Key Takeaways

- Surging demand for high-speed data and smart city projects is driving premium fibre growth, higher ARPU, and expanding high-margin, recurring revenue streams.

- Strategic acquisitions, operational efficiency, and digital service innovation are boosting profitability, operating leverage, and resilience against pricing pressures.

- Mounting competition, acquisition risks, technology shifts, and rising compliance costs threaten Superloop's pricing power, growth prospects, and profitability across both consumer and enterprise markets.

Catalysts

About Superloop- Operates as a telecommunications and internet service provider in Australia.

- The rapid uplift in high-speed data demand-driven by cloud computing, streaming, and the nbn's upgrade of 100-meg plans to 500-meg and introduction of new 2-gig segments-is creating an outsized opportunity in premium fibre connectivity where Superloop already commands a leading position in net new orders; this should accelerate top-line revenue growth and expand ARPU as higher-value plans proliferate.

- Ongoing urbanisation and smart city developments, evidenced by landmark contracts like the 10,000-lot Bradfield City project, are feeding the build-out and monetisation of Superloop's on-net Smart Communities business; this high-margin, annuity-style revenue stream supports sustainable improvements in EBITDA margins and long-term earnings.

- Superloop's consistent network infrastructure expansion and optimisation-bolstered by strategic acquisitions and disciplined CapEx-have resulted in strong operating leverage, seen in the company's ability to grow EBITDA 70% y/y on a 31% revenue uplift while shrinking OpEx as a percentage of revenue, thus directly improving net margins and free cash flow.

- The industry-wide transition to high-speed fibre and the company's strategic focus on wholesale/enterprise, underpinned by large-scale wins with challenger brands (e.g. Origin), is shifting revenue mix toward higher recurrence and margin stability, supporting earnings quality and resilience against consumer price competition.

- Recent successful integration of acquisitions (Uecomm, Exetel, prior M&A) and the fully digital, AI-enabled customer support for new offerings like Exetel ONE PLAN are reducing cost to serve and expected to drive both customer lifetime value and sustained expansion in group-wide cash conversion and profitability.

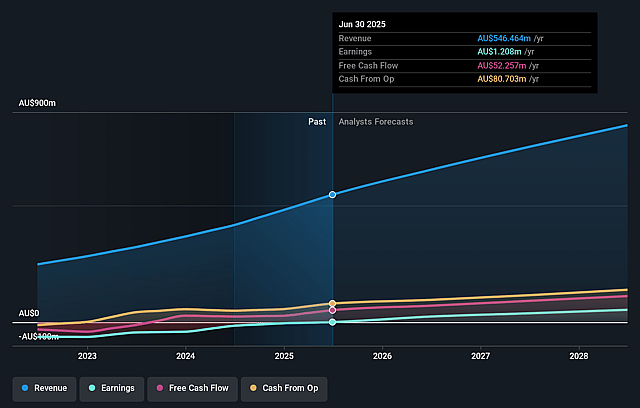

Superloop Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Superloop's revenue will grow by 15.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.2% today to 6.4% in 3 years time.

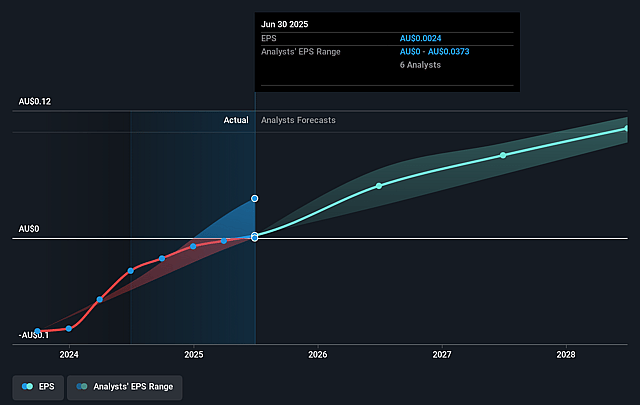

- Analysts expect earnings to reach A$53.9 million (and earnings per share of A$0.1) by about September 2028, up from A$1.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$66.5 million in earnings, and the most bearish expecting A$44.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.0x on those 2028 earnings, down from 1195.1x today. This future PE is lower than the current PE for the AU Telecom industry at 620.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Superloop Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying price competition in the consumer broadband market, especially around unique events like the nbn's Accelerate Great program and legacy provider responses, may constrain Superloop's ability to grow ARPU or maintain premium pricing-directly pressuring net margins and long-term earnings.

- The company's ongoing reliance on M&A for half of its strategic targets, alongside the difficulty in finding and executing suitable acquisitions, raises the risk of missing vital synergies or suffering from integration challenges, which could slow revenue growth and impact future earnings.

- Superloop's margin and revenue expansion in the business (enterprise) segment remain challenged by persistent industry-wide price erosion driven by the nbn's competitive offerings, with longer-term contracts cycling through lower prices-limiting the potential for meaningful revenue growth in this key area.

- The rollout of alternative high-speed technologies (such as 5G or LEO satellite internet), alongside regulatory changes mandating lower wholesale access costs, could gradually erode demand for Superloop's traditional fibre infrastructure, diminishing mid

- to long-term revenue and profitability.

- Growing ESG requirements and future network upgrade mandates (for energy efficiency, cybersecurity, etc.) may materially increase capex and opex beyond current expectations, potentially reducing free cash flow and squeezing net margins over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$3.483 for Superloop based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.9, and the most bearish reporting a price target of just A$2.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$843.8 million, earnings will come to A$53.9 million, and it would be trading on a PE ratio of 40.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$2.82, the analyst price target of A$3.48 is 19.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.