- Australia

- /

- Hospitality

- /

- ASX:GYG

ASX Growth Companies With High Insider Stakes

Reviewed by Simply Wall St

In the current Australian market, where sectors are showing mixed performance and the overall direction remains uncertain, investors are keenly observing companies that manage to stay in the green. Among these, growth companies with high insider ownership often attract attention as they can indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.1% | 91.2% |

| Titomic (ASX:TTT) | 11.3% | 74.9% |

| Pointerra (ASX:3DP) | 21.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 21.1% | 144.4% |

| Gratifii (ASX:GTI) | 17.8% | 137.7% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Echo IQ (ASX:EIQ) | 18.9% | 49.9% |

| Adveritas (ASX:AV1) | 18.8% | 96.8% |

| Acrux (ASX:ACR) | 15.9% | 121.1% |

Here's a peek at a few of the choices from the screener.

DUG Technology (ASX:DUG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: DUG Technology Ltd is a technology company offering hardware and software solutions to the technology and resource sectors across Australia, the United States, the United Kingdom, Malaysia, and the United Arab Emirates with a market cap of A$382.32 million.

Operations: The company's revenue is derived from three segments: Hpcaas ($27.44 million), Services ($51.87 million), and Software ($10.47 million).

Insider Ownership: 29.6%

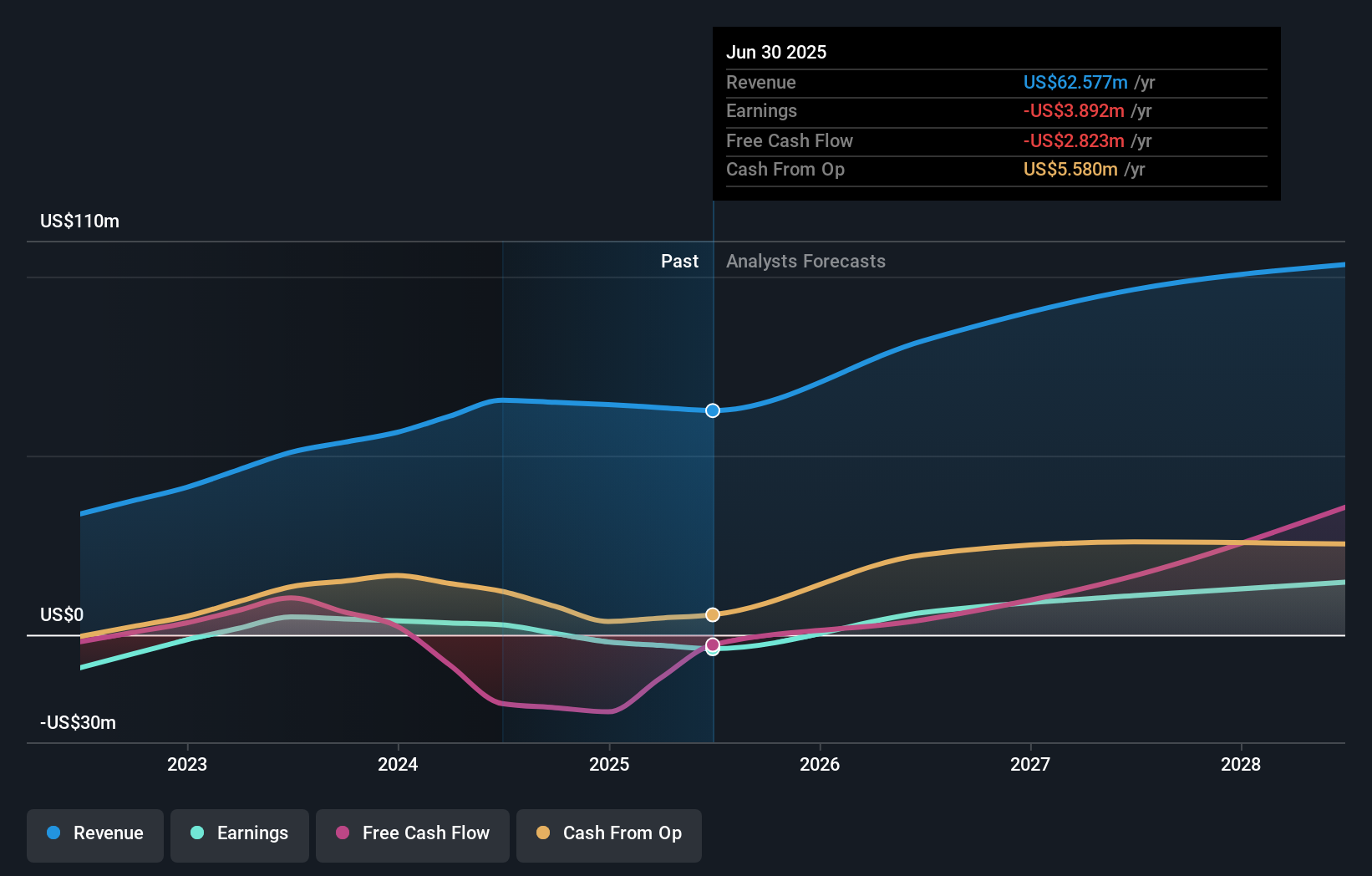

DUG Technology, with high insider ownership, is set for significant growth as it transitions to profitability within three years. The company trades at a substantial discount to its estimated fair value and offers strong earnings growth potential at 42.82% annually. Despite recent challenges, including a net loss of US$3.89 million for the year ending June 2025, DUG's revenue is expected to outpace the broader Australian market's growth rate significantly.

- Navigate through the intricacies of DUG Technology with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that DUG Technology's share price might be on the cheaper side.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited operates quick service restaurants across Australia, Singapore, Japan, and the United States with a market capitalization of A$2.72 billion.

Operations: The company generates revenue primarily from its quick service restaurant operations, totaling A$465.04 million.

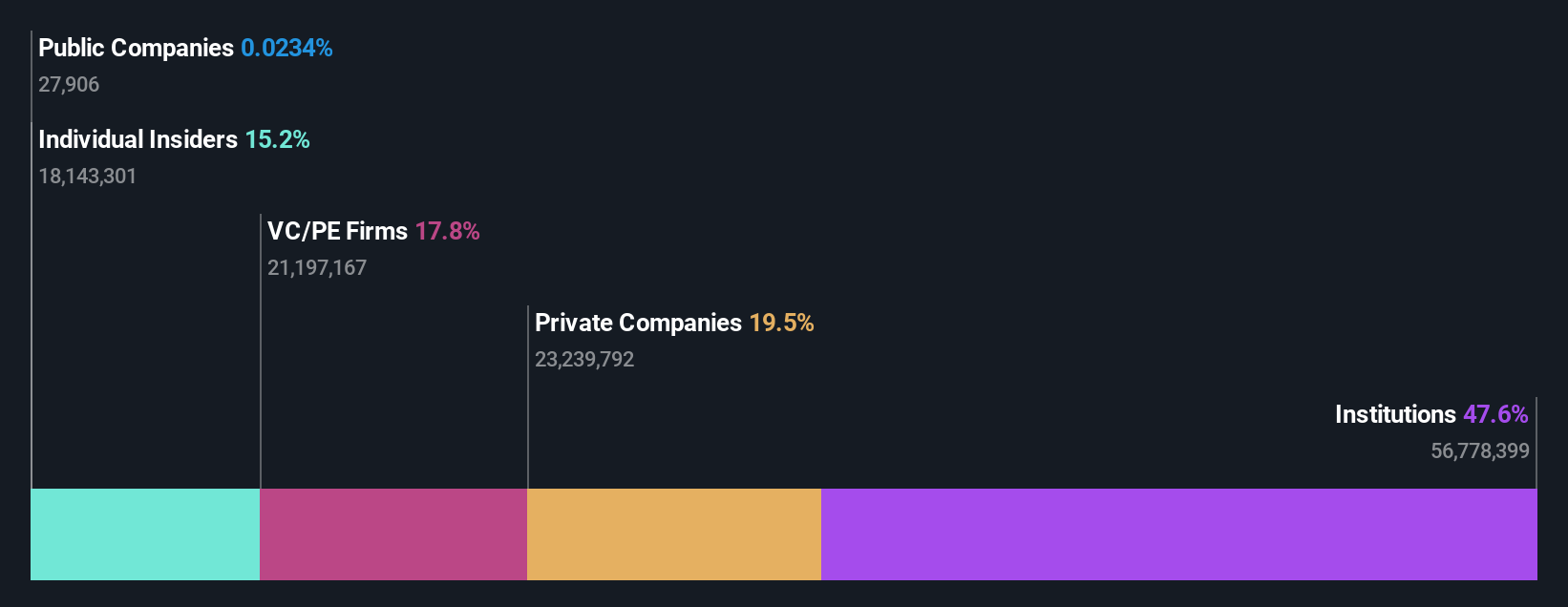

Insider Ownership: 15.2%

Guzman y Gomez exhibits strong growth potential with high insider ownership, as insiders have been buying more shares than selling recently. The company turned profitable this year, reporting A$14.48 million in net income for FY25 compared to a previous loss. Its earnings are forecasted to grow significantly at 33.3% annually, surpassing the market average. The recent A$100 million share buyback program aims to enhance shareholder returns while supporting expansion plans like opening 32 new restaurants in FY26.

- Unlock comprehensive insights into our analysis of Guzman y Gomez stock in this growth report.

- Upon reviewing our latest valuation report, Guzman y Gomez's share price might be too optimistic.

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products in Australia, with a market cap of A$2.85 billion.

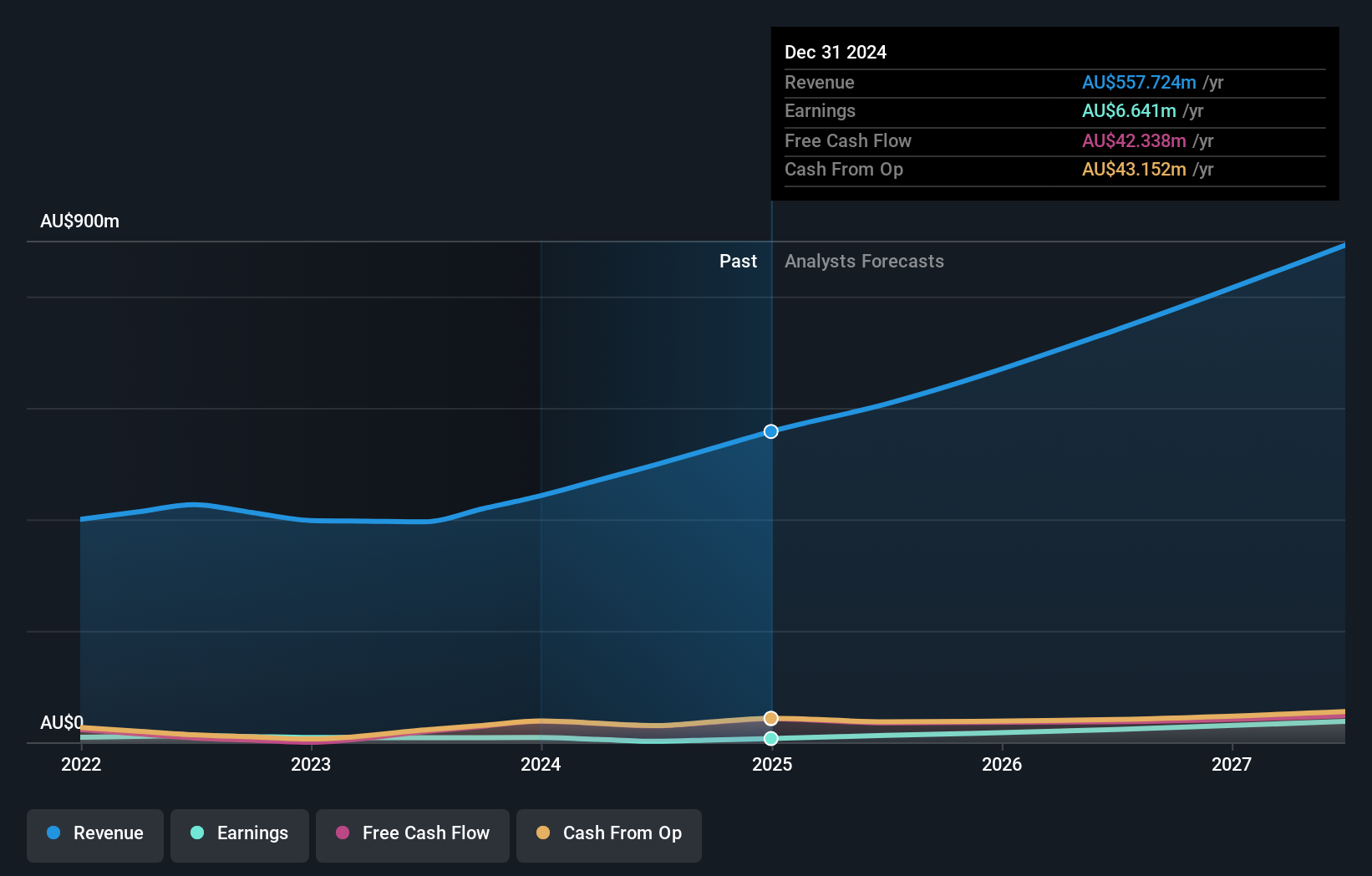

Operations: The company's revenue segment consists of A$600.72 million from the sale of furniture, homewares, and home improvement products through its online platform in Australia.

Insider Ownership: 10.6%

Temple & Webster Group demonstrates strong growth potential with significant insider ownership, as its earnings are forecasted to grow at 34% annually, outpacing the Australian market. Recent strategic moves include appointing Michael Malone as Non-Executive Director to bolster technology and governance expertise. The company remains debt-free and cash generative, aiming for both organic and inorganic expansion. FY25 net income rose to A$11.3 million from A$1.8 million, reflecting robust sales momentum and strategic execution.

- Take a closer look at Temple & Webster Group's potential here in our earnings growth report.

- The analysis detailed in our Temple & Webster Group valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 107 companies by clicking here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GYG

Guzman y Gomez

Operates and manages quick service restaurants in Australia, Singapore, Japan, and the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives