- Australia

- /

- Auto Components

- /

- ASX:PWH

ASX Value Stock Estimates Offering Opportunities In October 2025

Reviewed by Simply Wall St

As the Australian market experiences a slight pullback following a recent surge, investors are keenly observing how global factors like U.S. government actions and fluctuating commodity prices impact local indices. In this context, identifying undervalued stocks becomes crucial as they offer potential opportunities for growth amidst the current market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$3.19 | A$5.67 | 43.7% |

| Resimac Group (ASX:RMC) | A$1.16 | A$2.17 | 46.6% |

| Reckon (ASX:RKN) | A$0.635 | A$1.19 | 46.4% |

| NRW Holdings (ASX:NWH) | A$4.60 | A$8.57 | 46.3% |

| Immutep (ASX:IMM) | A$0.29 | A$0.5 | 41.7% |

| Elders (ASX:ELD) | A$7.38 | A$14.04 | 47.4% |

| Cynata Therapeutics (ASX:CYP) | A$0.225 | A$0.44 | 48.9% |

| Credit Clear (ASX:CCR) | A$0.26 | A$0.47 | 44.3% |

| CleanSpace Holdings (ASX:CSX) | A$0.71 | A$1.40 | 49.5% |

| Airtasker (ASX:ART) | A$0.385 | A$0.72 | 46.2% |

Let's take a closer look at a couple of our picks from the screened companies.

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited specializes in the design, prototyping, production, testing, validation, and sale of cooling products and solutions globally with a market cap of A$788.50 million.

Operations: The company's revenue segments include PWR C&R at A$42.33 million and PWR Performance Products at A$101.83 million.

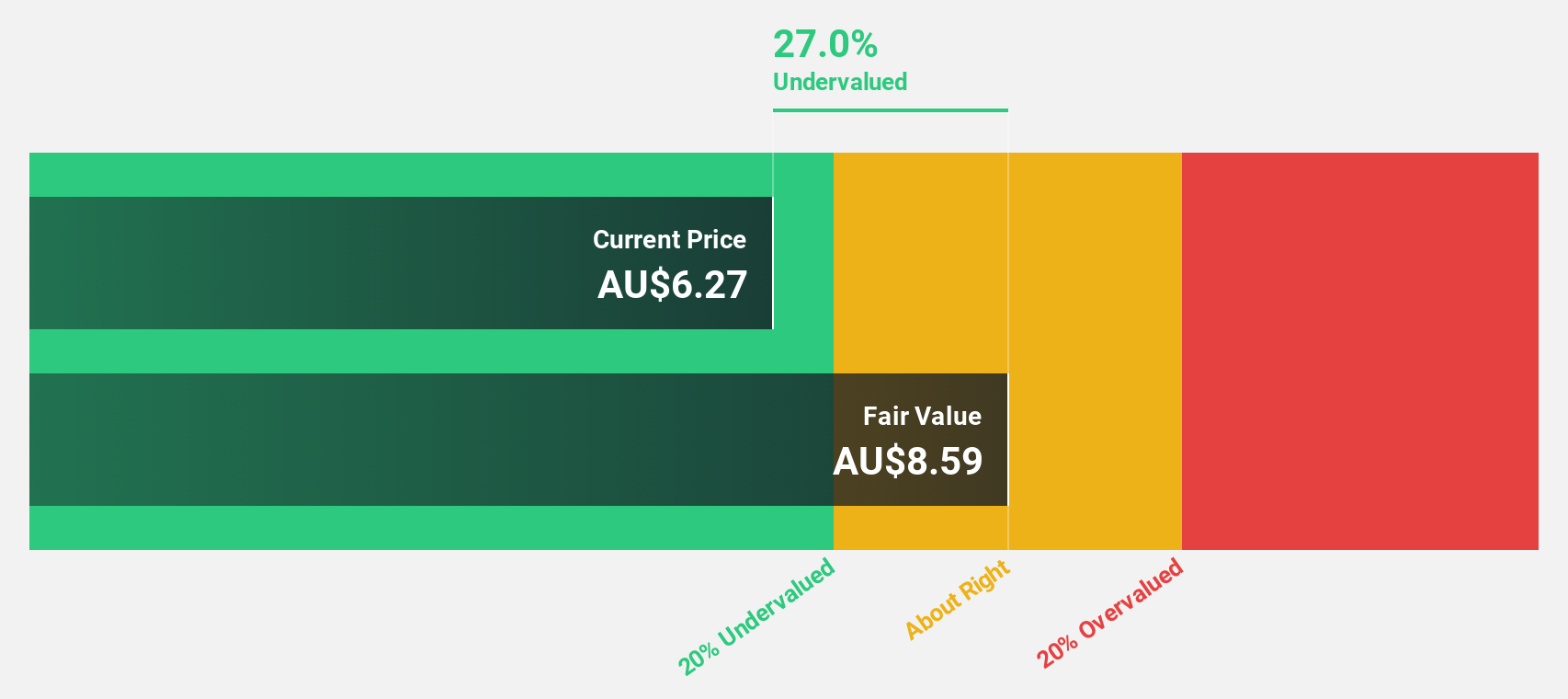

Estimated Discount To Fair Value: 10.7%

PWR Holdings is trading at A$7.84, below its estimated fair value of A$8.78, suggesting it may be undervalued based on cash flows. Despite a decline in net income to A$9.77 million from the previous year's A$24.81 million, earnings are forecast to grow significantly at 26.74% annually over the next three years, outpacing market expectations. However, profit margins have decreased from 17.8% to 7.5%, indicating potential challenges ahead despite growth forecasts.

- Upon reviewing our latest growth report, PWR Holdings' projected financial performance appears quite optimistic.

- Dive into the specifics of PWR Holdings here with our thorough financial health report.

Superloop (ASX:SLC)

Overview: Superloop Limited, with a market cap of A$1.63 billion, operates as a telecommunications and internet service provider in Australia.

Operations: The company's revenue segments comprise A$104.85 million from Business, A$363.69 million from Consumer, and A$77.92 million from Wholesale operations.

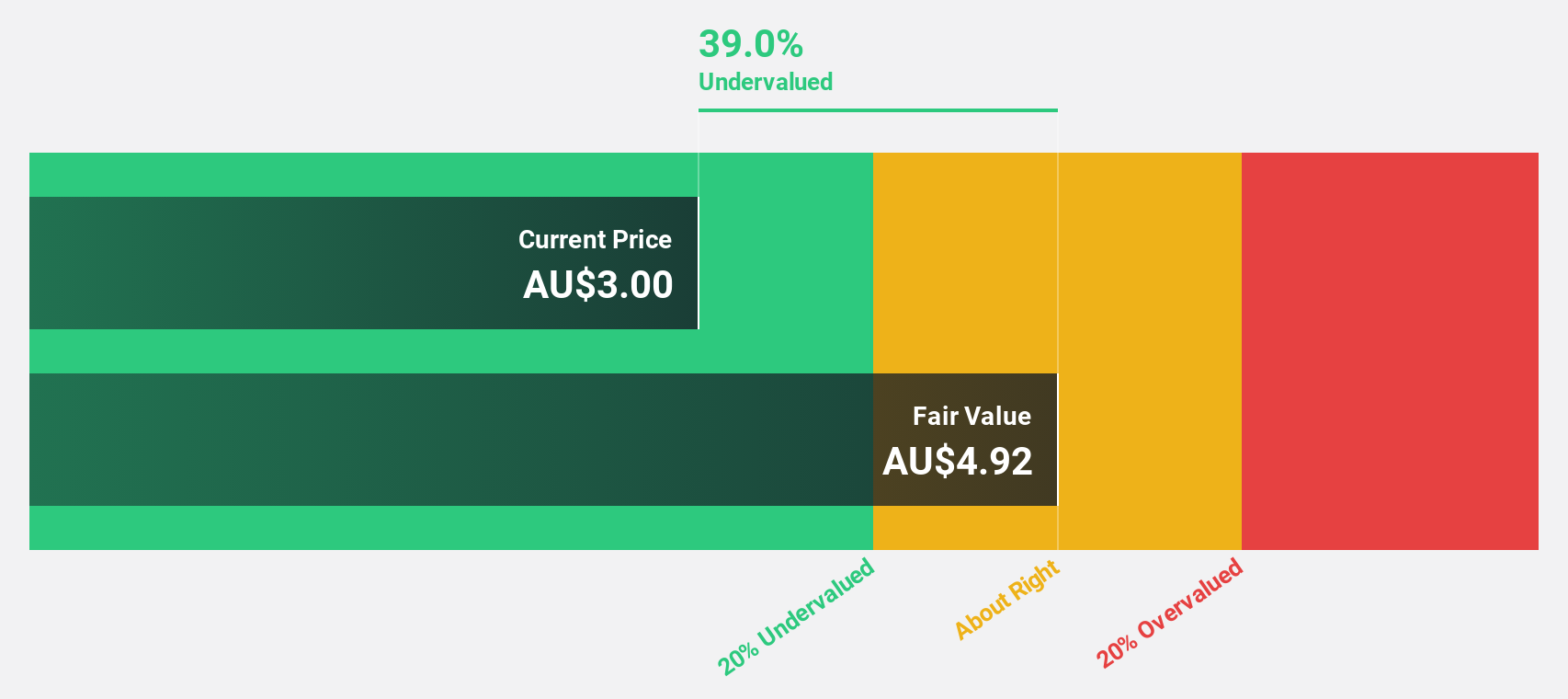

Estimated Discount To Fair Value: 43.7%

Superloop, trading at A$3.19, is significantly undervalued with a fair value estimate of A$5.67, driven by robust cash flow analysis. The company reported revenue growth to A$550.27 million from A$420.52 million and turned profitable with net income of A$1.21 million after a prior loss of A$14.74 million, highlighting improved financial health despite low forecasted return on equity and insider selling concerns. Its inclusion in the S&P/ASX 200 Index underscores its growing market presence.

- Our growth report here indicates Superloop may be poised for an improving outlook.

- Navigate through the intricacies of Superloop with our comprehensive financial health report here.

Web Travel Group (ASX:WEB)

Overview: Web Travel Group Limited offers online travel booking services across Australia, the United Arab Emirates, the United Kingdom, and globally, with a market cap of A$1.46 billion.

Operations: The company's revenue primarily comes from its Business to Business Travel (B2B) segment, which generated A$328.40 million.

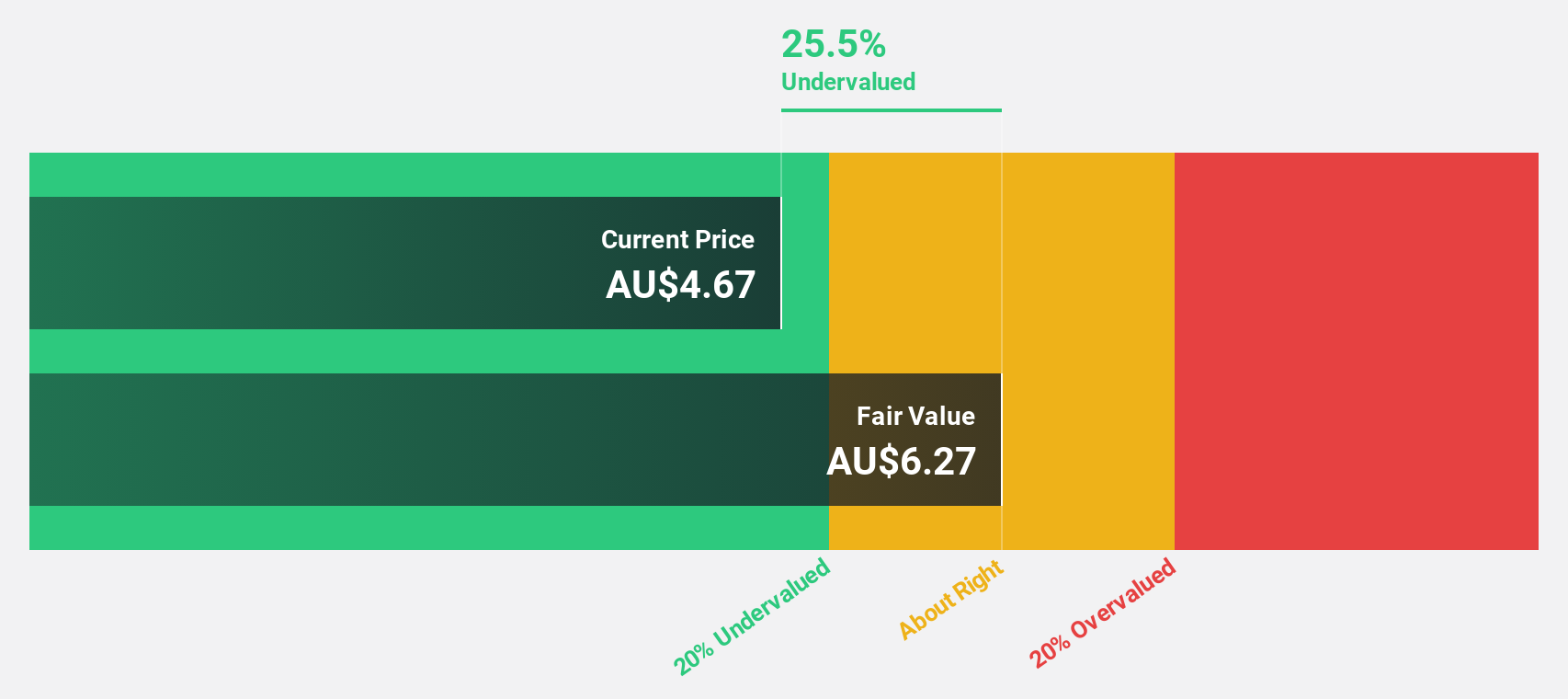

Estimated Discount To Fair Value: 37%

Web Travel Group, trading at A$4.05, is significantly undervalued with a fair value estimate of A$6.43, according to discounted cash flow analysis. Despite a decline in profit margins from 24.6% to 3.4%, earnings are projected to grow substantially at 32.1% annually over the next three years, outpacing the Australian market's growth rate of 11.4%. Revenue growth is also expected to exceed the market average, although it remains below high-growth benchmarks.

- In light of our recent growth report, it seems possible that Web Travel Group's financial performance will exceed current levels.

- Take a closer look at Web Travel Group's balance sheet health here in our report.

Next Steps

- Unlock our comprehensive list of 29 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PWH

PWR Holdings

Engages in the design, prototyping, production, testing, validation, and sale of cooling products and solutions in Australia, the United States, the United Kingdom, Italy, Germany, France, Japan, Finland, Croatia, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)