Elsight (ASX:ELS) Is Up 11.6% After Posting Record Revenue and First-Time Profitability

Reviewed by Sasha Jovanovic

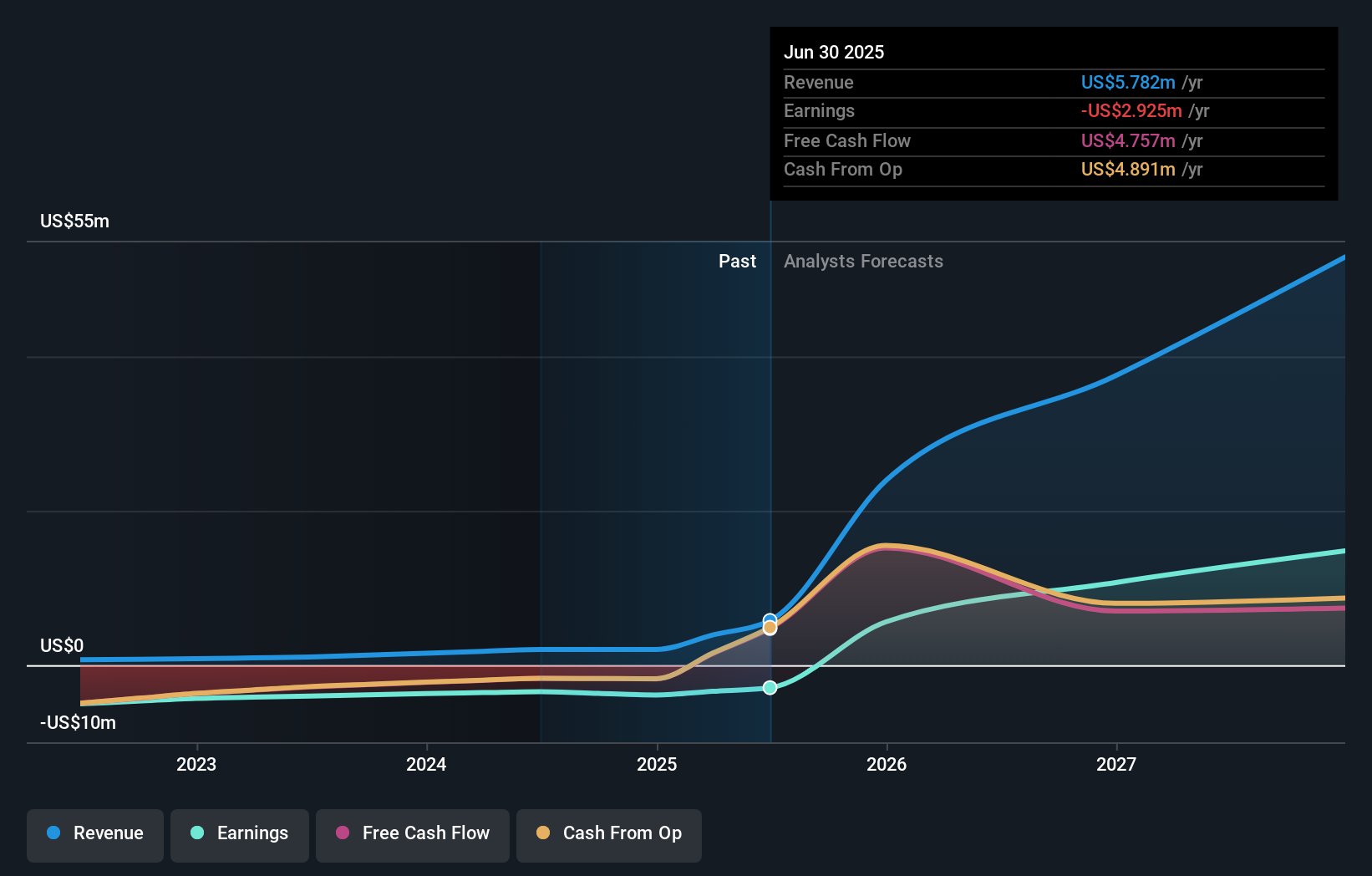

- On October 29, 2025, Elsight Limited reported its Q3 2025 earnings, achieving record-breaking quarterly revenue and reaching profitability for the first time in company history.

- Driving this milestone was robust growth across both defense and commercial markets, supported by increased investor attention following Elsight's inclusion in major ASX indices.

- Let's explore how Elsight's first-time profitability and broader market visibility shape its investment narrative going forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Elsight's Investment Narrative?

To see Elsight as a compelling holding, investors need to believe in the ongoing transformation of its business, from years of steep losses and modest revenues into a newly profitable, rapidly scaling technologies provider. The Q3 results mark a genuine shift in the near-term outlook: record revenues, the company’s first taste of profitability, and stronger brand presence after being added to two major ASX indices. These factors may drive greater institutional attention and help support future capital raises or customer expansion. However, even as catalysts like new contract wins and index inclusion become more influential, risks remain on investors’ radar. Notably, Elsight’s shares still trade at a premium to both peer and industry sales multiples, and recent heavy share dilution means future performance must justify the current valuation. While first-time profitability improves the narrative, risk from high relative valuation and ongoing execution challenges is still significant. On the flip side, recent equity dilution is one risk investors should keep in mind.

Elsight's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Elsight - why the stock might be worth over 2x more than the current price!

Build Your Own Elsight Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elsight research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Elsight research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elsight's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Elsight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELS

Elsight

Provides connectivity solutions in Israel, the United States, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)