Shareholders Will Most Likely Find JCurve Solutions Limited's (ASX:JCS) CEO Compensation Acceptable

JCurve Solutions Limited (ASX:JCS) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. The upcoming AGM on 16 November 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for JCurve Solutions

How Does Total Compensation For Stephen Canning Compare With Other Companies In The Industry?

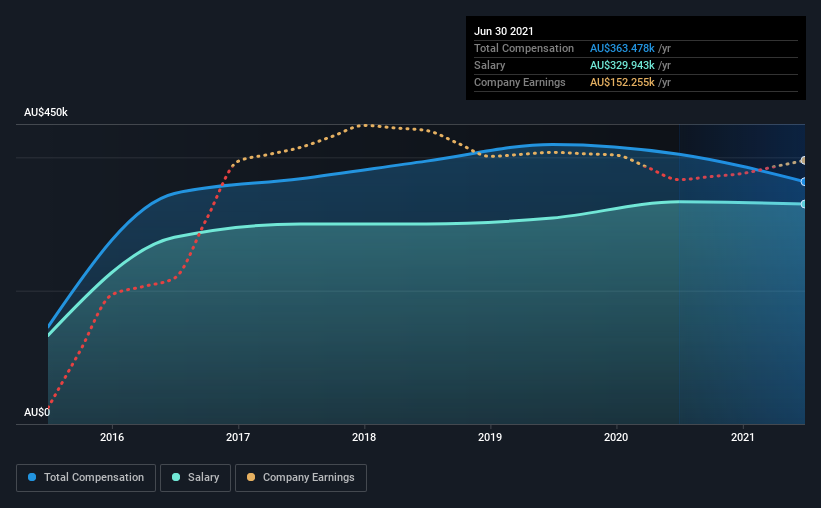

According to our data, JCurve Solutions Limited has a market capitalization of AU$20m, and paid its CEO total annual compensation worth AU$363k over the year to June 2021. That's a notable decrease of 10% on last year. Notably, the salary which is AU$329.9k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under AU$269m, the reported median total CEO compensation was AU$412k. So it looks like JCurve Solutions compensates Stephen Canning in line with the median for the industry. Furthermore, Stephen Canning directly owns AU$197k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$330k | AU$333k | 91% |

| Other | AU$34k | AU$71k | 9% |

| Total Compensation | AU$363k | AU$405k | 100% |

Talking in terms of the industry, salary represented approximately 63% of total compensation out of all the companies we analyzed, while other remuneration made up 37% of the pie. JCurve Solutions is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

JCurve Solutions Limited's Growth

JCurve Solutions Limited has reduced its earnings per share by 44% a year over the last three years. It saw its revenue drop 5.2% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has JCurve Solutions Limited Been A Good Investment?

Most shareholders would probably be pleased with JCurve Solutions Limited for providing a total return of 45% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for JCurve Solutions that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:JCS

JCurve Solutions

Provides enterprise resource planning (ERP) and telecommunications expense management solutions in Australia, New Zealand, Singapore, Thailand, and the Philippines.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)