- Australia

- /

- Hospitality

- /

- ASX:HLO

3 ASX Penny Stocks With Market Caps Under A$2B To Consider

Reviewed by Simply Wall St

As the Australian market braces for fresh CPI data from the ABS, investors are keeping a close watch on potential economic shifts that could influence trading strategies. Amidst these developments, penny stocks—despite their somewhat outdated moniker—remain an intriguing investment area due to their potential for discovering undervalued opportunities. In this article, we explore three ASX-listed penny stocks that exhibit strong financial foundations and promise hidden value for discerning investors.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.18 | A$102.84M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.575 | A$109.63M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.94 | A$453.29M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.30 | A$2.62B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.76 | A$465.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.01 | A$1.01B | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$4.01 | A$190.27M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.84 | A$148.2M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 463 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

BKI Investment (ASX:BKI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BKI Investment Company Limited is a publicly owned investment manager with a market cap of A$1.47 billion.

Operations: The company generates revenue of A$69.33 million from the securities industry.

Market Cap: A$1.47B

BKI Investment Company Limited, with a market cap of A$1.47 billion, reported revenue of A$69.33 million for FY2025, showing slight growth from the previous year. Despite being debt-free for five years and maintaining high-quality earnings, BKI's net income declined to A$61.86 million from A$64.39 million last year, with a lower net profit margin of 89.2%. The company's dividend yield is 4.34%, but it's not well covered by earnings or free cash flows, raising sustainability concerns despite experienced board oversight and stable weekly volatility at 1%.

- Jump into the full analysis health report here for a deeper understanding of BKI Investment.

- Evaluate BKI Investment's historical performance by accessing our past performance report.

Helloworld Travel (ASX:HLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helloworld Travel Limited is a travel distribution company operating in Australia, New Zealand, and internationally with a market cap of A$270.47 million.

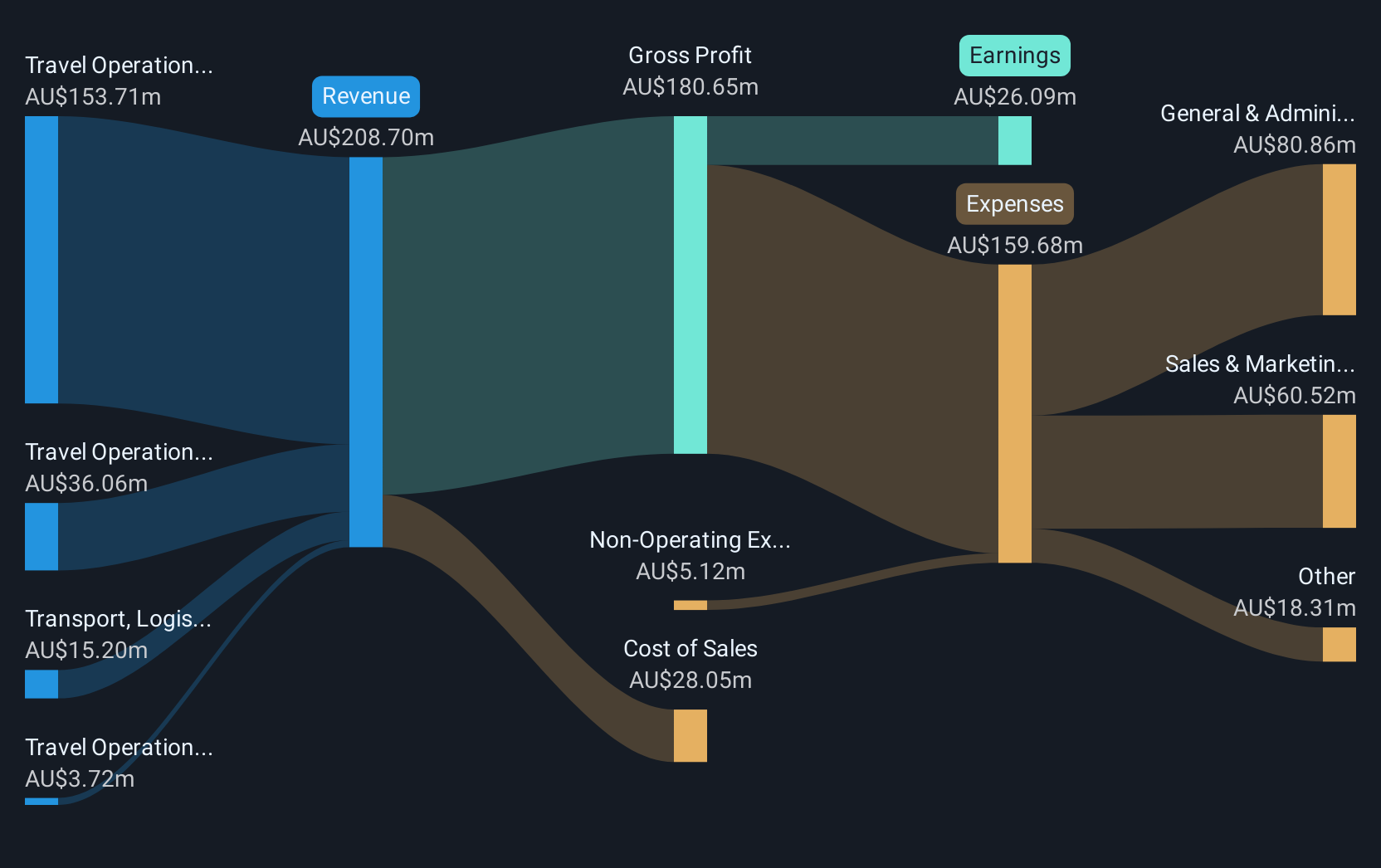

Operations: The company's revenue is primarily generated from Travel Operations in Australia (A$153.71 million), New Zealand (A$36.06 million), and the Rest of World (A$3.72 million), along with contributions from Transport, Logistics, and Warehousing (A$15.20 million).

Market Cap: A$270.47M

Helloworld Travel Limited, with a market cap of A$270.47 million, has been involved in merger discussions with Webjet Group and BGH Capital, potentially leading to a strategic consolidation. Despite recent negative earnings growth of -22.9%, Helloworld has maintained profitability over the past five years and is debt-free, offering financial stability. The company's short-term assets exceed its liabilities, but its 6.65% dividend isn't well covered by free cash flows, posing sustainability questions. Trading at a price-to-earnings ratio of 10.4x below the Australian market average suggests it might offer value compared to peers despite current challenges in earnings growth and profit margins declining from last year’s levels.

- Click to explore a detailed breakdown of our findings in Helloworld Travel's financial health report.

- Gain insights into Helloworld Travel's future direction by reviewing our growth report.

PharmX Technologies (ASX:PHX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PharmX Technologies Limited is a technology and software development company operating in Australia with a market cap of A$71.82 million.

Operations: PharmX Technologies generates revenue primarily from its Health Services segment, which accounted for A$7.07 million.

Market Cap: A$71.82M

PharmX Technologies, with a market cap of A$71.82 million, primarily generates revenue from its Health Services segment (A$7.07 million). The company is debt-free, eliminating interest payment concerns and demonstrating financial stability with short-term assets (A$5.7M) surpassing liabilities (A$1.1M). Despite negative earnings growth (-94.7%) over the past year and low return on equity (0.09%), PharmX has avoided shareholder dilution recently and maintains an experienced management team with a 2.8-year average tenure. However, profit margins have declined to 0.2% from last year's 4.2%, indicating challenges in maintaining profitability amidst industry pressures.

- Take a closer look at PharmX Technologies' potential here in our financial health report.

- Assess PharmX Technologies' previous results with our detailed historical performance reports.

Key Takeaways

- Click through to start exploring the rest of the 460 ASX Penny Stocks now.

- Seeking Other Investments? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Helloworld Travel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HLO

Helloworld Travel

Operates as a travel distribution company in Australia, New Zealand, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion