High Growth Tech Stocks in Australia Featuring Life360 and Two Others

Reviewed by Simply Wall St

The Australian market is experiencing a bullish trend, with the ASX reaching new all-time highs, driven by positive sentiment from Wall Street and expectations of potential rate cuts by the Reserve Bank of Australia in response to rising unemployment. In this environment, high-growth tech stocks like Life360 are garnering attention for their potential to capitalize on favorable economic conditions and investor optimism.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pro Medicus | 20.17% | 22.26% | ★★★★★★ |

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Echo IQ | 49.20% | 51.35% | ★★★★★★ |

| WiseTech Global | 20.46% | 23.23% | ★★★★★★ |

| BlinkLab | 51.57% | 52.67% | ★★★★★★ |

| Wrkr | 55.92% | 116.30% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Immutep | 70.84% | 42.55% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| SiteMinder | 18.77% | 55.55% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our ASX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Life360 (ASX:360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Life360, Inc. operates a technology platform that provides location services for people, pets, and things across various regions globally, with a market capitalization of A$8.63 billion.

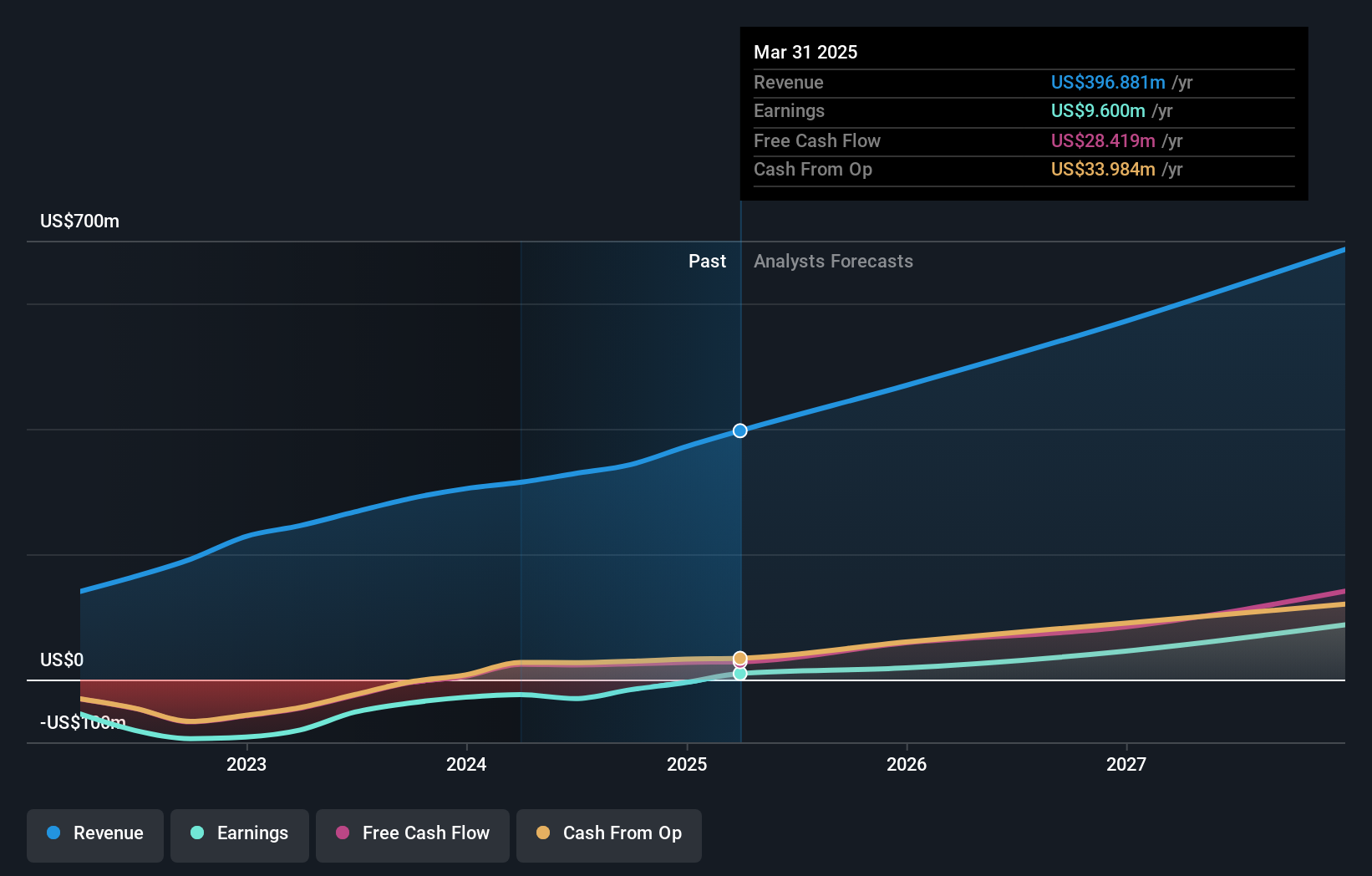

Operations: The company generates revenue primarily from its software and programming segment, amounting to $396.88 million. Its technology platform is utilized across North America, Europe, the Middle East, Africa, and other international markets.

Despite recent volatility, including its drop from several Russell indexes, Life360 has shown resilience and strategic foresight in the high-growth tech sector. The company's revenue is expected to grow by 16.1% annually, outpacing the Australian market's 5.5%, while earnings are forecasted to surge by an impressive 40.6% per year. This growth trajectory is supported by innovative advertising solutions like Place Ads and Uplift by Life360, which leverage real-world behavior to deliver targeted ads, evidenced by their partnership with Uber that generated over 100,000 rides from airport travelers alone. With $308.9 million raised from a convertible notes offering aimed at funding acquisitions and strategic investments, Life360 is poised to expand its technological footprint and enhance shareholder value through smart capital allocation.

- Take a closer look at Life360's potential here in our health report.

Gain insights into Life360's historical performance by reviewing our past performance report.

Codan (ASX:CDA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Codan Limited specializes in creating technology solutions for various clients, including United Nations organizations, security and military groups, government departments, individuals, and small-scale miners, with a market capitalization of A$3.67 billion.

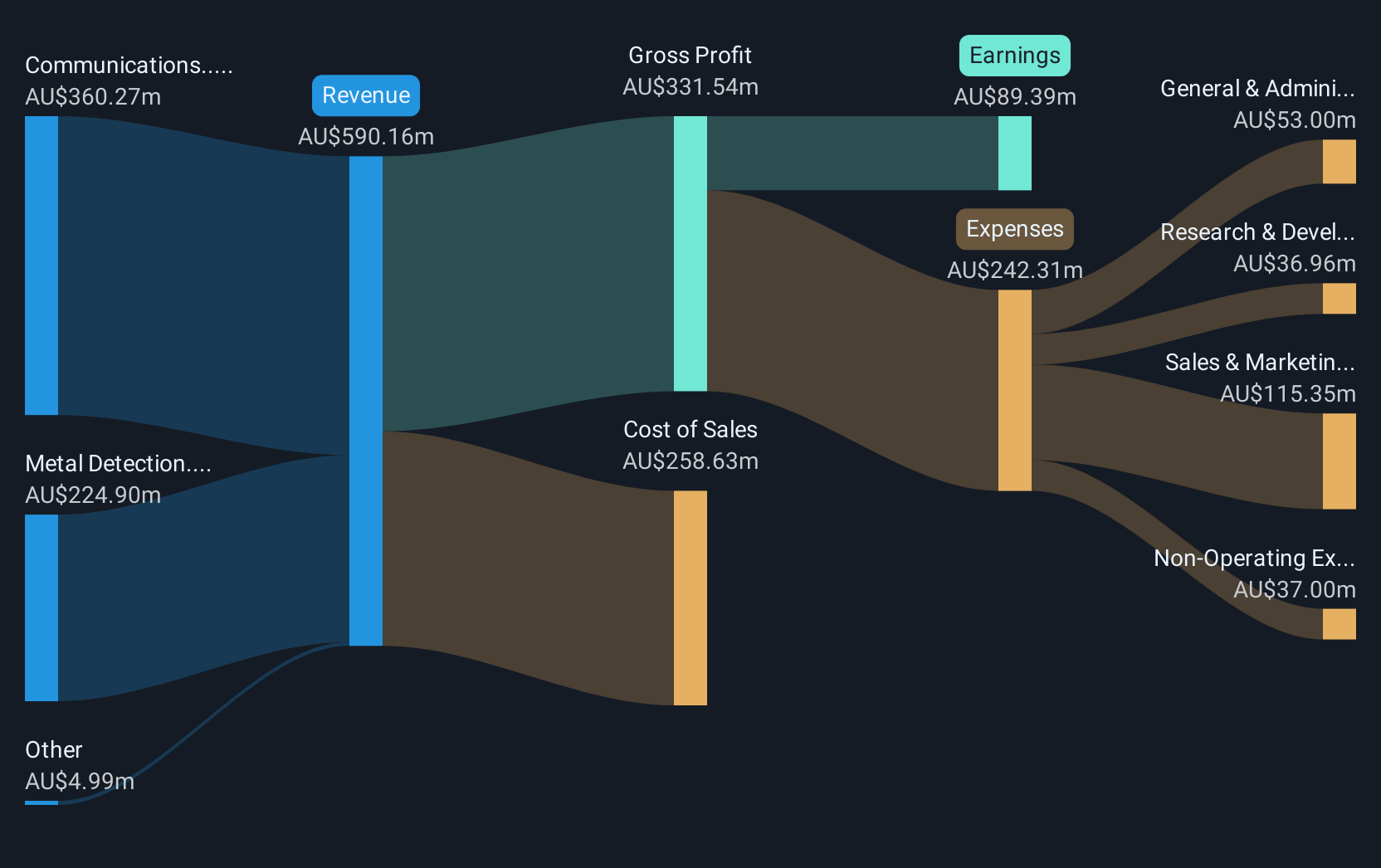

Operations: Codan Limited generates revenue primarily from its Communications and Metal Detection segments, with A$360.27 million and A$224.90 million respectively. The company focuses on providing technology solutions to a diverse range of clients, including governmental and military entities, as well as individuals in niche markets.

With a robust 19.4% increase in earnings over the past year, Codan has outperformed the Electronic industry's growth of 8.9%, showcasing its competitive edge in a challenging market. The company's revenue is expected to rise by 10.8% annually, surpassing the broader Australian market's growth rate of 5.6%. This financial vitality is underpinned by Codan’s commitment to innovation, as evidenced by its R&D expenses that strategically fuel advancements and efficiency in its operations. Looking ahead, while earnings are projected to grow at a steady rate of 15.76% per year, it’s clear that Codan is not just keeping pace but setting the pace in its sector through strategic investments and a keen focus on sustainable growth.

- Click to explore a detailed breakdown of our findings in Codan's health report.

Explore historical data to track Codan's performance over time in our Past section.

Xero (ASX:XRO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xero Limited offers online business solutions tailored for small businesses and their advisors across Australia, New Zealand, the United Kingdom, North America, and other international markets, with a market capitalization of approximately A$29.80 billion.

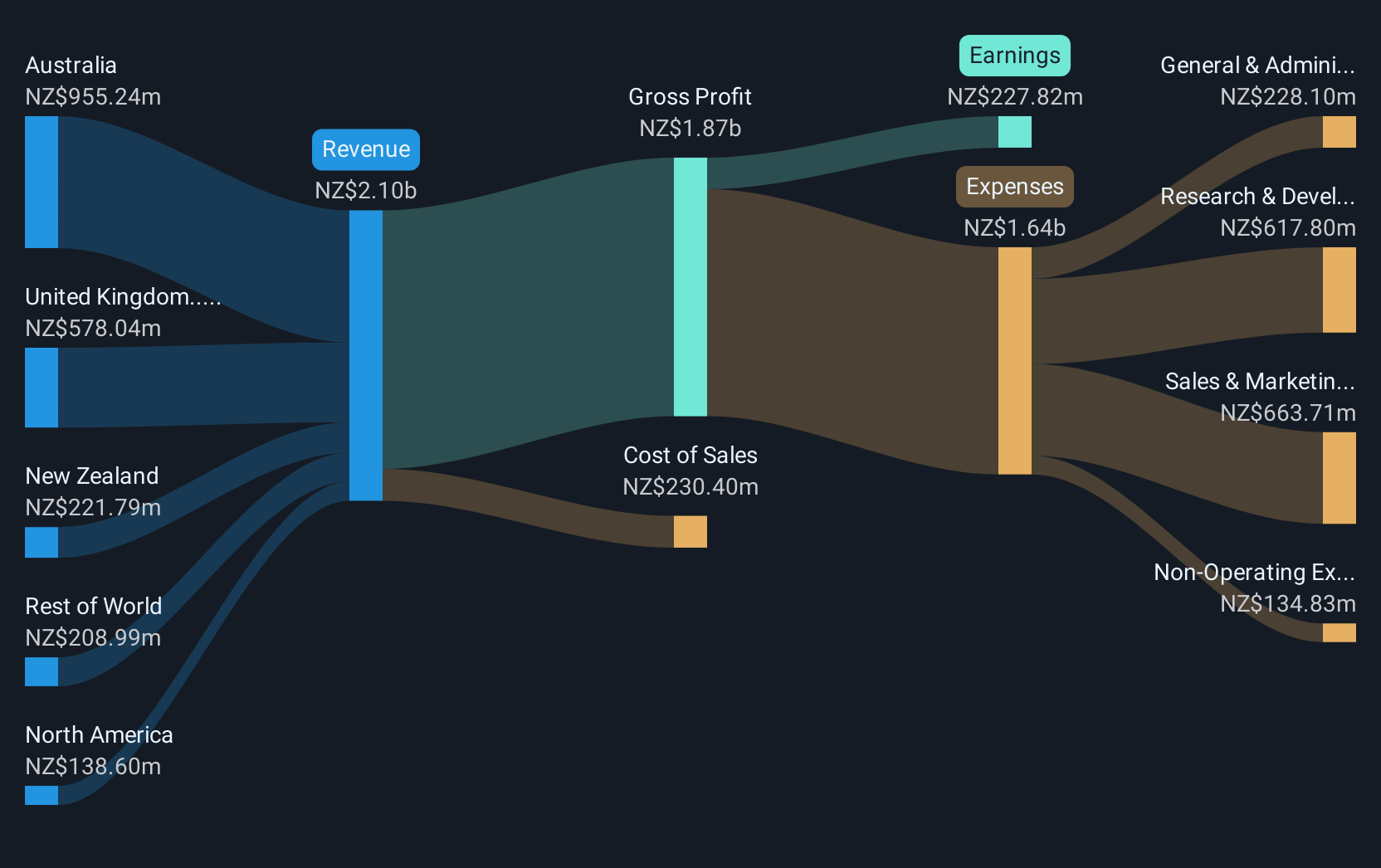

Operations: The company generates revenue primarily from providing online solutions for small businesses and their advisors, amounting to NZ$2.10 billion. Its operations span Australia, New Zealand, the United Kingdom, North America, and other international markets.

Xero's recent performance and strategic initiatives position it as a dynamic entity in the tech landscape, particularly within the software industry where it has outpaced its peers with a 30.4% earnings growth over the past year. This growth is significantly higher than the industry average of 5.6%. The company's commitment to innovation is evident from its R&D spending, which has been crucial in maintaining this momentum; however, specific figures were not disclosed. Additionally, Xero recently enhanced its platform through partnerships and integrations, such as with BILL for streamlined bill payments in the U.S., reflecting a proactive approach to addressing client needs and improving cash flow management for small businesses. These moves not only enhance Xero’s service offering but also solidify its standing in competitive markets by adapting to evolving business environments.

- Click here to discover the nuances of Xero with our detailed analytical health report.

Understand Xero's track record by examining our Past report.

Next Steps

- Embark on your investment journey to our 45 ASX High Growth Tech and AI Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:XRO

Xero

Provides online business solutions for small businesses and their advisors in Australia, New Zealand, the United Kingdom, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)