SiteMinder (ASX:SDR): Valuation Check After Adding AI-Focused Director Samantha Lawson to the Board

Reviewed by Simply Wall St

SiteMinder (ASX:SDR) has added Samantha Lawson to its board as an independent non executive director, bringing deep AI and digital transformation experience that could influence how investors think about the company’s next phase of product and revenue growth.

See our latest analysis for SiteMinder.

The latest board refresh lands while SiteMinder’s share price sits at A$6.27, with a modest year to date share price return and a powerful three year total shareholder return suggesting momentum has paused rather than disappeared.

If Lawson’s AI and digital track record has you thinking about what else might be poised for a step change, this could be a good moment to explore high growth tech and AI stocks.

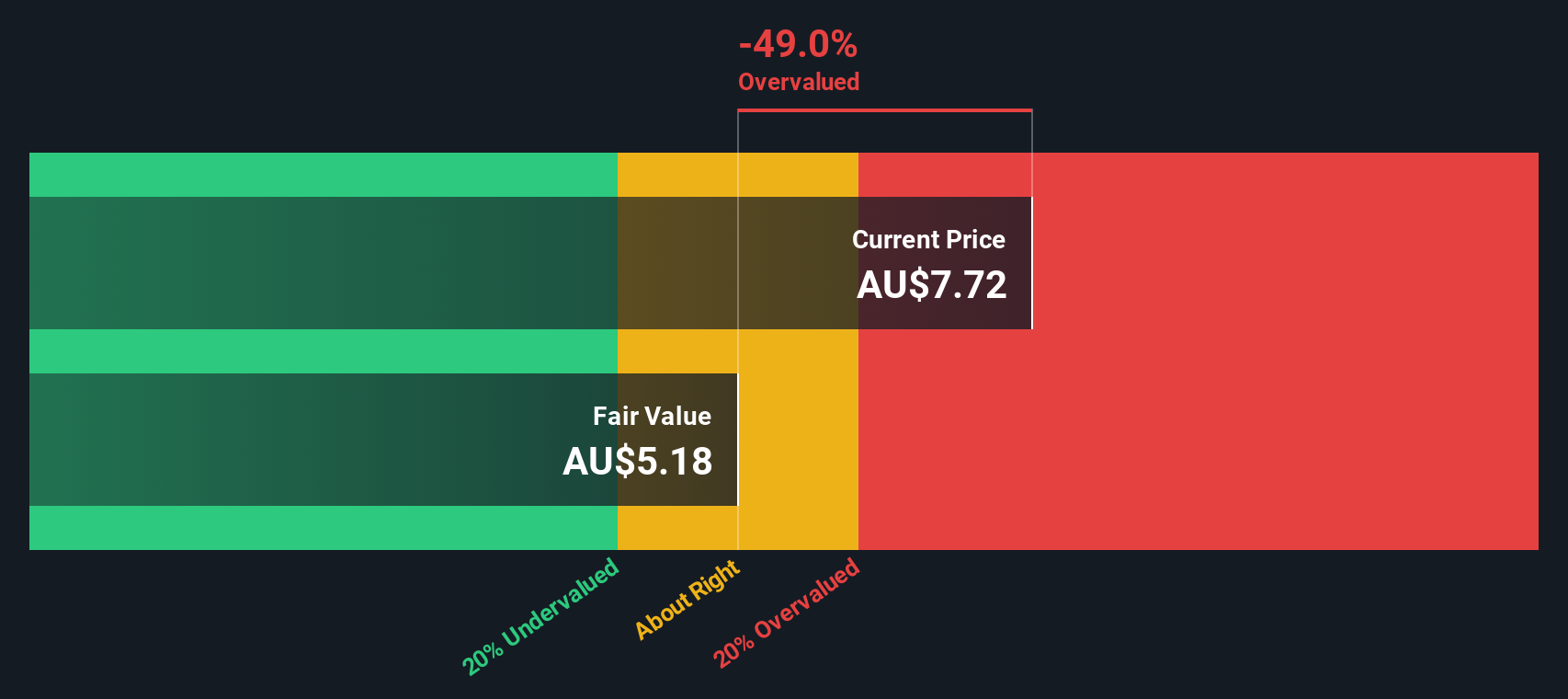

With shares trading at a discount to analyst targets but a premium to intrinsic value models, has SiteMinder quietly become an underappreciated AI driven travel software play, or is the market already baking in its next leg of growth?

Price to Sales of 7.8x: Is it justified?

On a price to sales basis, SiteMinder’s A$6.27 share price implies investors are paying a clear premium versus both peers and the broader software sector.

The price to sales multiple compares a company’s market value to its annual revenue. This can be a useful lens for fast growing, often still unprofitable, software and platform businesses like SiteMinder.

At 7.8 times sales, the market is effectively baking in strong future growth and margin expansion. This sits well above the estimated fair price to sales ratio of 4.5 times, suggesting expectations may be running ahead of fundamentals.

That premium looks even starker against the Australian software industry average of 3.5 times and a peer average of 6.3 times. This reinforces that SiteMinder is being priced as a higher quality or higher growth name than many of its closest comparables.

Explore the SWS fair ratio for SiteMinder

Result: Price to Sales of 7.8x (OVERVALUED)

However, escalating competition in hotel software and the challenge of turning rapid revenue growth into sustainable profitability could quickly cap the potential for re-rating.

Find out about the key risks to this SiteMinder narrative.

Another View on Value

Our DCF model points to a fair value of about A$5.82 per share, below the current A$6.27 price, so SiteMinder looks modestly overvalued on cash flows as well. If both revenue multiples and cash flows are flashing rich, what needs to go right to justify today’s price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SiteMinder for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SiteMinder Narrative

If you see the story differently, or would rather dig into the numbers yourself, you can build a personalised view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding SiteMinder.

Ready for your next investing move?

Before the market’s next big swing, consider using the Simply Wall St Screener to surface focused, data backed ideas you might otherwise miss.

- Capture potential early stage winners by scanning these 3606 penny stocks with strong financials that already show stronger balance sheets and fundamentals than most micro caps.

- Position your portfolio for the next technology wave by targeting these 26 AI penny stocks building real revenue from artificial intelligence, not just buzzwords.

- Seek more dependable cash returns by zeroing in on these 13 dividend stocks with yields > 3% that can help boost your income stream while you wait for growth to play out.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDR

SiteMinder

Provides software and online licensing solutions in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)