Nuix (ASX:NXL): Rethinking Valuation After Advanced AI Integration and SaaS Transformation

Reviewed by Kshitija Bhandaru

Nuix (ASX:NXL) is gaining fresh attention following its push into advanced AI integration and a transition to a SaaS-based model. These moves are strengthening its role in the ASX 300 tech sector.

See our latest analysis for Nuix.

After a tough year for shareholders, Nuix has seen impressive momentum lately, with a 25% share price gain over the past month and a 49% return in the last 90 days. While the one-year total shareholder return remains down sharply, the company’s 423% total return over three years stands out. This highlights long-term potential, even as sentiment shifts with each new development.

If Nuix’s bold pivot into AI and SaaS has you wondering what else is out there in tech, why not discover opportunities with our See the full list for free.?

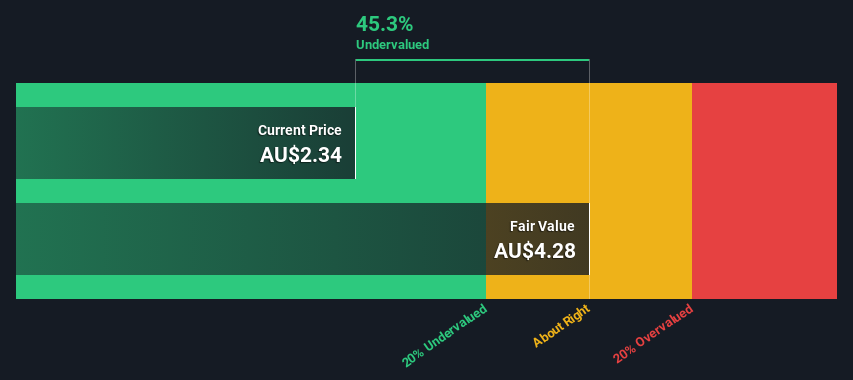

But with the recent surge in share price and optimism around Nuix’s AI and SaaS ambitions, investors may wonder if the market is getting ahead of itself or if the current value still leaves room for future upside.

Most Popular Narrative: 12.7% Undervalued

Compared to its last close at A$3.06, the most widely followed valuation narrative implies fair value sits noticeably higher. This sets the stage for a deeper look at the bullish case driving sentiment right now.

The shift from perpetual licenses to recurring subscription models is expected to provide greater revenue stability and predictability, positively impacting earnings over time. Increased targeting of larger enterprise contracts with higher average deal sizes suggests potential for significant revenue increases and improved net margins through economies of scale.

Want the numbers behind this high-conviction view? Analysts have mapped out aggressive earnings growth, margin expansion, and enterprise deal wins that power this valuation. Curious about the key forecasts that justify a premium multiple and where expectations are most ambitious? Dive into the full narrative to see which bold financial levers drive this fair value call.

Result: Fair Value of $3.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent legal costs and customer churn, especially in key overseas markets, could derail Nuix’s promising turnaround narrative in the quarters ahead.

Find out about the key risks to this Nuix narrative.

Another View: DCF Model Sends a Different Signal

While the popular valuation narrative suggests Nuix is undervalued, our DCF model challenges this optimism. Based on projected future cash flows, the SWS DCF model indicates a fair value of A$2.22, which is below the current share price. Does this suggest investors are pricing in too much hope, or is the narrative missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nuix Narrative

If these views do not quite fit your perspective, keep in mind you can dig into the numbers firsthand, shape your own viewpoint, and Do it your way in just a few minutes.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Nuix.

Looking for more investment ideas?

Unlock your edge as an investor by broadening your search beyond Nuix. Exceptional opportunities await in innovative sectors and overlooked pockets of the market. You do not want to miss what is gaining momentum now.

- Tap into the growth potential of artificial intelligence breakthroughs by starting with these 25 AI penny stocks, where tomorrow’s winners are making their mark today.

- Boost your portfolio’s income with steady payers and reliable yields by checking out these 19 dividend stocks with yields > 3%, handpicked for strong dividend performance.

- Outpace the crowd by targeting companies trading below fair value with these 892 undervalued stocks based on cash flows, and seize a chance before the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives