- Australia

- /

- Energy Services

- /

- ASX:MCE

Matrix Composites & Engineering Leads 3 ASX Penny Stocks To Consider

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 close down by 0.2% at 8,310 points, with China's economic data exceeding expectations and driving positive sentiment in certain sectors like Industrials and Utilities. For investors interested in smaller or newer companies, penny stocks can still offer surprising value despite their somewhat outdated moniker. By focusing on those with strong financial foundations and potential for growth, investors may find opportunities that balance stability with upside potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.90 | A$240.44M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.92 | A$106.21M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$332.15M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.965 | A$109.89M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.325 | A$64.64M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.11 | A$326.82M | ★★★★☆☆ |

Click here to see the full list of 1,025 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Matrix Composites & Engineering (ASX:MCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Matrix Composites & Engineering Ltd specializes in designing, engineering, and manufacturing engineered polymer products for the energy, mining and resource, and defence industries with a market cap of A$53.71 million.

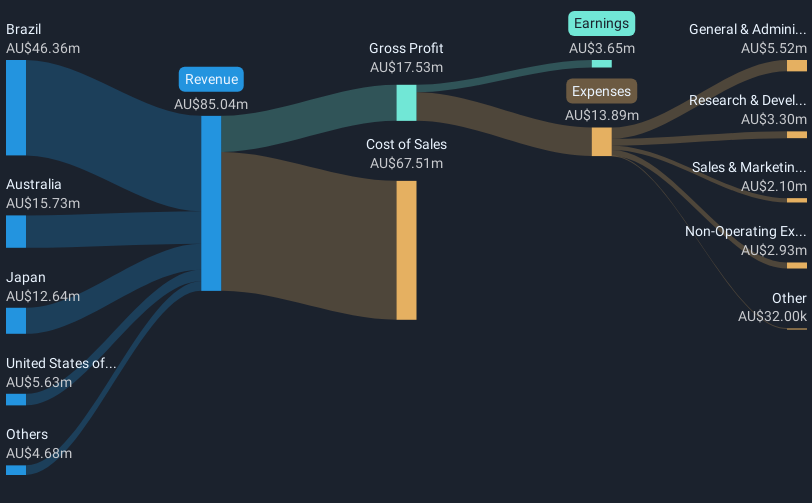

Operations: The company generates revenue of A$85.04 million from its Oil Well Equipment & Services segment.

Market Cap: A$53.71M

Matrix Composites & Engineering Ltd, with a market cap of A$53.71 million, shows mixed performance as a penny stock. Despite stable weekly volatility and high-quality earnings, its recent negative earnings growth and reduced profit margins raise concerns. The company’s debt is well-covered by operating cash flow, and it holds more cash than total debt, indicating financial stability. However, the interest coverage ratio remains below optimal levels. Trading at 26.2% below estimated fair value suggests potential undervaluation but requires cautious consideration due to management changes and volatility in share price over the past three months.

- Navigate through the intricacies of Matrix Composites & Engineering with our comprehensive balance sheet health report here.

- Assess Matrix Composites & Engineering's future earnings estimates with our detailed growth reports.

Praemium (ASX:PPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Praemium Limited, with a market cap of A$334.69 million, offers advisors and wealth management solutions through a seamless digital platform experience in Australia and internationally.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to A$82.73 million.

Market Cap: A$334.69M

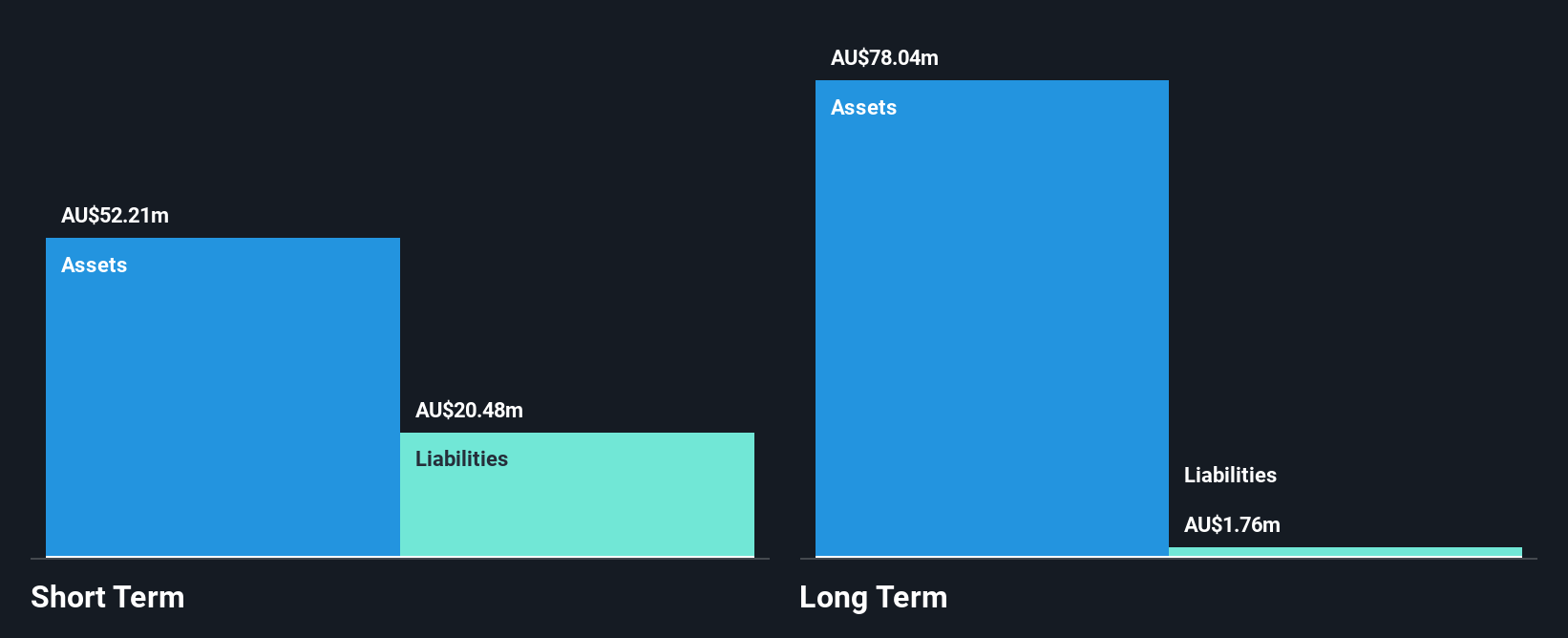

Praemium Limited, with a market cap of A$334.69 million, presents a complex picture as an investment option. While it boasts significant annual earnings growth over the past five years and operates debt-free, recent negative earnings growth and reduced profit margins pose challenges. The company's price-to-earnings ratio of 38.2x suggests good relative value compared to the industry average of 67.3x, yet this is tempered by a large one-off loss impacting recent financial results. Praemium's short-term assets comfortably cover both its short-term and long-term liabilities, indicating solid liquidity despite volatility in profit margins and return on equity remaining low at 8%.

- Click to explore a detailed breakdown of our findings in Praemium's financial health report.

- Understand Praemium's earnings outlook by examining our growth report.

Wisr (ASX:WZR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wisr Limited operates in the lending business in Australia and has a market cap of A$38.97 million.

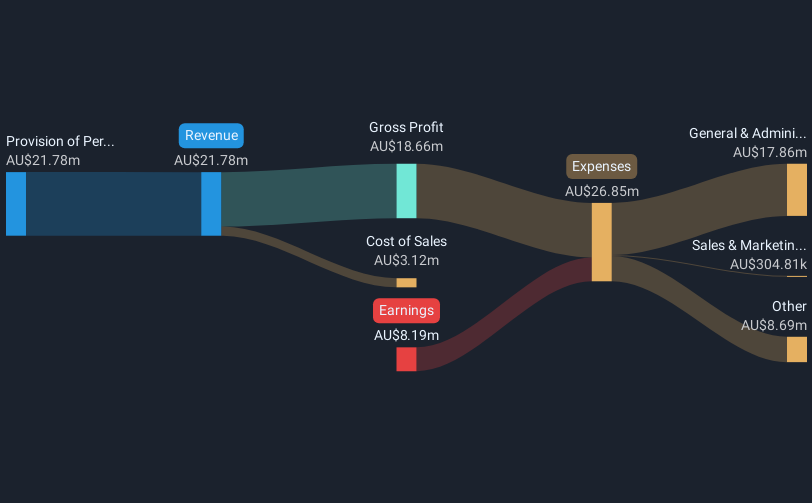

Operations: The company generates revenue primarily from the provision of personal loans to consumers, amounting to A$21.78 million.

Market Cap: A$38.97M

Wisr Limited, with a market cap of A$38.97 million, operates in the lending sector and faces challenges typical of penny stocks. Despite being unprofitable, it has reduced losses by 8.3% annually over five years and maintains a cash runway exceeding three years due to positive free cash flow growth. However, its high net debt to equity ratio of 1482.6% raises concerns about financial stability. The company’s revenue is forecasted to grow at 37.17% per year, yet volatility remains high with substantial short-term asset coverage over liabilities indicating some financial resilience amidst management's inexperience and share price instability.

- Unlock comprehensive insights into our analysis of Wisr stock in this financial health report.

- Evaluate Wisr's prospects by accessing our earnings growth report.

Summing It All Up

- Take a closer look at our ASX Penny Stocks list of 1,025 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MCE

Matrix Composites & Engineering

Engages in the design, manufacture, and supply of engineered composite products in Australia, Brazil, the United States, the United Kingdom, Japan, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives