- Australia

- /

- Hospitality

- /

- ASX:JIN

3 ASX Dividend Stocks Yielding Up To 9.5%

Reviewed by Simply Wall St

As the ASX200 experiences a modest rise of 0.23% to 8,330 points amidst heightened investor attention surrounding the inauguration of Donald Trump as the 47th President of the United States, Australian markets are closely monitoring sector performances with utilities leading at a 0.5% increase. In this environment, dividend stocks remain attractive for their potential to provide steady income; here we explore three ASX-listed stocks yielding up to 9.5%, offering insights into what makes them appealing in today's market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.36% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.79% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.37% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.93% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.78% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.91% | ★★★★☆☆ |

| Sugar Terminals (NSX:SUG) | 7.77% | ★★★★☆☆ |

| Ricegrowers (ASX:SGLLV) | 5.03% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 9.52% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.50% | ★★★★☆☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

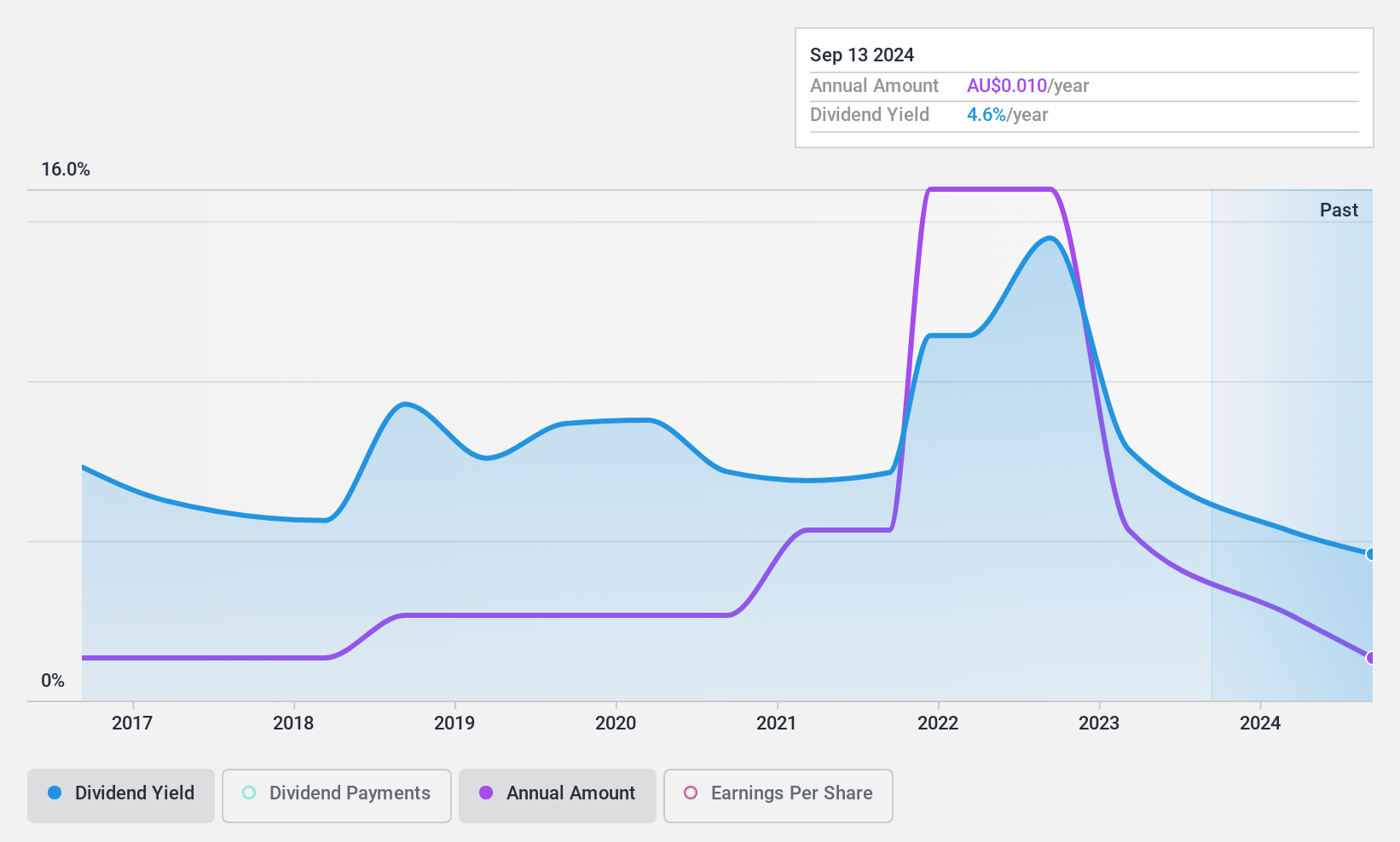

Grange Resources (ASX:GRR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grange Resources Limited is an integrated iron ore mining and pellet production company operating in Australia and internationally, with a market cap of A$243.04 million.

Operations: Grange Resources Limited generates revenue from its ore mining segment, amounting to A$570.41 million.

Dividend Yield: 9.5%

Grange Resources offers a high dividend yield of 9.52%, positioning it in the top 25% of dividend payers in Australia. However, its dividends have been volatile and unreliable over the past decade, with no growth recorded during this period. Despite this inconsistency, GRR's dividends are well-covered by earnings and cash flows, with payout ratios of 21.8% and 11.6%, respectively, suggesting sustainability from a financial standpoint even as it trades below estimated fair value.

- Get an in-depth perspective on Grange Resources' performance by reading our dividend report here.

- Our valuation report unveils the possibility Grange Resources' shares may be trading at a discount.

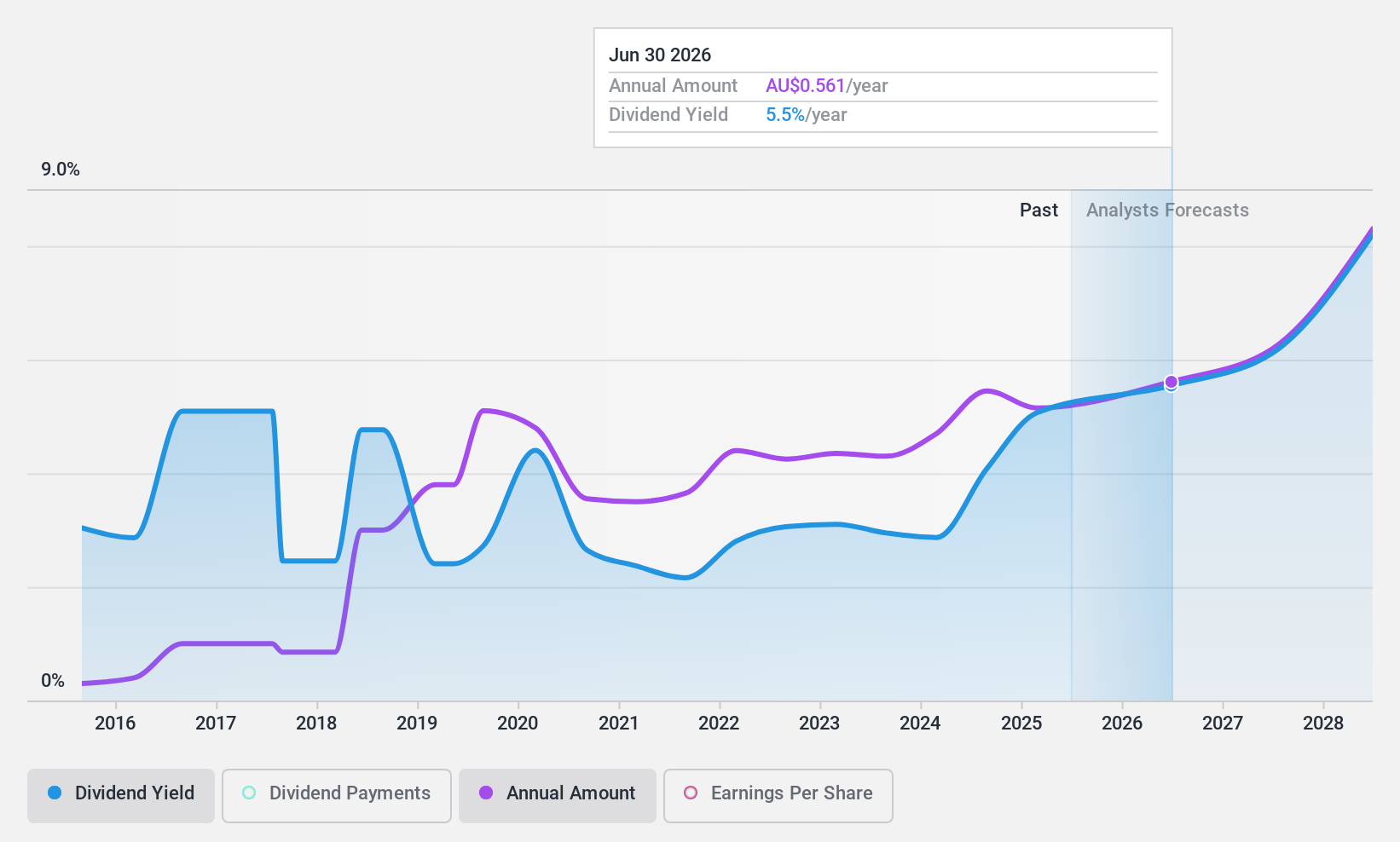

Jumbo Interactive (ASX:JIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jumbo Interactive Limited operates as an online retailer of lottery tickets across Australia, the United Kingdom, Canada, Fiji, and other international markets with a market cap of A$775.28 million.

Operations: Jumbo Interactive Limited generates revenue through three main segments: Managed Services (A$25.84 million), Lottery Retailing (A$123.40 million), and Software-As-A-Service (SaaS) (A$50.73 million).

Dividend Yield: 4.4%

Jumbo Interactive's dividend payments have been volatile and unreliable over the past decade, despite being covered by both earnings (79.1% payout ratio) and cash flows (63.2% cash payout ratio). The company's dividend yield of 4.4% is below the top 25% of Australian dividend payers. Recent strategic moves to pursue acquisitions in the UK and Canada may impact future growth, though not directly related to its domestic dividend prospects.

- Click to explore a detailed breakdown of our findings in Jumbo Interactive's dividend report.

- Our valuation report here indicates Jumbo Interactive may be undervalued.

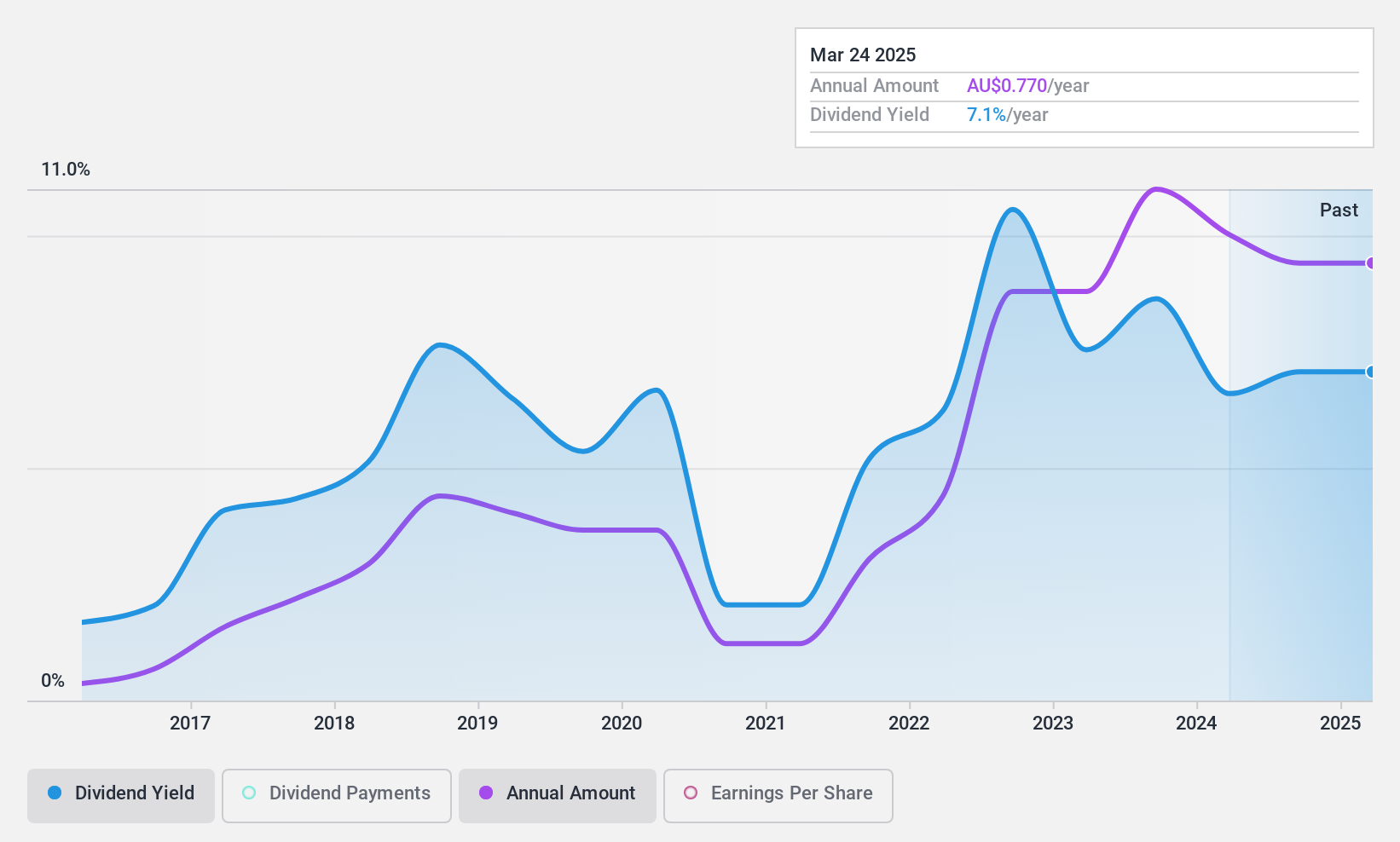

Lycopodium (ASX:LYL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lycopodium Limited offers engineering and project delivery services across the resources, rail infrastructure, and industrial processes sectors in Australia with a market cap of A$425.67 million.

Operations: Lycopodium Limited's revenue segments include A$366.49 million from Resources, A$11.45 million from Process Industries, and A$10.21 million from Rail Infrastructure.

Dividend Yield: 7.1%

Lycopodium's dividend yield of 7.06% is among the top 25% in Australia, supported by a reasonable payout ratio of 60.3%, though cash flow coverage remains weak with a cash payout ratio of 122.9%. Despite earnings growth averaging 33.8% annually over five years, dividend payments have been historically volatile and unreliable, with significant insider selling recently noted. The company has provided guidance for potential dividends up to A$0.15 for the first half of fiscal year 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Lycopodium.

- Our valuation report here indicates Lycopodium may be overvalued.

Key Takeaways

- Navigate through the entire inventory of 30 Top ASX Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JIN

Jumbo Interactive

Engages in the retail of lottery tickets through internet and mobile devices in Australia, the United Kingdom, Canada, Fiji, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives