Will Director’s Share Acquisition and Stakeholder Exit Reshape Superloop’s (ASX:SLC) Leadership Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, Superloop Limited reported director Paul Tyler acquired 534,869 fully paid ordinary shares following the exercise of share options, and announced that Australian Retirement Trust Pty Ltd is no longer a substantial holder in the company.

- These shareholder changes highlight shifting influences on Superloop’s governance and may reflect evolving confidence in its leadership and prospects.

- To understand the implications for Superloop's investment narrative, we'll examine how this director's increased equity signals leadership confidence and potential influence.

Find companies with promising cash flow potential yet trading below their fair value.

Superloop Investment Narrative Recap

To be a shareholder in Superloop, you generally need to believe in its ability to capitalise on the growing demand for high-speed fibre and leverage its established position in network infrastructure. The recent director share acquisition and Australian Retirement Trust's exit signal shifts in boardroom confidence, yet these developments do not materially affect the near-term catalyst of premium fibre demand or the key risk of price competition in the broadband market.

Among recent announcements, Superloop’s strong FY 2025 results, showing increased revenue to A$550.27 million and a return to profitability, stand out as particularly relevant. These financial improvements reinforce the importance of the company's core growth drivers, while not alleviating the persistent competitive threats facing its margins and long-term earnings stability.

In contrast, investors should be especially aware that recurring price pressure from rivals could...

Read the full narrative on Superloop (it's free!)

Superloop's outlook projects A$843.8 million in revenue and A$53.9 million in earnings by 2028. This scenario assumes a 15.6% annual revenue growth rate and a sharp earnings increase of A$52.7 million from current earnings of A$1.2 million.

Uncover how Superloop's forecasts yield a A$3.48 fair value, a 13% upside to its current price.

Exploring Other Perspectives

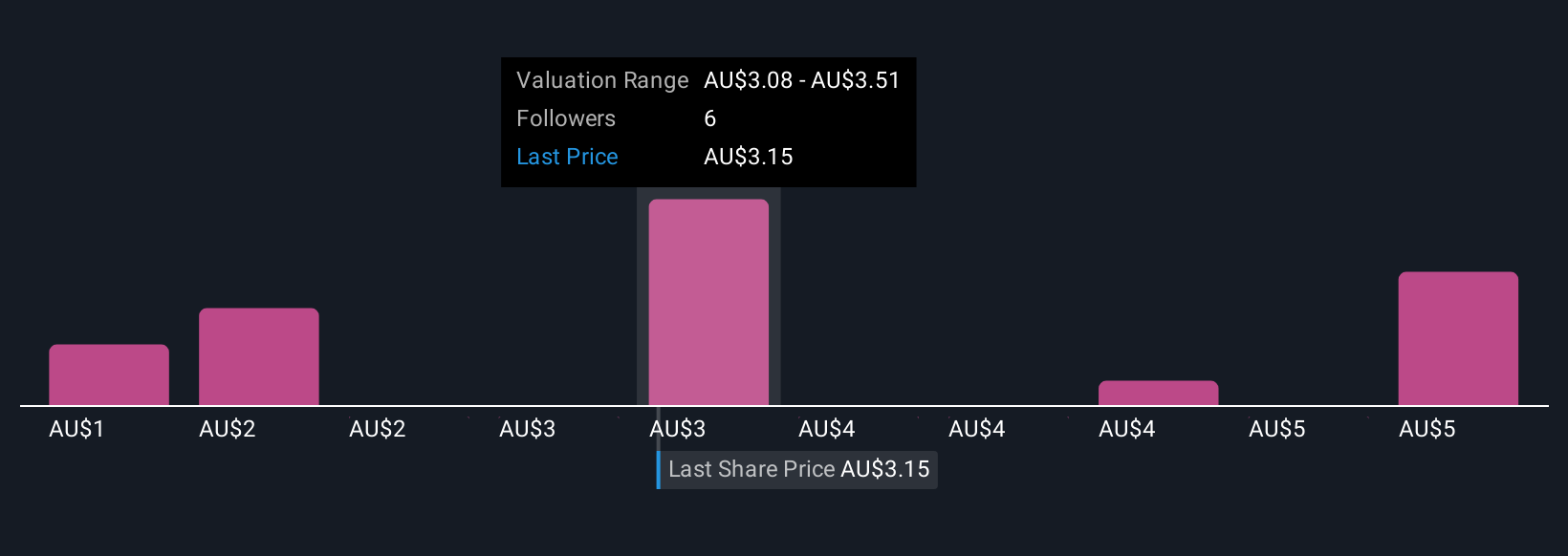

Simply Wall St Community members provided eight fair value estimates for Superloop, ranging widely from A$1.35 to A$5.67 per share. Despite recent earnings momentum, recurring industry price pressure remains a central issue that could impact Superloop’s ability to sustain growth, and readers are encouraged to consider multiple viewpoints when assessing future prospects.

Explore 8 other fair value estimates on Superloop - why the stock might be worth as much as 84% more than the current price!

Build Your Own Superloop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Superloop research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Superloop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Superloop's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLC

Superloop

Operates as a telecommunications and internet service provider in Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.