We Think Shareholders Are Less Likely To Approve A Large Pay Rise For IODM Limited's (ASX:IOD) CEO For Now

CEO Mark Reilly has done a decent job of delivering relatively good performance at IODM Limited (ASX:IOD) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 20 October 2021. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for IODM

Comparing IODM Limited's CEO Compensation With the industry

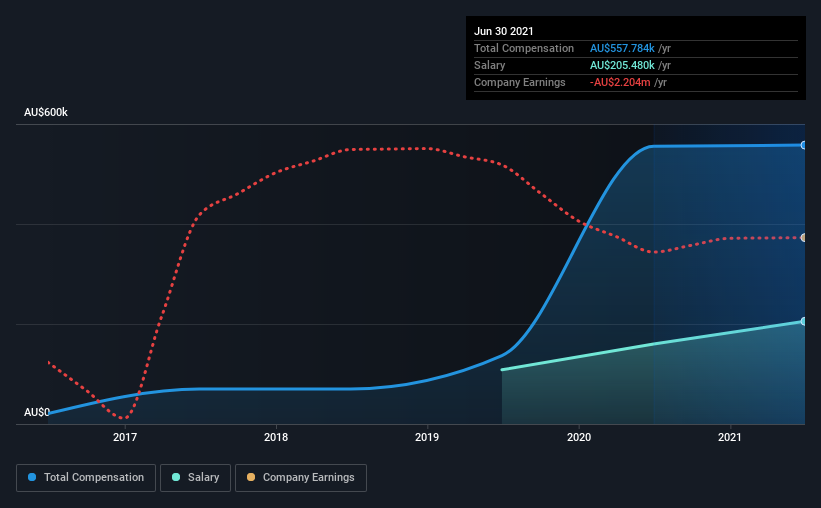

At the time of writing, our data shows that IODM Limited has a market capitalization of AU$183m, and reported total annual CEO compensation of AU$558k for the year to June 2021. That is, the compensation was roughly the same as last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at AU$205k.

On comparing similar-sized companies in the industry with market capitalizations below AU$272m, we found that the median total CEO compensation was AU$418k. Accordingly, our analysis reveals that IODM Limited pays Mark Reilly north of the industry median. Furthermore, Mark Reilly directly owns AU$8.7m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$205k | AU$160k | 37% |

| Other | AU$352k | AU$396k | 63% |

| Total Compensation | AU$558k | AU$556k | 100% |

On an industry level, roughly 64% of total compensation represents salary and 36% is other remuneration. In IODM's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

IODM Limited's Growth

Over the last three years, IODM Limited has shrunk its earnings per share by 27% per year. It achieved revenue growth of 33% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has IODM Limited Been A Good Investment?

We think that the total shareholder return of 2,186%, over three years, would leave most IODM Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 3 warning signs for IODM (2 shouldn't be ignored!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:IOD

IODM

Provides cloud based software as a service in Australia, New Zealand, the United States, and the United Kingdom.

Moderate risk with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)