Vinyl Group (ASX:VNL) hikes 18% this week, taking five-year gains to 448%

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. For example, the Vinyl Group Ltd (ASX:VNL) share price is up a whopping 442% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. And in the last month, the share price has gained 37%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

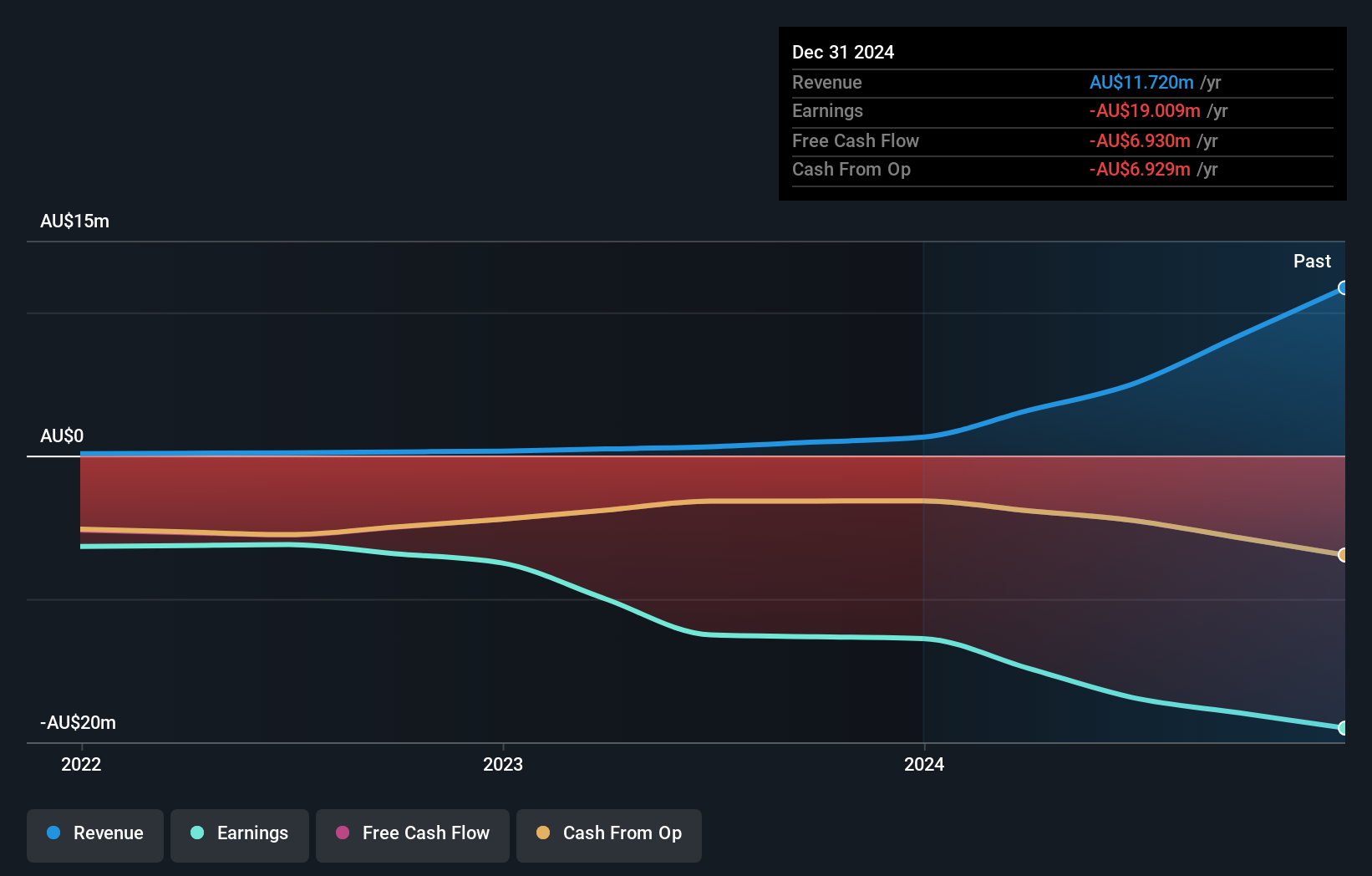

Vinyl Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 5 years Vinyl Group saw its revenue grow at 90% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 40% per year in that time. Despite the strong run, top performers like Vinyl Group have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Vinyl Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Vinyl Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Vinyl Group hasn't been paying dividends, but its TSR of 448% exceeds its share price return of 442%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Vinyl Group shareholders have received a total shareholder return of 32% over the last year. However, that falls short of the 41% TSR per annum it has made for shareholders, each year, over five years. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Vinyl Group (2 are a bit concerning!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VNL

Vinyl Group

Focuses on delivering technology and media solutions that connect music creators, fans and brands in Australia, the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet with low risk.

Market Insights

Community Narratives