3 ASX Penny Stocks With Market Caps Under A$200M To Consider

Reviewed by Simply Wall St

The Australian market has been buzzing with activity, reflecting a festive spirit reminiscent of October's highs, despite ongoing tech jitters and fluctuating oil prices. For investors interested in smaller or newer companies, penny stocks—although the term might sound outdated—offer intriguing opportunities for value and growth. This article explores several ASX penny stocks that exhibit financial strength and potential, making them appealing options for those seeking promising investments in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$108.9M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.465 | A$70.76M | ✅ 2 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.82 | A$433.41M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.05 | A$225.28M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$40.53M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.19B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.785 | A$366M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.34B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.95 | A$133.86M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$645.2M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 432 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

CTI Logistics (ASX:CLX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CTI Logistics Limited, along with its subsidiaries, provides transport and logistics services in Australia and has a market cap of A$178.39 million.

Operations: The company's revenue is primarily derived from its Transport segment, generating A$232.21 million, and its Logistics segment, contributing A$126.96 million, with additional income from Property amounting to A$9.69 million.

Market Cap: A$178.39M

CTI Logistics, with a market cap of A$178.39 million, primarily generates revenue from its Transport and Logistics segments. Despite stable weekly volatility and a seasoned management team, the company faces challenges with short-term assets not covering liabilities. While debt is well covered by operating cash flow and interest payments are manageable, CTI's dividend is not well supported by free cash flows. The company has shown high-quality earnings historically but experienced negative earnings growth recently. Its Price-To-Earnings ratio suggests value relative to the broader Australian market, though Return on Equity remains low at 11.1%.

- Unlock comprehensive insights into our analysis of CTI Logistics stock in this financial health report.

- Learn about CTI Logistics' historical performance here.

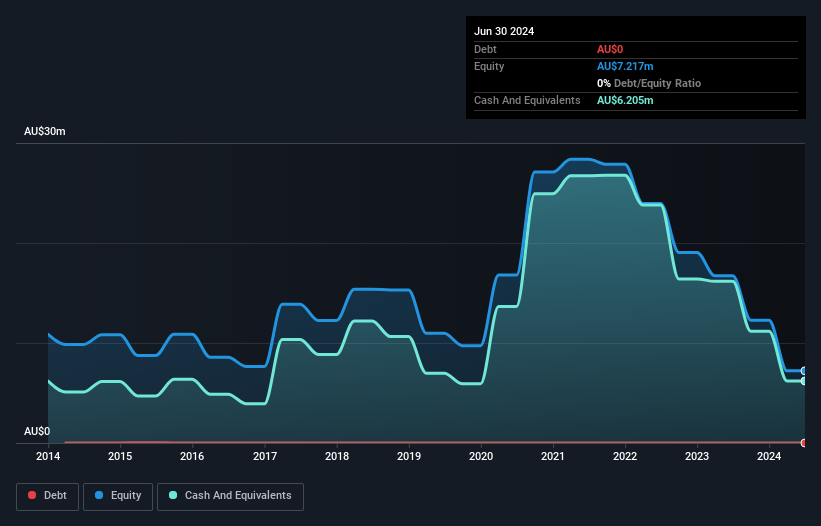

Cynata Therapeutics (ASX:CYP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cynata Therapeutics Limited, along with its subsidiaries, focuses on developing and commercializing proprietary induced pluripotent stem cell and mesenchymal stem cell technology under the Cymerus brand for therapeutic use in humans, with a market cap of A$68.86 million.

Operations: The company's revenue of A$1.89 million is derived from the development and commercialisation of therapeutic products.

Market Cap: A$68.86M

Cynata Therapeutics, with a market cap of A$68.86 million, is in the spotlight for its innovative stem cell technology but remains pre-revenue with A$1.89 million in revenue from therapeutic developments. The company recently completed patient enrolment for a Phase 2 trial of CYP-001, targeting acute graft versus host disease, with results expected mid-2026. Despite being debt-free and having no long-term liabilities, Cynata faces financial challenges including less than a year of cash runway and unprofitability projected over the next three years. Its experienced management team offers stability amid these uncertainties as they navigate clinical advancements.

- Dive into the specifics of Cynata Therapeutics here with our thorough balance sheet health report.

- Learn about Cynata Therapeutics' future growth trajectory here.

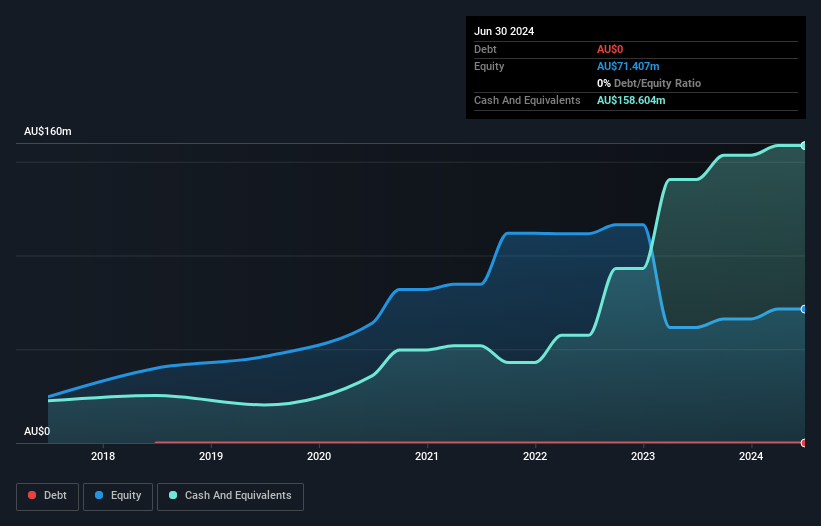

NobleOak Life (ASX:NOL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NobleOak Life Limited is an Australian company that underwrites life insurance products, with a market capitalization of A$136.63 million.

Operations: The company's revenue is derived from three segments: Genus contributing A$10.99 million, Direct with A$88.92 million, and Strategic Partnerships generating A$335.21 million.

Market Cap: A$136.63M

NobleOak Life Limited, with a market cap of A$136.63 million, presents a mixed picture for investors in penny stocks. The company is debt-free and has adequate short-term assets (A$460.5M) to cover both short-term (A$258.3M) and long-term liabilities (A$220.0M), indicating financial stability. However, recent negative earnings growth (-23.3%) contrasts with the insurance industry's average growth, highlighting potential challenges in profitability despite high-quality earnings and an experienced board (5.8 years tenure). Trading below its estimated fair value offers potential upside but requires careful consideration of its low return on equity (8%) and management's relatively short tenure.

- Click here to discover the nuances of NobleOak Life with our detailed analytical financial health report.

- Understand NobleOak Life's earnings outlook by examining our growth report.

Where To Now?

- Access the full spectrum of 432 ASX Penny Stocks by clicking on this link.

- Curious About Other Options? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NobleOak Life might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NOL

NobleOak Life

Engages in underwriting life insurance products in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)