Envirosuite Limited (ASX:EVS) Released Earnings Last Week And Analysts Lifted Their Price Target To AU$0.17

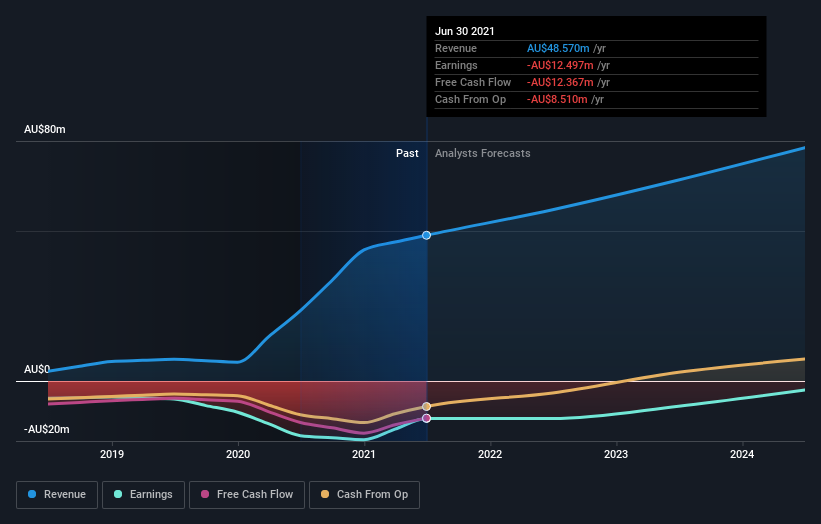

Investors in Envirosuite Limited (ASX:EVS) had a good week, as its shares rose 7.7% to close at AU$0.14 following the release of its yearly results. The results look positive overall; while revenues of AU$49m were in line with analyst predictions, statutory losses were 6.2% smaller than expected, with Envirosuite losing AU$0.012 per share. The analyst typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimate to see what could be in store for next year.

View our latest analysis for Envirosuite

Following the latest results, Envirosuite's sole analyst are now forecasting revenues of AU$57.1m in 2022. This would be a notable 18% improvement in sales compared to the last 12 months. Losses are expected to be contained, narrowing 18% from last year to AU$0.01. Before this latest report, the consensus had been expecting revenues of AU$57.0m and AU$0.005 per share in losses. While this year's revenue estimates held steady, there was also a regrettable increase in loss per share expectations, suggesting the consensus has a bit of a mixed view on the stock.

Despite expectations of heavier losses next year,the analyst has lifted their price target 17% to AU$0.17, perhaps implying these losses are not expected to be recurring over the long term.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Envirosuite's revenue growth will slow down substantially, with revenues to the end of 2022 expected to display 18% growth on an annualised basis. This is compared to a historical growth rate of 73% over the past five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 16% annually. Factoring in the forecast slowdown in growth, it looks like Envirosuite is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at Envirosuite. Happily, there were no real changes to sales forecasts, with the business still expected to grow in line with the overall industry. We note an upgrade to the price target, suggesting that the analyst believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Envirosuite going out as far as 2024, and you can see them free on our platform here.

You still need to take note of risks, for example - Envirosuite has 3 warning signs we think you should be aware of.

When trading Envirosuite or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Envirosuite might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EVS

Envirosuite

Develops and sells environmental management technology solutions.

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)