- Australia

- /

- Metals and Mining

- /

- ASX:GAL

Uncovering Bailador Technology Investments And 2 More ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market is facing a challenging start to the week, with a sharp decline on Wall Street and fluctuating commodity prices influencing investor sentiment. Despite these broader market pressures, certain investment opportunities remain attractive, particularly in the realm of penny stocks. While the term "penny stocks" may seem outdated, these smaller or newer companies can offer significant growth potential when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.90 | A$240.44M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.94 | A$108.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$322.38M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$253.28M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.255 | A$107.15M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.59 | A$779.23M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.93 | A$486.42M | ★★★★☆☆ |

Click here to see the full list of 1,049 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bailador Technology Investments (ASX:BTI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bailador Technology Investments Limited is a venture capital firm focusing on mid venture, growth capital, late venture, PIPESs and expansion capital in companies beyond the start-up phase, with a market cap of A$180.74 million.

Operations: The company generates revenue of A$40.55 million from its internet-related businesses.

Market Cap: A$180.74M

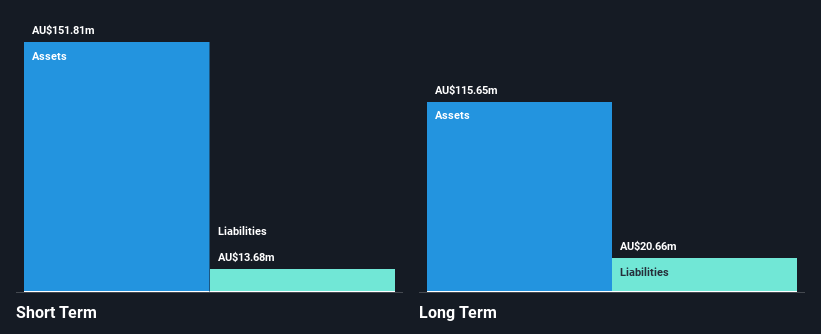

Bailador Technology Investments has demonstrated significant earnings growth, with a 281.8% increase over the past year, surpassing industry averages. The firm maintains a strong balance sheet, with short-term assets of A$151.8 million exceeding both short and long-term liabilities, and it remains debt-free for five years. Its net profit margins have improved to 51%, indicating enhanced profitability. Despite trading at 54.4% below estimated fair value and having stable weekly volatility of 2%, its return on equity is low at 8.9%. However, the dividend yield of 5.63% lacks coverage by free cash flows, suggesting sustainability concerns.

- Get an in-depth perspective on Bailador Technology Investments' performance by reading our balance sheet health report here.

- Gain insights into Bailador Technology Investments' past trends and performance with our report on the company's historical track record.

CTI Logistics (ASX:CLX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CTI Logistics Limited, along with its subsidiaries, offers transport and logistics services across Australia and has a market cap of A$152.51 million.

Operations: The company's revenue is primarily derived from its Transport segment at A$225.42 million and Logistics segment at A$118.28 million, with additional income from Property amounting to A$6.37 million.

Market Cap: A$152.51M

CTI Logistics Limited has demonstrated a satisfactory net debt to equity ratio of 23.5%, with its operating cash flow covering debt well at 105%. However, short-term assets of A$52.8 million do not cover either short or long-term liabilities, posing potential liquidity concerns. Despite negative earnings growth over the past year and shareholder dilution, the company's earnings are forecasted to grow by 14.41% annually. Trading at a significant discount to estimated fair value and having an experienced management team, CTI's profitability remains challenged with declining profit margins from 5.6% to 4.9%. Recent guidance suggests modest revenue growth expectations for the half-year ending December 2024.

- Click here to discover the nuances of CTI Logistics with our detailed analytical financial health report.

- Learn about CTI Logistics' future growth trajectory here.

Galileo Mining (ASX:GAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Galileo Mining Ltd is involved in the exploration of mineral deposits in Western Australia, with a market cap of A$31.62 million.

Operations: No revenue segments have been reported.

Market Cap: A$31.62M

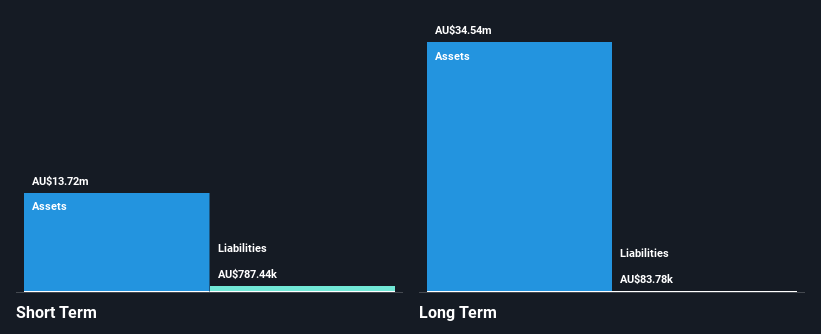

Galileo Mining Ltd, with a market cap of A$31.62 million, is a pre-revenue company involved in mineral exploration in Western Australia. The company has no debt and its short-term assets of A$13.7 million comfortably cover both short-term (A$787.4K) and long-term liabilities (A$83.8K). Galileo recently became profitable, although this was significantly influenced by a large one-off gain of A$5 million as of June 2024. Its price-to-earnings ratio stands at 9.4x, below the Australian market average, suggesting potential value despite low return on equity at 7.1%.

- Take a closer look at Galileo Mining's potential here in our financial health report.

- Understand Galileo Mining's track record by examining our performance history report.

Where To Now?

- Take a closer look at our ASX Penny Stocks list of 1,049 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GAL

Galileo Mining

Engages in the exploration of mineral deposits in Western Australia.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives