Exploring Undervalued Small Caps With Insider Actions In June 2024

Amidst a fluctuating Australian market, with the ASX200 experiencing a slight downturn and sectors like IT and Energy facing declines, small-cap stocks remain a focal point for investors seeking potential growth opportunities. The current economic backdrop, marked by challenges in global markets such as China's property sector woes, sets a complex stage for identifying undervalued small caps that could offer substantial value in these turbulent times.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 17.2x | 2.6x | 46.02% | ★★★★★★ |

| Tabcorp Holdings | NA | 0.6x | 26.72% | ★★★★★★ |

| GUD Holdings | 14.0x | 1.4x | 6.96% | ★★★★★☆ |

| Codan | 27.6x | 4.1x | 24.68% | ★★★★☆☆ |

| Eagers Automotive | 9.3x | 0.3x | 31.08% | ★★★★☆☆ |

| Fiducian Group | 18.2x | 3.2x | 4.40% | ★★★☆☆☆ |

| Dicker Data | 21.6x | 0.8x | -1.94% | ★★★☆☆☆ |

| Smartgroup | 17.3x | 4.3x | 48.62% | ★★★☆☆☆ |

| Coventry Group | 285.2x | 0.4x | -28.14% | ★★★☆☆☆ |

| Lynch Group Holdings | NA | 0.4x | -14.28% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a diversified technology company specializing in communications equipment and metal detection, with a market capitalization of approximately A$1.07 billion.

Operations: The company generates its revenue primarily from communications and metal detection, contributing A$291.50 million and A$212.20 million respectively. It has observed a net income margin of 14.67% as of the most recent period, alongside a gross profit margin that stands at 54.42%.

PE: 27.6x

Recently, insiders at Codan have shown their confidence through share purchases, signaling a potential undervalued opportunity in this lesser-known Australian entity. With earnings expected to grow by 16% annually, the company's financial health appears robust. This insider activity, coupled with promising growth forecasts, suggests that Codan might be poised for future value realization despite its reliance on higher-risk funding sources. Such dynamics offer an intriguing blend of risk and potential reward for discerning investors looking beyond mainstream options.

- Click here and access our complete valuation analysis report to understand the dynamics of Codan.

-

Review our historical performance report to gain insights into Codan's's past performance.

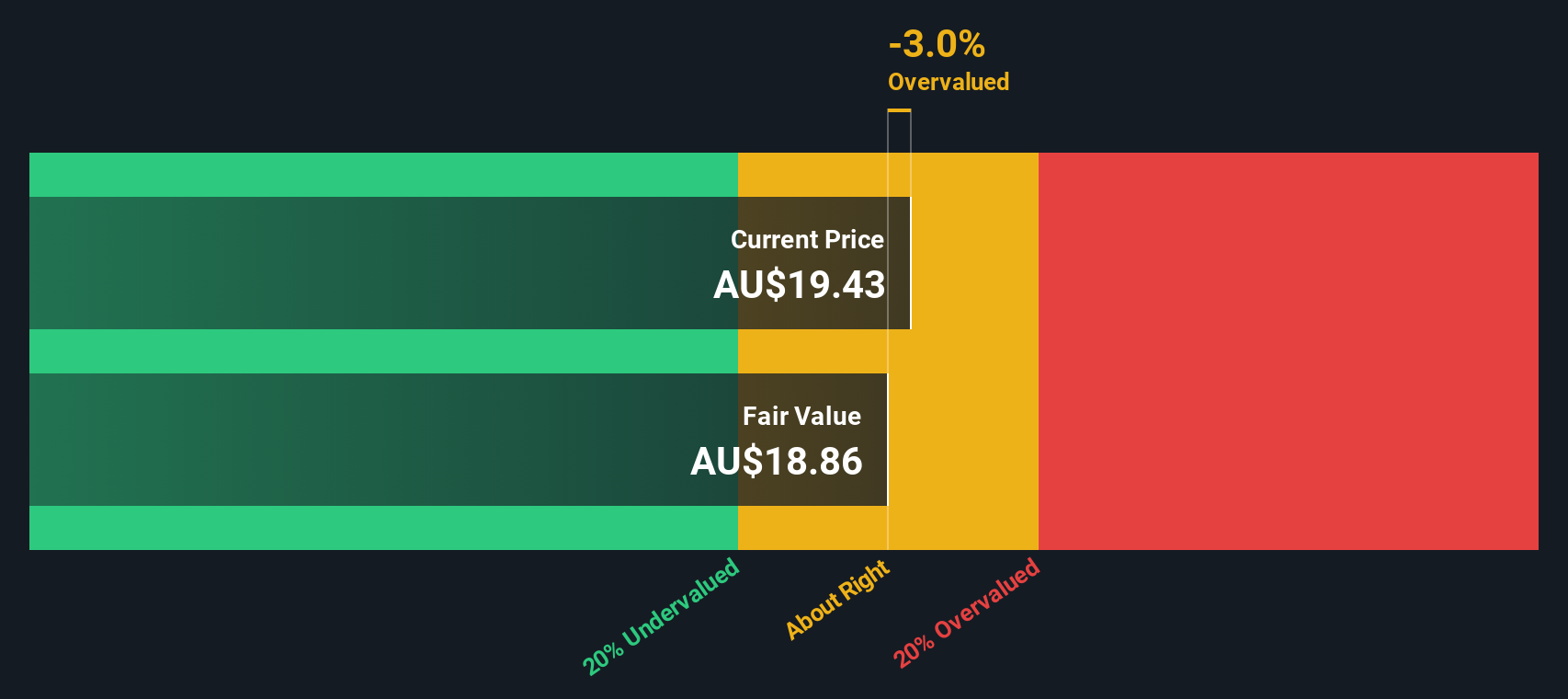

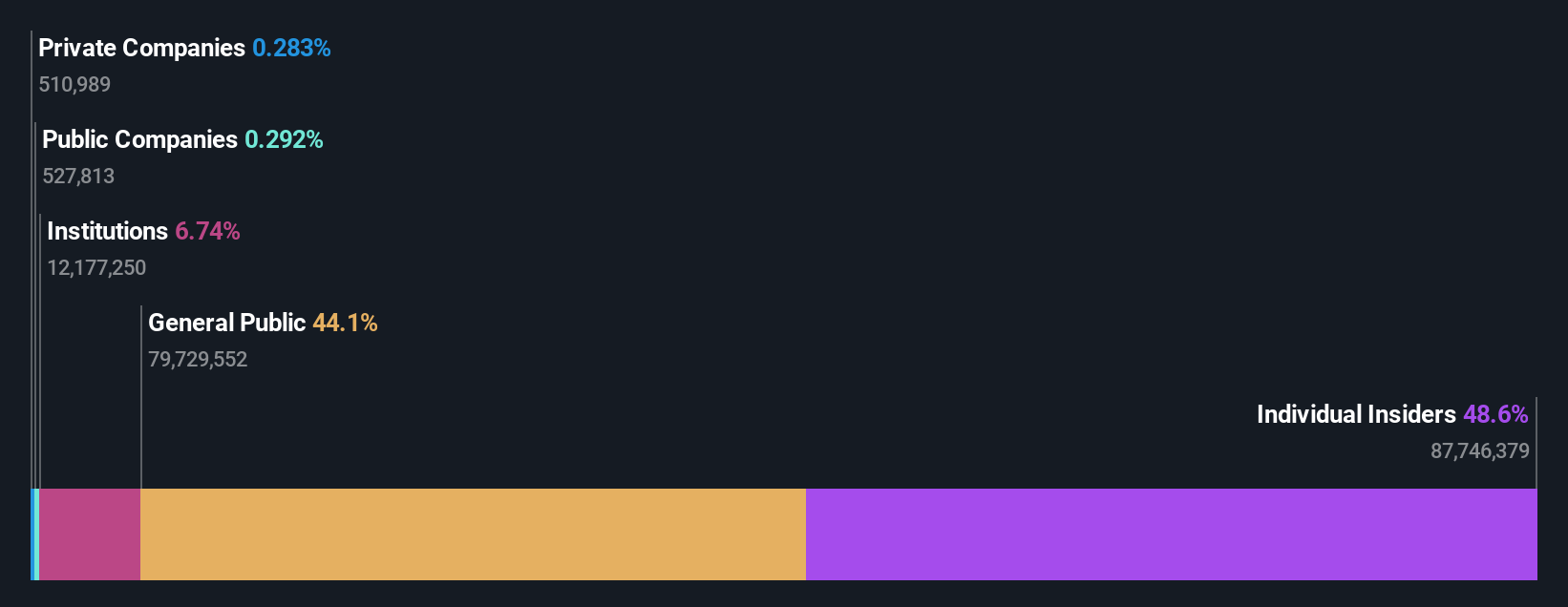

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is a wholesale distributor of computer peripherals, with a market capitalization of approximately A$2.27 billion.

Operations: Wholesale - Computer Peripherals generated A$2.27 billion in revenue with a gross profit margin of 14.23% as of the latest reporting period, reflecting an increase in efficiency compared to previous periods. The net income for the same period stood at A$82.15 million, indicating robust profitability amidst operational expenditures and non-operating costs.

PE: 21.6x

Recently, Dicker Data's insider, David Dicker, demonstrated confidence in the firm by purchasing A$704K worth of shares. This move aligns with the company's robust financial outlook, which anticipates an earnings growth of approximately 8% per year. Despite a high debt level that poses challenges, the company maintains a strong market position without relying on customer deposits. Upcoming events include an Annual General Meeting and a regular dividend payout, signaling ongoing operational activity and shareholder engagement.

- Click here to discover the nuances of Dicker Data with our detailed analytical valuation report.

-

Evaluate Dicker Data's historical performance by accessing our past performance report.

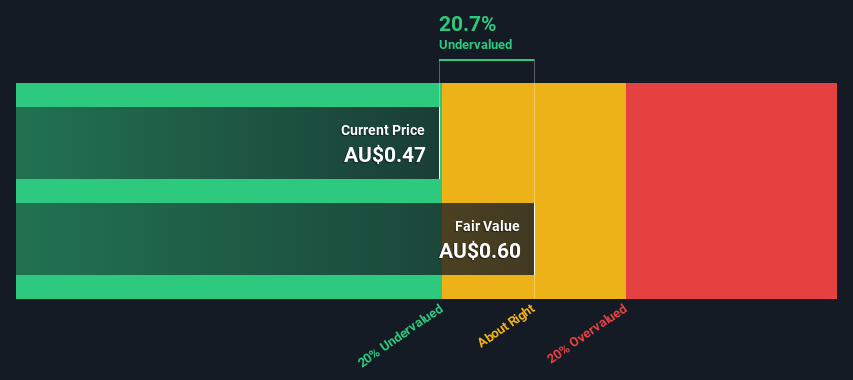

Tabcorp Holdings (ASX:TAH)

Simply Wall St Value Rating: ★★★★★★

Overview: Tabcorp Holdings is a diversified entertainment company operating primarily in gaming services and wagering, with a market capitalization of approximately A$11 billion.

Operations: The company's gross profit margin has remained consistently high at approximately 98% to 100%, reflecting its ability to manage production costs effectively. Notably, in the most recent period reported, it achieved a revenue of A$2.40 billion with a net income margin significantly impacted, recording -0.26%.

PE: -2.4x

Tabcorp Holdings, reflecting a promising trajectory with earnings expected to surge by 82% annually, stands out in the landscape of undervalued Australian entities. Recently, insider confidence was underscored as they purchased shares, signaling optimism about the company's future. Despite relying solely on external borrowing—a higher risk funding method—this has not deterred its financial strategy. This blend of insider activity and robust growth forecasts paints a compelling picture for potential investors looking at underappreciated opportunities.

Turning Ideas Into Actions

- Navigate through the entire inventory of 27 Undervalued ASX Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CDA

Codan

Develops technology solutions for United Nations organizations, security and military agencies, government departments, corporates, individuals consumers, and small-scale miners.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)