The Australian market is experiencing volatility, with the ASX 200 futures indicating a significant drop following global economic tensions, including new tariffs and fluctuating commodity prices. In such uncertain times, investors often look to smaller or newer companies for potential growth opportunities. Penny stocks, despite their somewhat outdated name, can still offer value by providing access to companies with strong financial foundations and the potential for long-term growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.79 | A$84.44M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.545 | A$107.02M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.38 | A$368.64M | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | A$3.30 | A$158.08M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.96 | A$244.91M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.28 | A$1.2B | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$3.34 | A$1.12B | ★★★★★★ |

| MotorCycle Holdings (ASX:MTO) | A$1.995 | A$147.24M | ★★★★★★ |

| CTI Logistics (ASX:CLX) | A$1.75 | A$136.52M | ★★★★☆☆ |

| Accent Group (ASX:AX1) | A$2.02 | A$1.14B | ★★★★☆☆ |

Click here to see the full list of 1,015 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

MotorCycle Holdings (ASX:MTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MotorCycle Holdings Limited operates motorcycle dealerships across Australia and has a market capitalization of A$147.24 million.

Operations: MotorCycle Holdings Limited has not reported any specific revenue segments for its operations.

Market Cap: A$147.24M

MotorCycle Holdings Limited, with a market cap of A$147.24 million, shows potential in the penny stock segment due to its undervaluation at 26.7% below estimated fair value and good relative value compared to peers. Despite experiencing negative earnings growth over the past year, the company reported an increase in half-year sales to A$327.98 million and net income of A$9.45 million, indicating some resilience. The company's debt management appears prudent with a satisfactory net debt to equity ratio of 32.9%, while interest payments are well covered by EBIT at 6.6 times coverage, supporting financial stability amidst dividend increases and executive changes.

- Click here and access our complete financial health analysis report to understand the dynamics of MotorCycle Holdings.

- Gain insights into MotorCycle Holdings' future direction by reviewing our growth report.

Southern Cross Media Group (ASX:SXL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Southern Cross Media Group Limited, with a market cap of A$167.93 million, produces audio content for broadcast and digital networks in Australia.

Operations: Southern Cross Media Group Limited has not reported any specific revenue segments.

Market Cap: A$167.93M

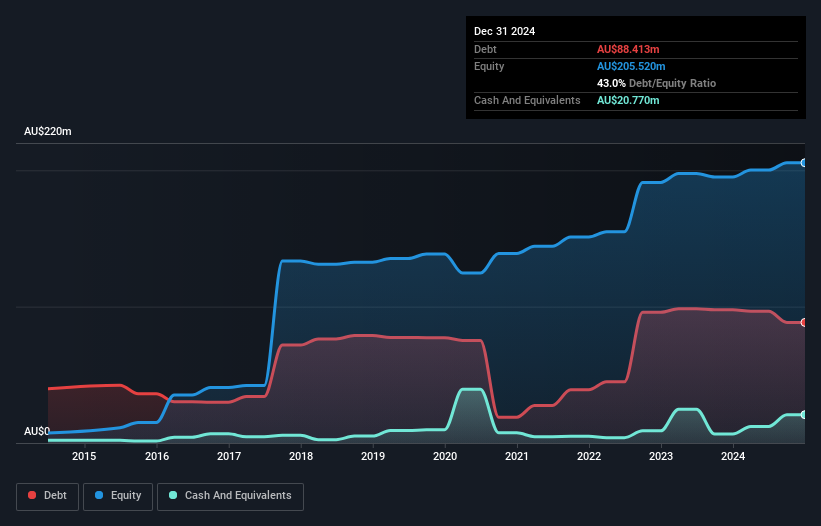

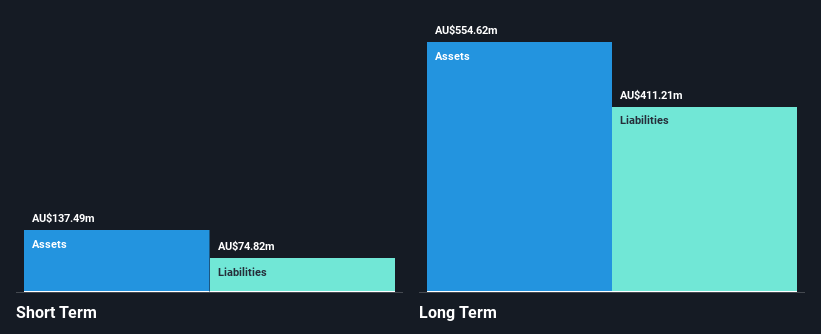

Southern Cross Media Group Limited, with a market cap of A$167.93 million, presents a mixed picture in the penny stock space. The company is trading at 38% below its estimated fair value and maintains a stable cash runway exceeding three years despite being unprofitable. Recent earnings reports show sales growth to A$209.68 million, with net income slightly increasing to A$3.22 million for the half-year ended December 2024. However, long-term liabilities remain uncovered by short-term assets (A$137.5M vs A$411.2M), and the debt-to-equity ratio is high at 45%. Strategic asset sales aim to reduce debt further while executive changes bolster leadership stability amidst ongoing transformation efforts.

- Jump into the full analysis health report here for a deeper understanding of Southern Cross Media Group.

- Explore Southern Cross Media Group's analyst forecasts in our growth report.

Wiseway Group (ASX:WWG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wiseway Group Limited operates as a logistics and freight forwarding service provider across Australia, New Zealand, China, Singapore, and the United States with a market capitalization of A$30.12 million.

Operations: Wiseway Group's revenue segments have not been reported.

Market Cap: A$30.12M

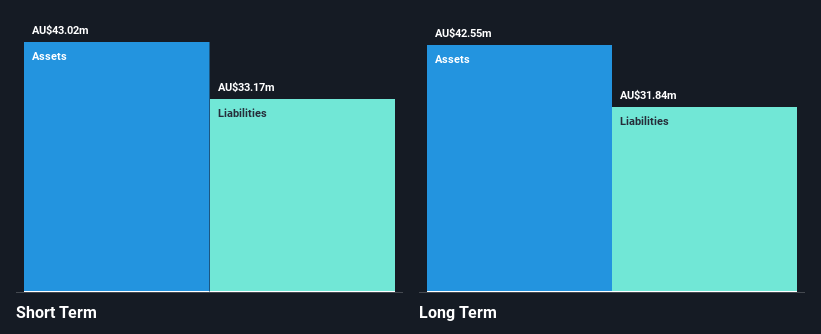

Wiseway Group Limited, with a market cap of A$30.12 million, shows both potential and challenges as a penny stock. The company reported significant sales growth to A$83.9 million for the half-year ended December 2024, with net income rising to A$0.983 million compared to the previous year. Despite this progress, Wiseway's debt remains high with a net debt to equity ratio of 125.2%, although interest payments are well covered by EBIT at 21.6 times coverage. Short-term assets exceed liabilities by A$9.8 million, while an interim dividend increase reflects confidence in future performance amidst experienced management and board oversight.

- Unlock comprehensive insights into our analysis of Wiseway Group stock in this financial health report.

- Understand Wiseway Group's track record by examining our performance history report.

Where To Now?

- Navigate through the entire inventory of 1,015 ASX Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXL

Southern Cross Media Group

Southern Cross Media Group Limited, together with its subsidiaries, creates audio content for distribution on broadcast and digital networks in Australia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives