- Australia

- /

- Capital Markets

- /

- ASX:AVC

ASX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the ASX200 experiences a modest rise of 0.21% to 8,135 points, sector performance varies with Utilities leading gains and Energy lagging behind. In such a diverse market landscape, identifying promising investment opportunities requires careful consideration of financial health and growth potential. Penny stocks, often associated with smaller or newer companies, still offer intriguing possibilities for investors seeking value at lower price points; when these stocks are supported by strong fundamentals, they can present an opportunity for significant returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| LaserBond (ASX:LBL) | A$0.62 | A$72.68M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.85 | A$102.34M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.81 | A$291.55M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.665 | A$815.98M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.165 | A$1.08B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.33 | A$127.72M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.12 | A$328.36M | ★★★★☆☆ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Auctus Investment Group (ASX:AVC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Auctus Investment Group Limited, formerly Yonder and Beyond Group Limited, is a private equity and venture capital firm focusing on mid-market growth sectors, real estate, and infrastructure, with a market cap of A$43.75 million.

Operations: The firm generates revenue of A$7.70 million from its Information Technology segment.

Market Cap: A$43.75M

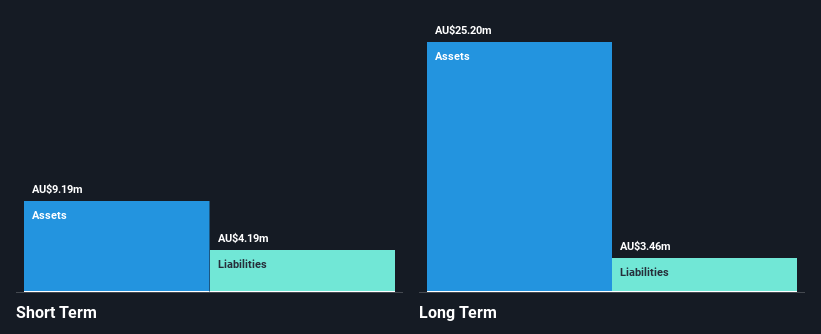

Auctus Investment Group has demonstrated a significant turnaround, becoming profitable this year with net income of A$2.01 million for the full year ended June 30, 2024, compared to a net loss previously. Despite this positive shift, revenue declined to A$3.77 million from A$16.14 million the prior year. The company maintains a strong balance sheet with no debt and short-term assets exceeding both short- and long-term liabilities. However, shareholder dilution occurred over the past year with shares outstanding increasing by 6.3%. The management team is experienced, averaging over six years in tenure.

- Click to explore a detailed breakdown of our findings in Auctus Investment Group's financial health report.

- Review our historical performance report to gain insights into Auctus Investment Group's track record.

Optiscan Imaging (ASX:OIL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Optiscan Imaging Limited develops, manufactures, and commercializes endomicroscopic digital imaging technology solutions for medical, translational, and pre-clinical applications across Australia, Germany, China, and the United States with a market cap of A$137.83 million.

Operations: The company generates revenue from its Confocal Microscopes segment, amounting to A$2.99 million.

Market Cap: A$137.83M

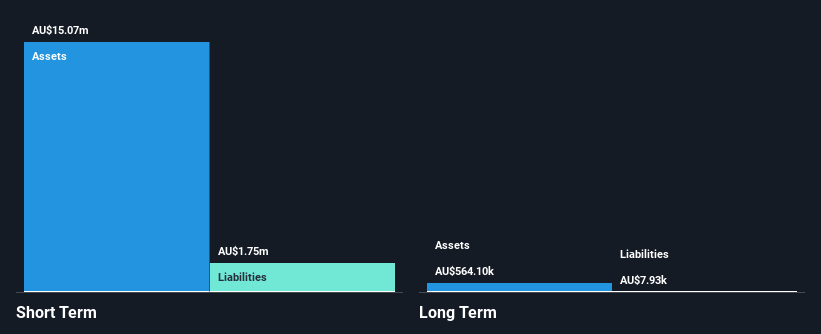

Optiscan Imaging faces challenges with declining sales, reporting A$1.16 million for the year ended June 30, 2024, down from A$1.68 million previously. The company remains unprofitable, with net losses widening to A$6.06 million from A$4.35 million the prior year. Despite this, Optiscan's financial position is relatively stable; it has more cash than debt and short-term assets of A$15.1 million exceed both short- and long-term liabilities significantly. Management and board members are experienced but must navigate increasing losses while maintaining a sufficient cash runway for over a year amidst ongoing operational challenges.

- Jump into the full analysis health report here for a deeper understanding of Optiscan Imaging.

- Gain insights into Optiscan Imaging's past trends and performance with our report on the company's historical track record.

Prophecy International Holdings (ASX:PRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Prophecy International Holdings Limited designs, develops, and markets computer software applications and services across various regions including Australia, New Zealand, the Middle East, North America, Europe, Africa, and Asia with a market cap of A$53.01 million.

Operations: The company's revenue is primarily derived from its eMite segment at A$14.24 million, followed by SNARE at A$8.25 million, and a smaller contribution from the Legacy segment at A$0.70 million.

Market Cap: A$53.01M

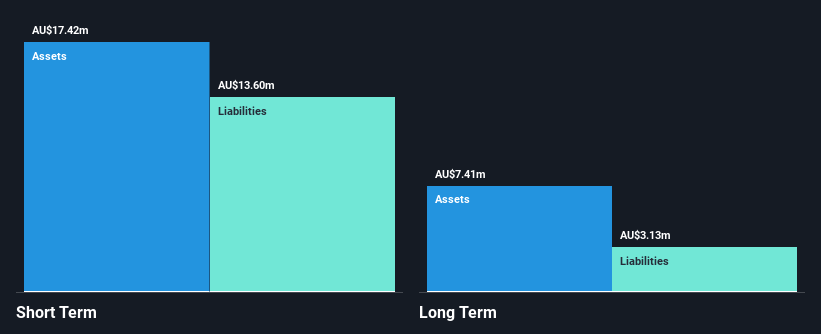

Prophecy International Holdings, with a market cap of A$53.01 million, is navigating financial challenges despite a revenue increase to A$22.87 million for the year ended June 30, 2024. The company remains unprofitable, with net losses widening to A$4.24 million from the previous year's A$2.49 million. However, Prophecy's financial health is supported by short-term assets of A$17.4 million exceeding both short- and long-term liabilities and being debt-free for five years. Its seasoned management team has maintained a sufficient cash runway for over three years while avoiding shareholder dilution amidst stable volatility levels.

- Click here and access our complete financial health analysis report to understand the dynamics of Prophecy International Holdings.

- Evaluate Prophecy International Holdings' historical performance by accessing our past performance report.

Summing It All Up

- Reveal the 1,033 hidden gems among our ASX Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AVC

Auctus Investment Group

Auctus Investment Group Limited previously known as Yonder and Beyond Group Limited is a private equity, and venture capital firm specializing in mid-market, growth sectors, real estate, and infrastructure.

Flawless balance sheet slight.