- Australia

- /

- Metals and Mining

- /

- ASX:HAV

Promising ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The Australian market has shown a positive trend, with the ASX200 closing up 0.45% at 8,347 points as investors assess the implications of global political shifts. Amidst this backdrop, penny stocks—often representing smaller or newer companies—continue to capture interest due to their potential for growth at lower price points. When these stocks exhibit strong financial health and robust fundamentals, they can offer attractive opportunities without many of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.91 | A$240.44M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.95 | A$106.21M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.975 | A$332.15M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$109.89M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.315 | A$64.64M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.12 | A$326.82M | ★★★★☆☆ |

Click here to see the full list of 1,025 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Connexion Mobility (ASX:CXZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Connexion Mobility Ltd develops and commercializes fleet management software for the automotive industry across Australia, the United States, Canada, and Mexico, with a market cap of A$23.47 million.

Operations: The company generates revenue of $9.84 million from developing global information technology solutions for the automotive industries.

Market Cap: A$23.47M

Connexion Mobility Ltd, with a market cap of A$23.47 million, generates A$9.84 million in revenue from its global IT solutions for the automotive industry. The company is debt-free and has stable weekly volatility at 5%. Its short-term assets significantly exceed both short- and long-term liabilities, indicating strong financial health. Despite a decrease in net profit margins from 26.6% to 19.1%, Connexion's Return on Equity remains high at 30%. Recent strategic integration with Uber for Business enhances dealership operations, potentially boosting service profitability—a crucial aspect given dealerships' reliance on fixed operations for gross profit.

- Get an in-depth perspective on Connexion Mobility's performance by reading our balance sheet health report here.

- Learn about Connexion Mobility's historical performance here.

Havilah Resources (ASX:HAV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Havilah Resources Limited, with a market cap of A$72.94 million, is involved in the exploration and evaluation of mineral resource properties in Australia.

Operations: The company generates revenue of A$0.01 million from its activities in the exploration for and evaluation of mineral resources.

Market Cap: A$72.94M

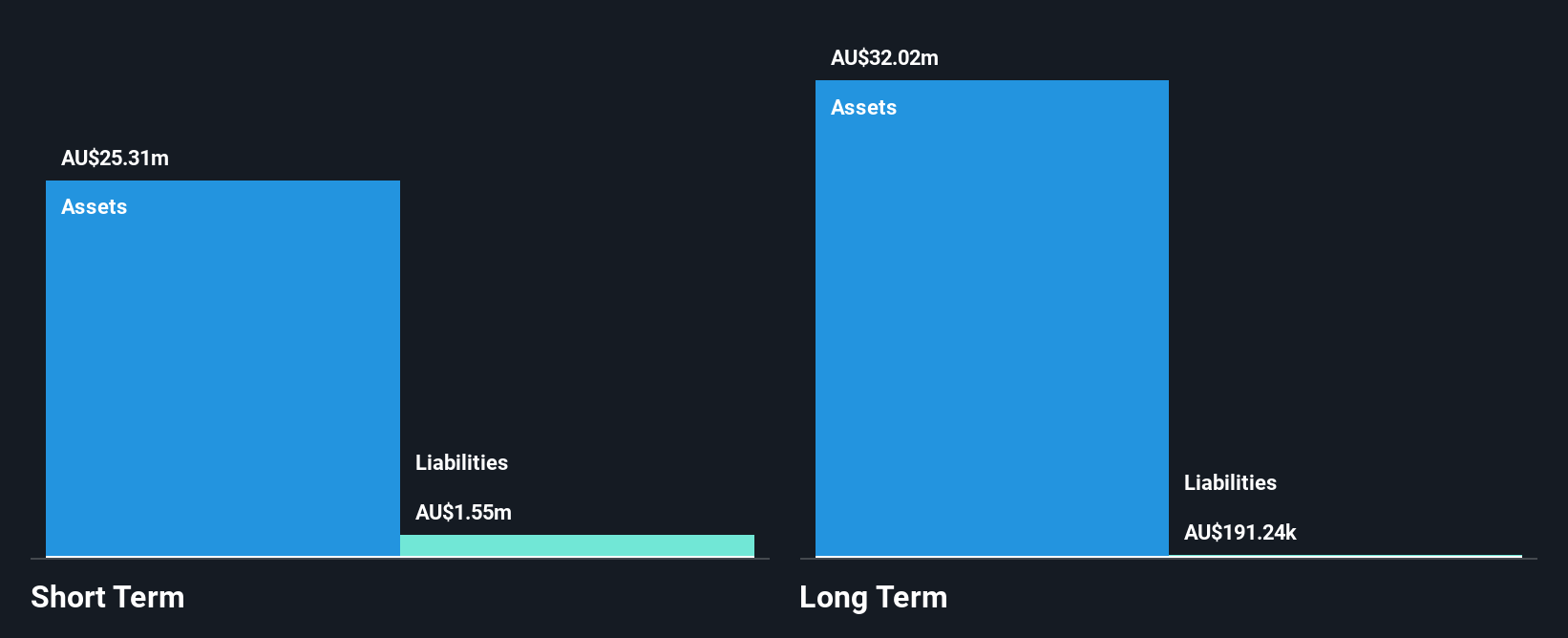

Havilah Resources Limited, with a market cap of A$72.94 million, is pre-revenue and debt-free. Its financial stability is underscored by short-term assets of A$23.4 million surpassing both short- and long-term liabilities. Despite the absence of meaningful revenue, earnings grew significantly by 90.2% over the past year, aided by a substantial one-off gain of A$5 million. The company’s Price-to-Earnings ratio (13.1x) is lower than the Australian market average, indicating potential value for investors cautious about its auditor's going concern doubts filed in October 2024 due to ongoing profitability challenges without consistent revenue streams.

- Navigate through the intricacies of Havilah Resources with our comprehensive balance sheet health report here.

- Examine Havilah Resources' past performance report to understand how it has performed in prior years.

Noxopharm (ASX:NOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Noxopharm Limited is an Australian biotech company focused on discovering and developing treatments for cancer, inflammation, and mRNA vaccines, with a market cap of A$26.01 million.

Operations: The company's revenue is derived entirely from its development activities in both oncology and non-oncology fields, totaling A$2.40 million.

Market Cap: A$26.01M

Noxopharm Limited, with a market cap of A$26.01 million, is pre-revenue and currently unprofitable, having seen losses increase by 9.5% annually over the past five years. Despite this, it maintains financial stability with short-term assets of A$4.8 million exceeding both its short- and long-term liabilities. The company remains debt-free and boasts a cash runway sufficient for over three years based on current free cash flow levels. Recent developments include a private placement raising up to A$500,000 through convertible notes, which could influence future capital structure amid high share price volatility compared to most Australian stocks.

- Click to explore a detailed breakdown of our findings in Noxopharm's financial health report.

- Review our historical performance report to gain insights into Noxopharm's track record.

Summing It All Up

- Click through to start exploring the rest of the 1,022 ASX Penny Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Havilah Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HAV

Havilah Resources

Engages in the exploration and evaluation of mineral resource properties in Australia.

Flawless balance sheet with proven track record.