Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Qube Holdings (ASX:QUB), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Qube Holdings with the means to add long-term value to shareholders.

Check out our latest analysis for Qube Holdings

How Fast Is Qube Holdings Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Qube Holdings has grown EPS by 26% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

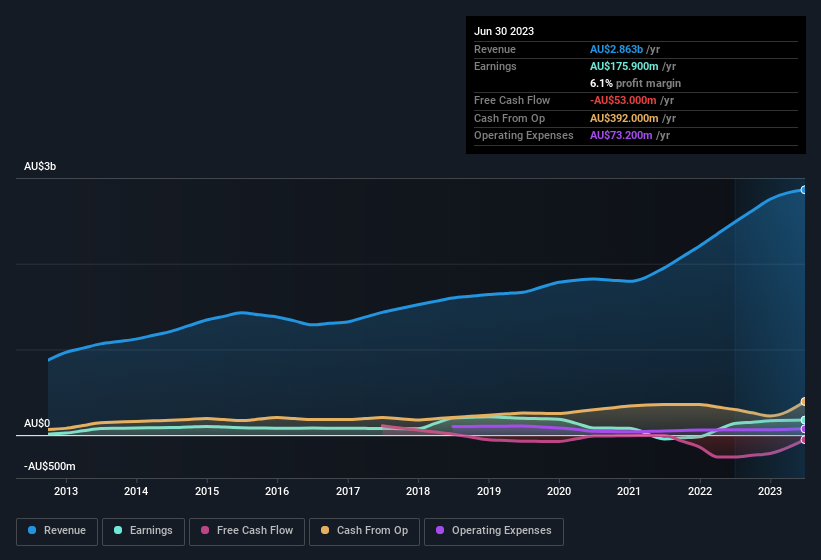

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Qube Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to AU$2.9b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Qube Holdings' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Qube Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One positive for Qube Holdings, is that company insiders spent AU$74k acquiring shares in the last year. While this investment may be modest, it is great considering the lack of insider selling.

Along with the insider buying, another encouraging sign for Qube Holdings is that insiders, as a group, have a considerable shareholding. With a whopping AU$91m worth of shares as a group, insiders have plenty riding on the company's success. This would indicate that the goals of shareholders and management are one and the same.

Should You Add Qube Holdings To Your Watchlist?

You can't deny that Qube Holdings has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Still, you should learn about the 1 warning sign we've spotted with Qube Holdings.

The good news is that Qube Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Qube Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:QUB

Qube Holdings

Provides import and export logistics services in Australia, New Zealand, and Southeast Asia.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives