- Australia

- /

- Infrastructure

- /

- ASX:ALX

3 ASX Stocks That May Be Priced Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

The Australian stock market recently reached new heights with the ASX200 hitting an all-time intra-day high of 8,515 points, while discussions around potential interest rate cuts by the Reserve Bank of Australia have captured investor attention. In this environment, identifying stocks that may be priced below their estimated intrinsic value can offer opportunities for investors to potentially capitalize on favorable market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$6.91 | A$12.22 | 43.5% |

| SKS Technologies Group (ASX:SKS) | A$2.05 | A$3.83 | 46.5% |

| Mader Group (ASX:MAD) | A$6.21 | A$11.90 | 47.8% |

| Atlas Arteria (ASX:ALX) | A$4.98 | A$9.54 | 47.8% |

| MLG Oz (ASX:MLG) | A$0.62 | A$1.17 | 47.1% |

| Ansell (ASX:ANN) | A$35.14 | A$58.55 | 40% |

| Charter Hall Group (ASX:CHC) | A$15.43 | A$28.84 | 46.5% |

| IDP Education (ASX:IEL) | A$13.17 | A$26.31 | 50% |

| Syrah Resources (ASX:SYR) | A$0.22 | A$0.42 | 48% |

| ReadyTech Holdings (ASX:RDY) | A$3.19 | A$6.19 | 48.5% |

Here's a peek at a few of the choices from the screener.

Atlas Arteria (ASX:ALX)

Overview: Atlas Arteria Limited is involved in owning, developing, and operating toll roads, with a market cap of A$7.28 billion.

Operations: The company's revenue segments include APRR with A$1.70 billion, ADELAC at A$36.90 million, Warnow Tunnel generating A$25.10 million, Chicago Skyway contributing A$128.90 million, and Dulles Greenway at A$115 million.

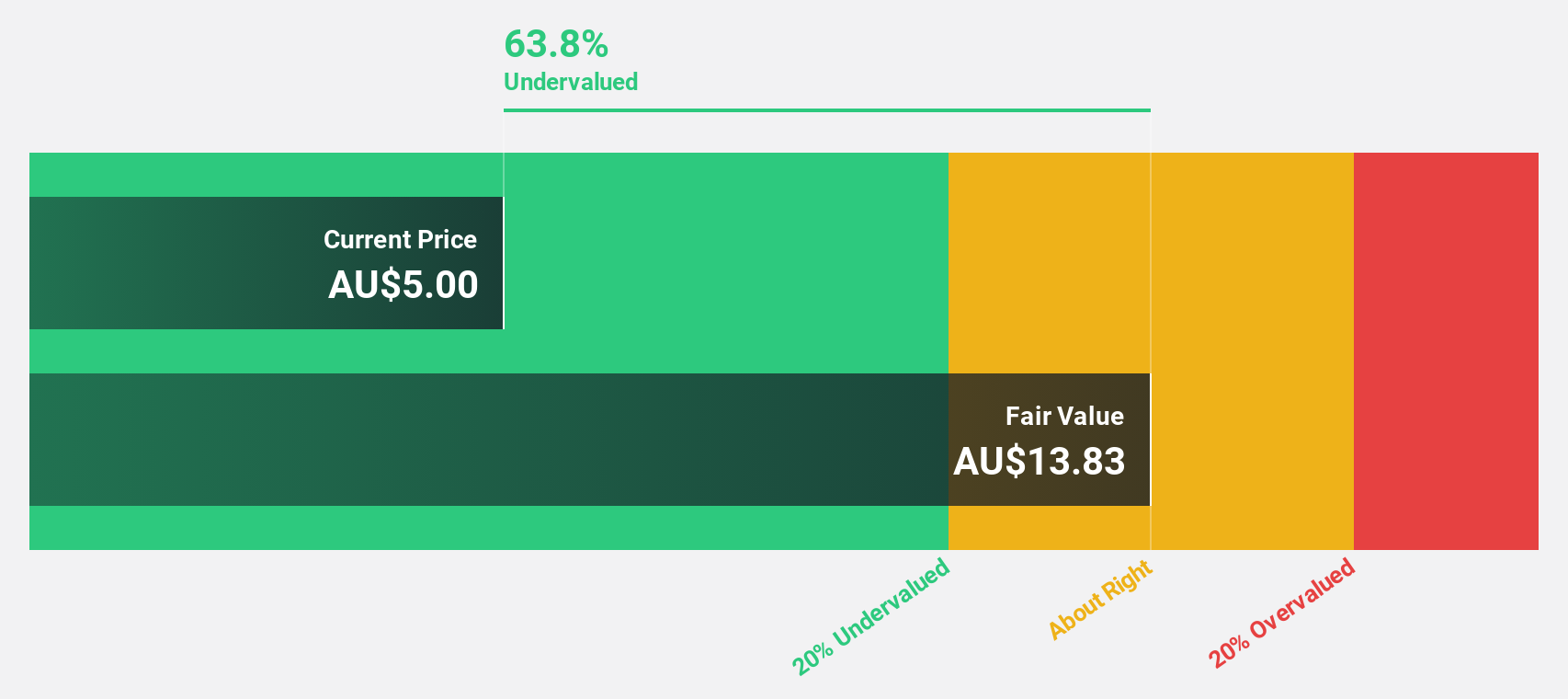

Estimated Discount To Fair Value: 47.8%

Atlas Arteria is trading at A$4.98, significantly below its estimated fair value of A$9.54, indicating potential undervaluation based on cash flows. Despite this, the dividend yield of 8.03% is not well covered by earnings or free cash flows, raising sustainability concerns. Earnings are forecast to grow at 20.36% annually over the next three years, outpacing the broader Australian market's growth expectations and suggesting strong future cash flow potential despite a low projected return on equity of 8.1%.

- According our earnings growth report, there's an indication that Atlas Arteria might be ready to expand.

- Get an in-depth perspective on Atlas Arteria's balance sheet by reading our health report here.

IDP Education (ASX:IEL)

Overview: IDP Education Limited specializes in placing students into educational institutions across Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland and has a market cap of A$3.67 billion.

Operations: The company generates revenue of A$1.04 billion from its Educational Services segment, specifically in Education & Training Services.

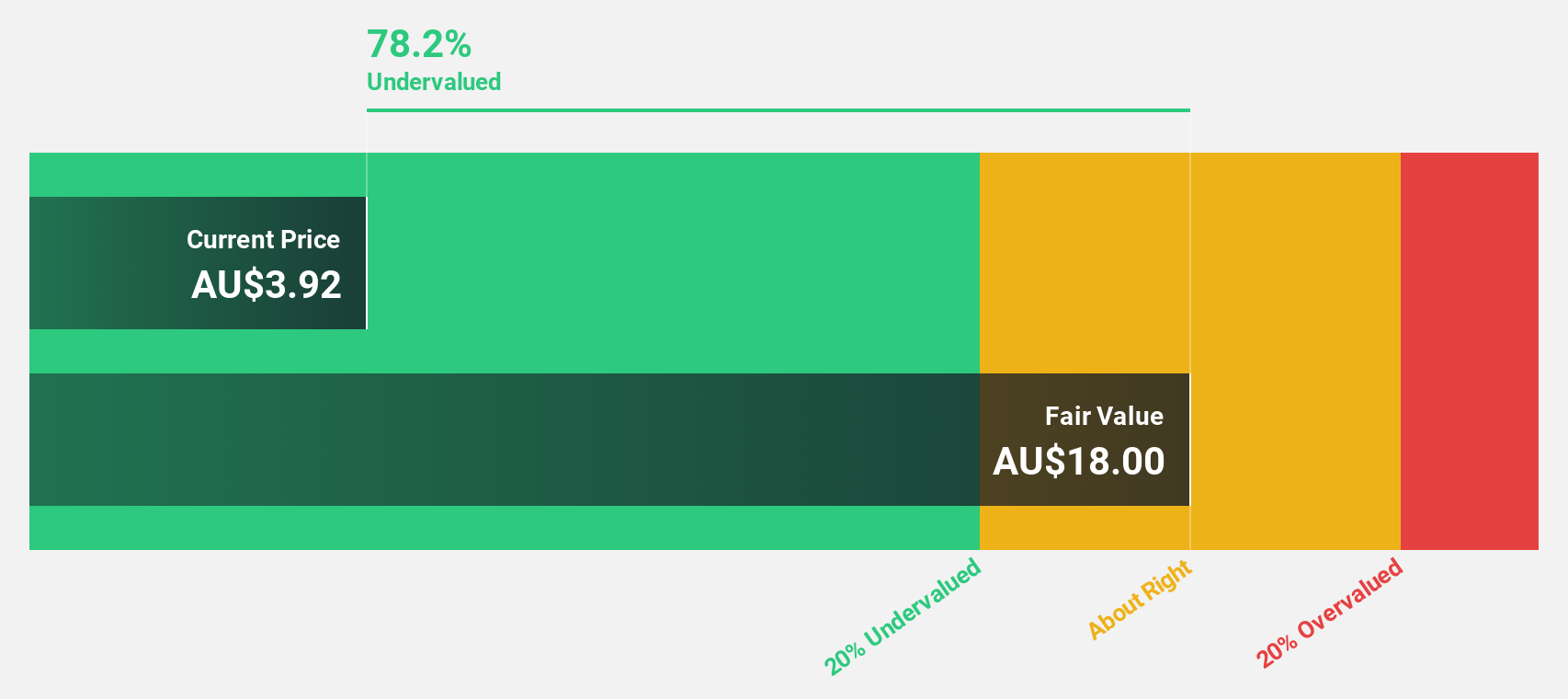

Estimated Discount To Fair Value: 50%

IDP Education, trading at A$13.17, is significantly undervalued based on cash flow analysis, with a fair value estimate of A$26.31. Its earnings are projected to grow at 13.8% annually, surpassing the broader Australian market's growth rate of 12.5%. Although revenue growth is slower than desired at 7.5%, it still exceeds the market average of 6%. The company's return on equity is expected to remain robust over the next three years at 28.5%.

- Our comprehensive growth report raises the possibility that IDP Education is poised for substantial financial growth.

- Click here to discover the nuances of IDP Education with our detailed financial health report.

Megaport (ASX:MP1)

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across regions including Australia, New Zealand, Hong Kong, Singapore, Japan, North America, Italy, and Europe with a market cap of A$1.30 billion.

Operations: The company's revenue segments are comprised of A$31.88 million from Europe, A$52.58 million from Asia-Pacific, and A$110.81 million from North America.

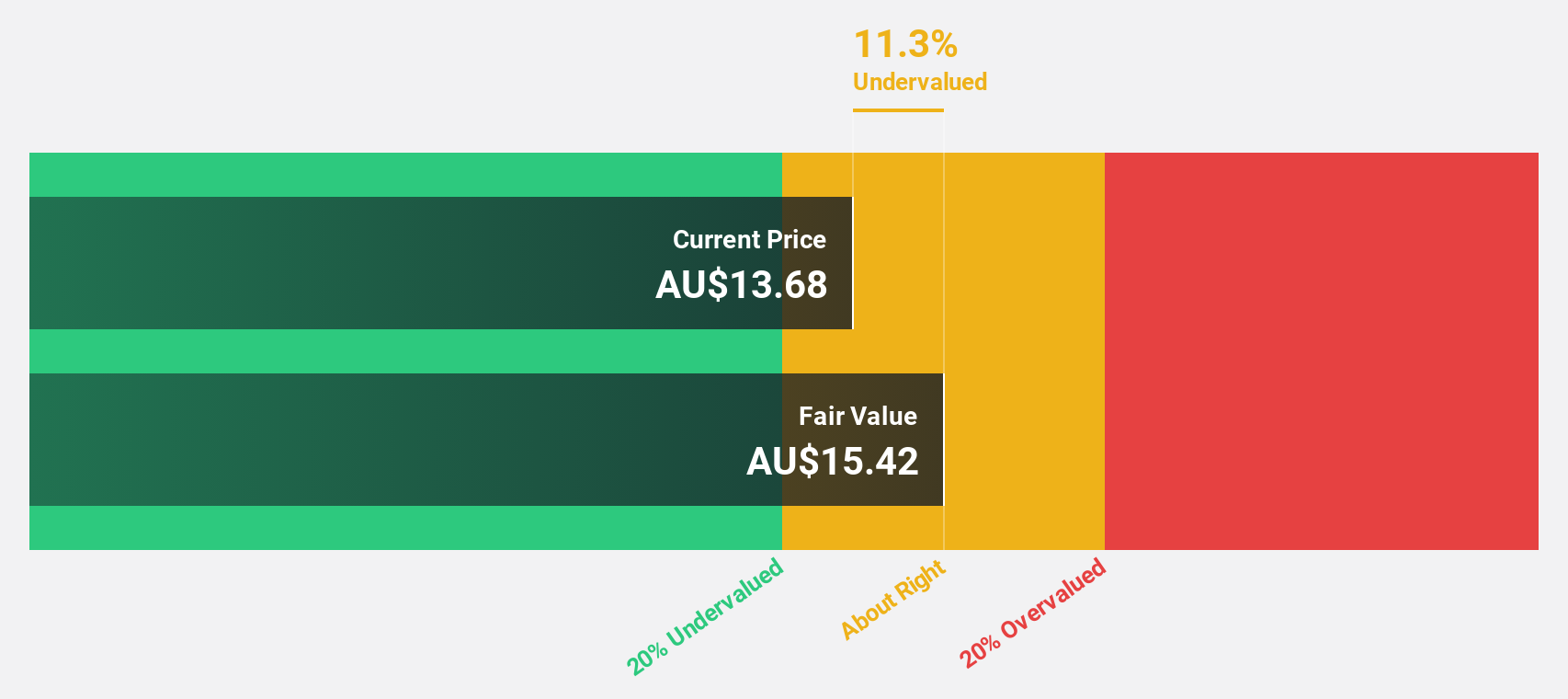

Estimated Discount To Fair Value: 30.7%

Megaport, priced at A$8.29, is trading significantly below its estimated fair value of A$11.97, highlighting its potential as an undervalued stock based on cash flows. Despite a lower forecasted return on equity of 18.6% in three years, the company's earnings are anticipated to grow substantially at 27.3% annually, outpacing the Australian market's growth rate of 12.5%. Recent expansions into Brazil and partnerships in the UK further strengthen Megaport's global presence and connectivity offerings.

- Our growth report here indicates Megaport may be poised for an improving outlook.

- Dive into the specifics of Megaport here with our thorough financial health report.

Seize The Opportunity

- Discover the full array of 43 Undervalued ASX Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALX

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives