Vinyl Group (ASX:VNL) shareholder returns have been strong, earning 129% in 1 year

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the Vinyl Group Ltd (ASX:VNL) share price has soared 126% return in just a single year. It's also up 29% in about a month. We note that Vinyl Group reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report. It is also impressive that the stock is up 111% over three years, adding to the sense that it is a real winner.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Vinyl Group

Vinyl Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last year Vinyl Group saw its revenue grow by 709%. That's stonking growth even when compared to other loss-making stocks. Meanwhile, the market has paid attention, sending the share price soaring 126% in response. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

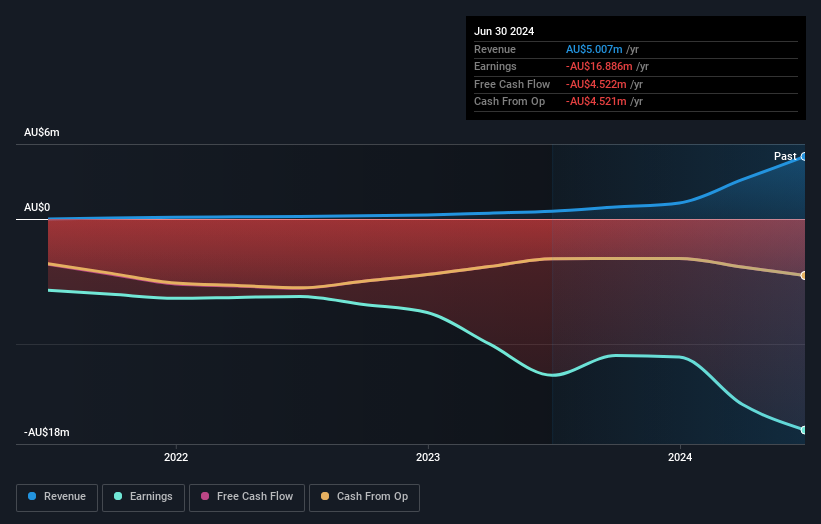

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Vinyl Group's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We've already covered Vinyl Group's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Vinyl Group's TSR, at 129% is higher than its share price return of 126%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's good to see that Vinyl Group has rewarded shareholders with a total shareholder return of 129% in the last twelve months. That certainly beats the loss of about 10% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Vinyl Group has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Vinyl Group is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VNL

Vinyl Group

Operates as a music company in Australia, the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet low.

Market Insights

Community Narratives