infrastructure costs to support renewables highlights that cost containment will be critical for supporting both dividends and returns in the near term.

In contrast, any sharp increase in required capital expenditure should catch the eye of investors who may not realize just how closely Origin’s margins are tied to...

Read the full narrative on Origin Energy (it's free!)

Origin Energy’s outlook anticipates revenues of A$16.8 billion and earnings of A$1.2 billion by 2028. This scenario is based on a 0.3% annual revenue decline and a decrease of A$200 million in earnings from the current A$1.4 billion.

Uncover how Origin Energy's forecasts yield a A$11.12 fair value, a 12% downside to its current price.

Exploring Other Perspectives

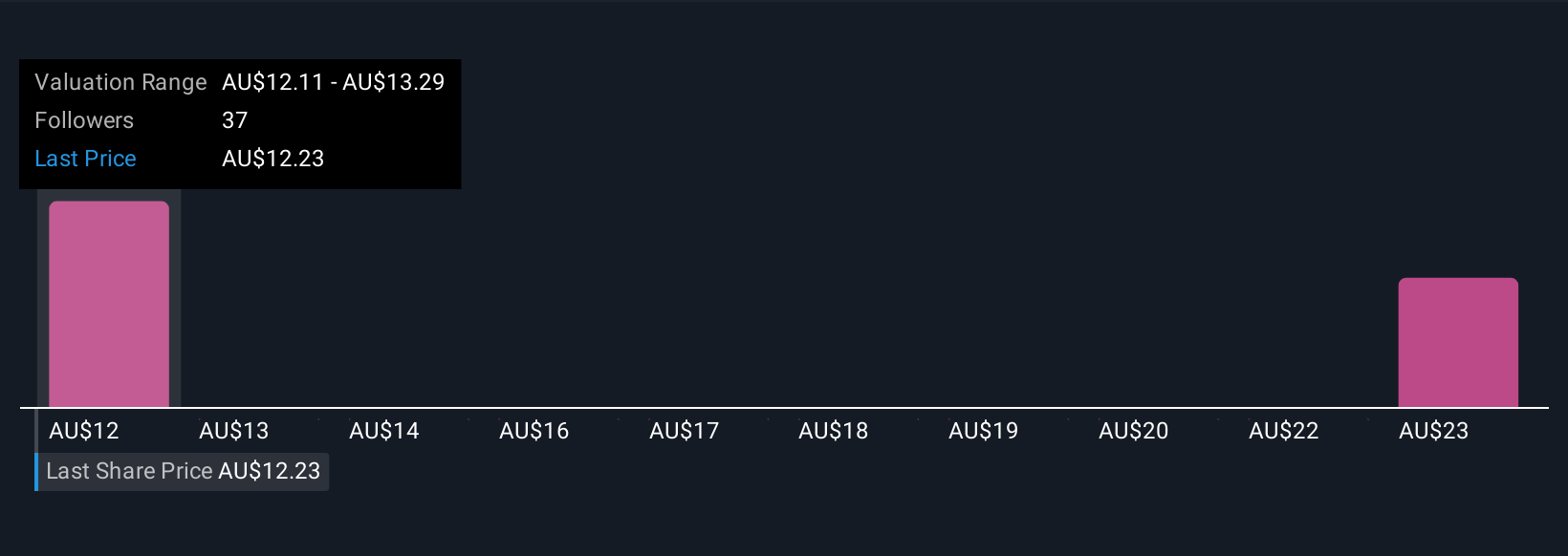

Simply Wall St Community members provided fair value estimates for Origin Energy ranging from A$10.51 to A$11.12, based on two independent analyses. With transition costs rising and returns under pressure, community sentiment reflects a wide range of expectations, consider the diversity of outlooks when weighing the company’s future.

Explore 2 other fair value estimates on Origin Energy - why the stock might be worth 17% less than the current price!

Build Your Own Origin Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Origin Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Origin Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Origin Energy's overall financial health at a glance.

No Opportunity In Origin Energy?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ORG

Origin Energy

An integrated energy company, engages in the exploration and production of natural gas, electricity generation, wholesale and retail sale of electricity and gas, and sale of liquefied natural gas in Australia and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion