- Australia

- /

- Tech Hardware

- /

- ASX:BDT

BirdDog Technology Among 3 ASX Penny Stocks To Watch

Reviewed by Simply Wall St

Australian shares are experiencing a slight rebound, climbing around 0.5% after a significant one-day loss not seen since May 2020, as the market recalibrates following recent volatility. Amidst these fluctuations, investors often seek opportunities that balance potential growth with financial resilience. Penny stocks, though sometimes considered relics of past trading days, remain relevant for those looking to uncover hidden value in smaller or newer companies with strong financial foundations. In this article, we explore three such penny stocks on the ASX that stand out for their promising potential and robust balance sheets.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.535 | A$119.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.685 | A$953.71M | ✅ 4 ⚠️ 1 View Analysis > |

| Cedar Woods Properties (ASX:CWP) | A$4.98 | A$410.9M | ✅ 5 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.31 | A$61.8M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.21 | A$341.43M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.57 | A$109.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$2.85 | A$135.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.825 | A$612.1M | ✅ 5 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.59 | A$420.19M | ✅ 5 ⚠️ 1 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$2.90 | A$239.94M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 983 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

BirdDog Technology (ASX:BDT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BirdDog Technology Limited develops and manufactures hardware and software video technology solutions across multiple regions, including North America, Europe, the United Kingdom, the Asia Pacific, and Latin America, with a market cap of A$7.43 million.

Operations: The company generates revenue of A$16.56 million from its operations in developing and manufacturing hardware and software solutions.

Market Cap: A$7.43M

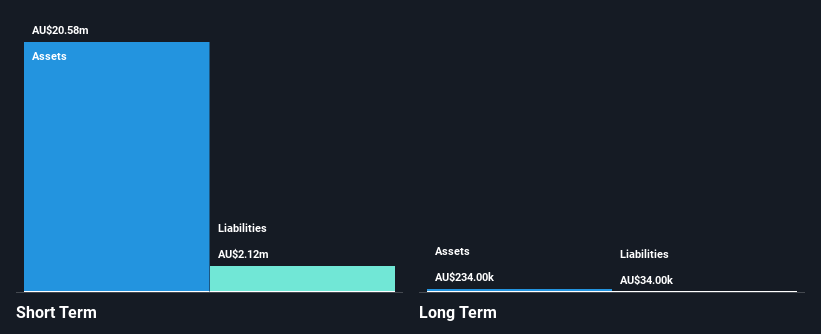

BirdDog Technology Limited, with a market cap of A$7.43 million, is navigating financial challenges as it remains unprofitable with increasing losses over the past five years. Despite short-term assets exceeding liabilities and being debt-free, the company has less than a year of cash runway and experiences high share price volatility. Recent earnings show reduced revenue from A$10.99 million to A$9.25 million year-over-year but decreased net loss from A$5.82 million to A$2.05 million in the same period, indicating some operational improvements. The company announced a significant share buyback program aimed at delisting from the Australian Securities Exchange by June 2025.

- Click to explore a detailed breakdown of our findings in BirdDog Technology's financial health report.

- Understand BirdDog Technology's earnings outlook by examining our growth report.

Cleo Diagnostics (ASX:COV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cleo Diagnostics Ltd is a medical diagnostics and devices company that develops and commercializes non-invasive blood tests for detecting ovarian cancer in Australia, with a market cap of A$47.55 million.

Operations: Cleo Diagnostics Ltd has not reported any specific revenue segments.

Market Cap: A$47.55M

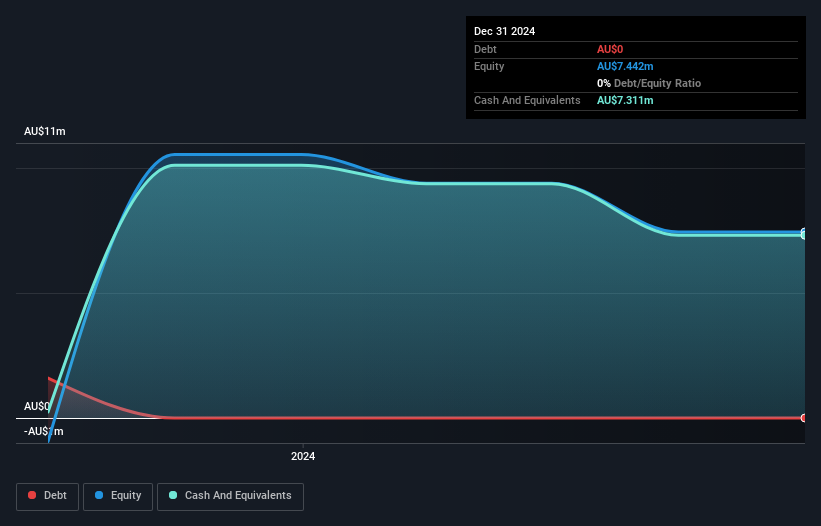

Cleo Diagnostics Ltd, with a market cap of A$47.55 million, is pre-revenue, making less than US$1m in revenue (A$211K). Despite being unprofitable and having a negative return on equity (-41.64%), the company has not diluted shareholders over the past year and maintains sufficient cash runway for 1.9 years if free cash flow continues to reduce at historical rates. Its short-term assets (A$7.5M) comfortably cover liabilities (A$447.9K), and it remains debt-free with no long-term liabilities. The management team is considered experienced, although recent earnings show a net loss reduction from A$2.61 million to A$1.95 million year-over-year.

- Click here to discover the nuances of Cleo Diagnostics with our detailed analytical financial health report.

- Assess Cleo Diagnostics' previous results with our detailed historical performance reports.

Mindax (ASX:MDX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mindax Limited is an Australian company focused on the exploration and development of mineral properties, with a market capitalization of A$129.07 million.

Operations: The company's revenue segment is solely from Iron Ore, with a reported amount of A$-0.006597 million.

Market Cap: A$129.07M

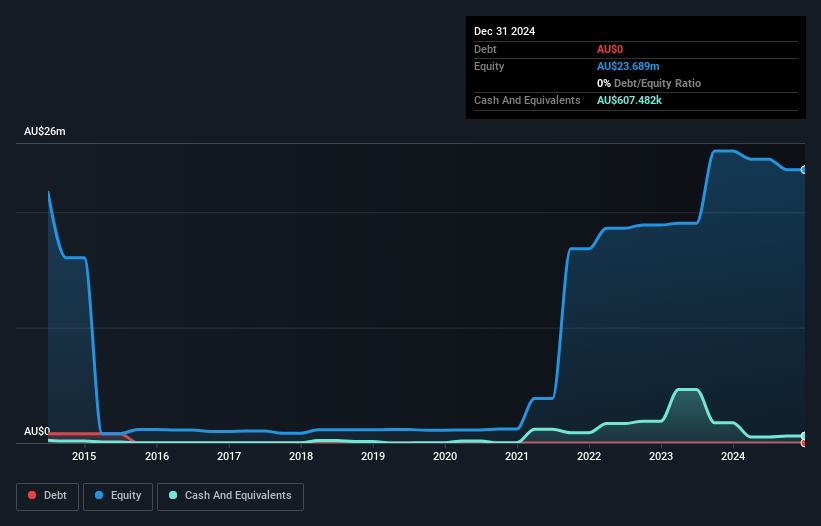

Mindax Limited, with a market cap of A$129.07 million, is pre-revenue, generating less than US$1m in revenue (A$-2K). Despite being unprofitable and experiencing increased losses over the past five years at 24.2% annually, it remains debt-free and has not diluted shareholders recently. The company's short-term assets (A$707.5K) fall short of covering its short-term liabilities (A$1.9M), but exceed long-term liabilities (A$453.1K). Recent earnings show a reduced net loss from A$1.26 million to A$1.01 million year-over-year, while additional capital raised should extend its cash runway beyond three months.

- Jump into the full analysis health report here for a deeper understanding of Mindax.

- Evaluate Mindax's historical performance by accessing our past performance report.

Taking Advantage

- Reveal the 983 hidden gems among our ASX Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Terbium and there are only 20 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BirdDog Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BDT

BirdDog Technology

Develops and manufactures hardware and software video technology solutions in North America, Europe, the United Kingdom, the Asia Pacific, and Latin America.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)