Further weakness as Spirit Technology Solutions (ASX:ST1) drops 19% this week, taking five-year losses to 86%

While it may not be enough for some shareholders, we think it is good to see the Spirit Technology Solutions Ltd (ASX:ST1) share price up 12% in a single quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Indeed, the share price is down a whopping 87% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The important question is if the business itself justifies a higher share price in the long term. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

After losing 19% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Given that Spirit Technology Solutions didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over five years, Spirit Technology Solutions grew its revenue at 10% per year. That's a pretty good rate for a long time period. So it is unexpected to see the stock down 13% per year in the last five years. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

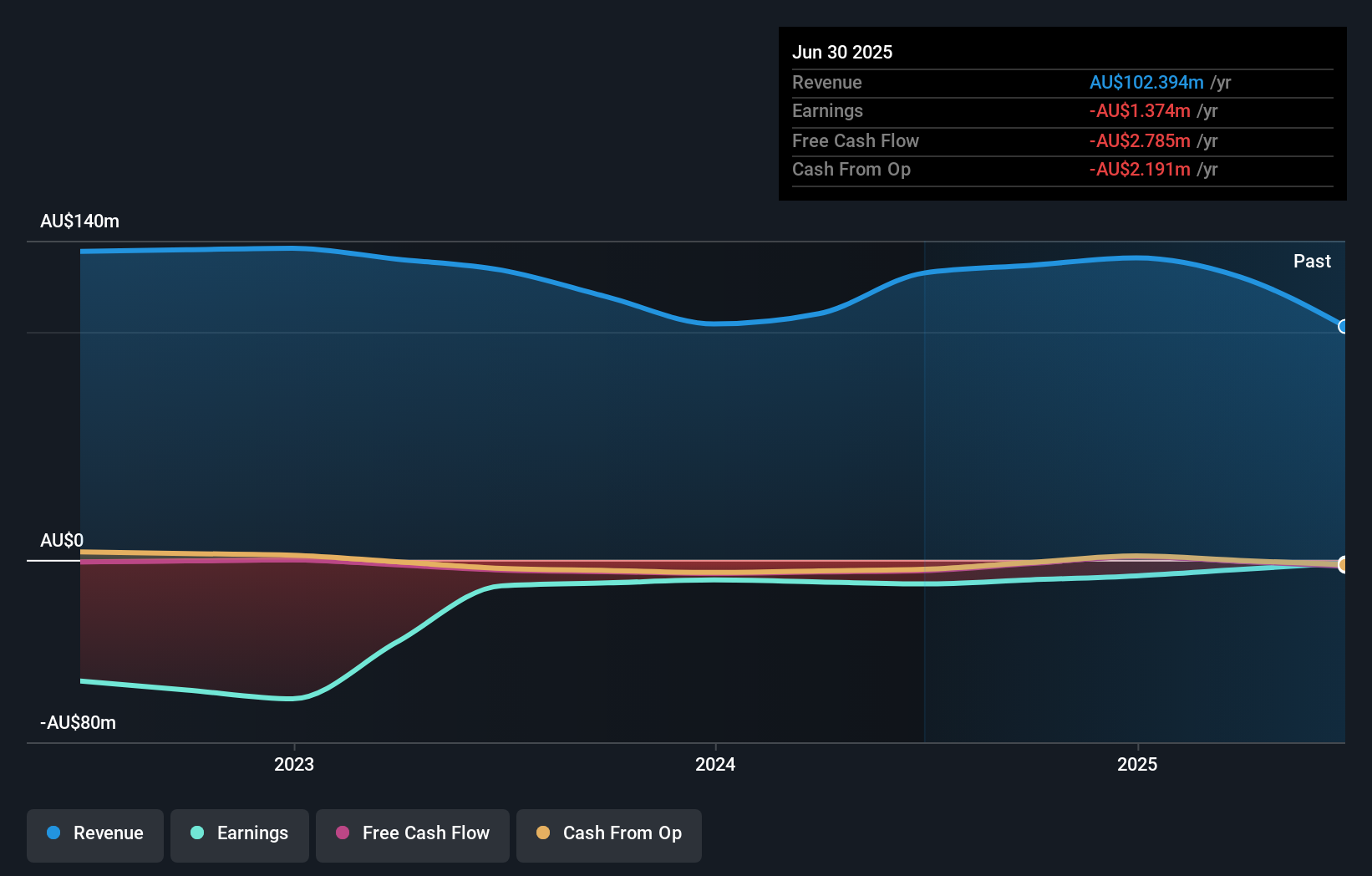

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Spirit Technology Solutions' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 12% in the last year, Spirit Technology Solutions shareholders lost 9.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Spirit Technology Solutions better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Spirit Technology Solutions (including 1 which makes us a bit uncomfortable) .

Spirit Technology Solutions is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ST1

Spirit Technology Solutions

Engages in the provision of cyber security, and technology services and solutions in Australia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives