As the ASX200 edges up 0.23% to 8,330 points, investors are keenly watching market movements with Donald Trump set to be sworn in as the 47th President of the United States. In this climate of heightened alertness, identifying stocks that offer both stability and potential growth becomes crucial. While penny stocks may seem like a term from a bygone era, they remain relevant for those seeking opportunities in smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.90 | A$240.44M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$332.15M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.92 | A$106.21M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$248.8M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.965 | A$109.89M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.325 | A$64.64M | ★★★★★☆ |

Click here to see the full list of 1,025 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aims Property Securities Fund (ASX:APW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aims Property Securities Fund, with a market cap of A$77.69 million, is a close-ended fund of funds launched by MacArthurCook Ltd.

Operations: The revenue segments for ASX:APW include contributions from AIMS APAC REIT (A$0.56 million), AIMS Total Return Fund (A$0.62 million), AIMS Property Fund (Laverton) (A$36.12 million), and AIMS Real Estate Opportunity Fund (A$1.21 million).

Market Cap: A$77.69M

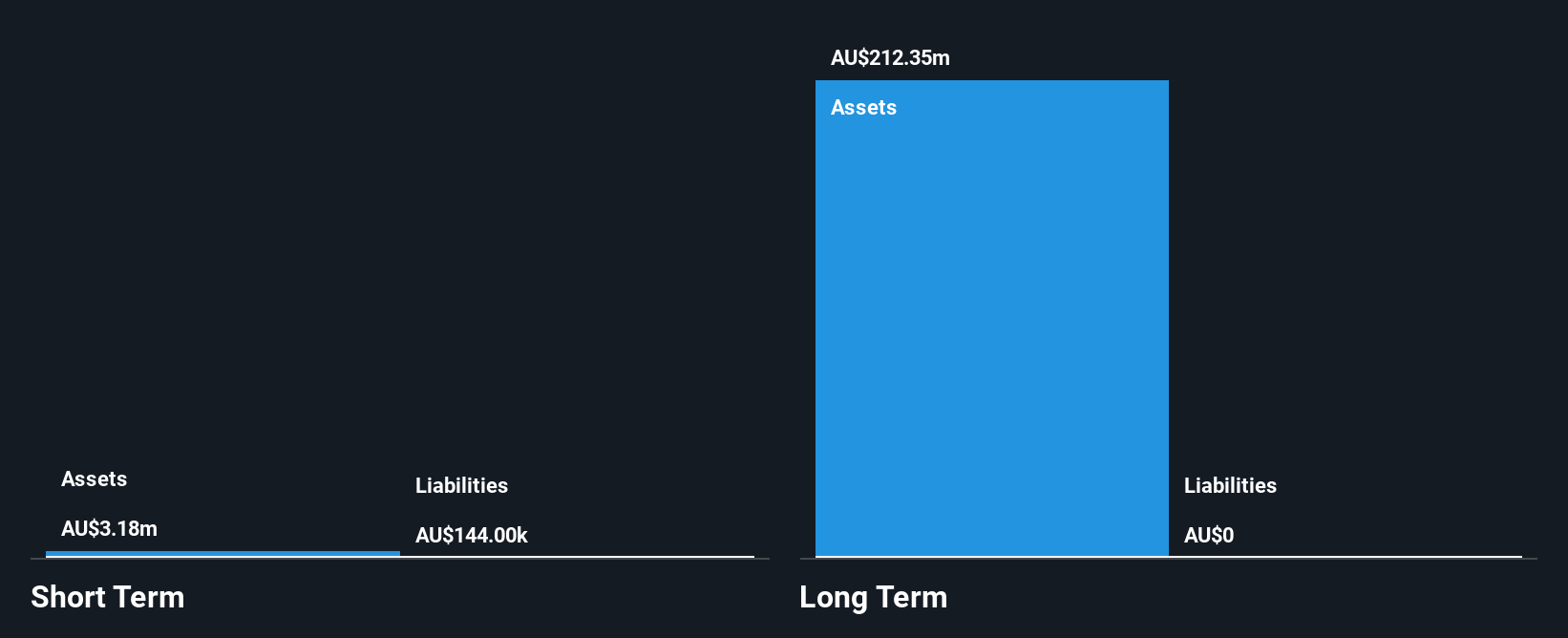

Aims Property Securities Fund, with a market cap of A$77.69 million, demonstrates several strengths as a penny stock. Its earnings have grown significantly by 61.1% over the past year, surpassing both its 5-year average growth and the REITs industry average. The fund's seasoned board and absence of debt further bolster its financial stability, while short-term assets comfortably cover liabilities. Despite having a low return on equity at 14.5%, APW offers high-quality earnings with impressive net profit margins at 94.6%. Its price-to-earnings ratio of 3.2x suggests it may be undervalued compared to the broader Australian market.

- Dive into the specifics of Aims Property Securities Fund here with our thorough balance sheet health report.

- Learn about Aims Property Securities Fund's historical performance here.

Agency Group Australia (ASX:AU1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: The Agency Group Australia Limited operates in the real estate sector within Australia and has a market cap of A$9.67 million.

Operations: The company generates revenue primarily from Real Estate Property Services, amounting to A$87.06 million, and Mortgage Origination Services, contributing A$0.88 million.

Market Cap: A$9.67M

Agency Group Australia, with a market cap of A$9.67 million, faces challenges typical of penny stocks. It is currently unprofitable with a negative return on equity (-61.96%) and high net debt to equity ratio (85.6%). However, it has reduced its debt over the past five years and maintains a sufficient cash runway for over three years due to positive free cash flow growth. Recent board changes include appointing Dr. Michael Schaper as Non-Executive Director, enhancing governance with his extensive regulatory experience, which could support strategic development in the real estate sector's franchise-based environment.

- Click here to discover the nuances of Agency Group Australia with our detailed analytical financial health report.

- Gain insights into Agency Group Australia's past trends and performance with our report on the company's historical track record.

GWR Group (ASX:GWR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GWR Group Limited is involved in the exploration, evaluation, and development of mining projects in Australia, with a market cap of A$27.30 million.

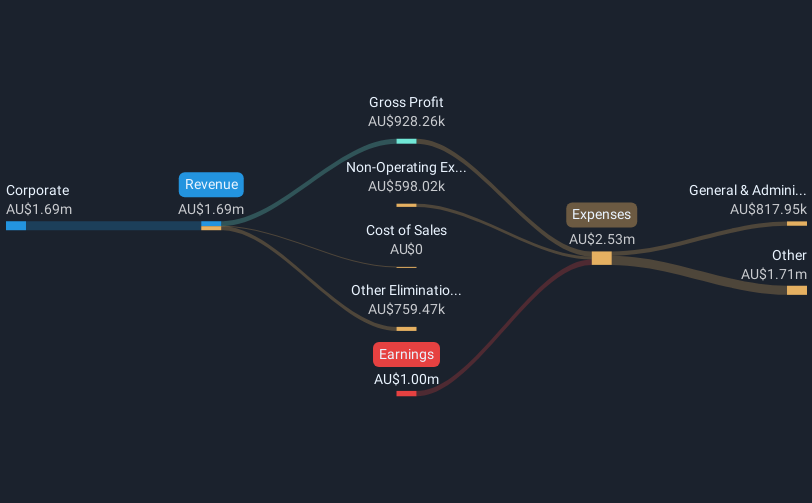

Operations: The company generates revenue primarily from its corporate activities, amounting to A$1.69 million.

Market Cap: A$27.3M

GWR Group, with a market cap of A$27.30 million, is pre-revenue and unprofitable but maintains financial stability through its strong asset position. The company has no debt and a sufficient cash runway exceeding three years based on current free cash flow trends. Recent leadership changes include the resignation of long-serving Executive Director Michael Wilson and the appointment of Simon Borck as CFO and Joint Company Secretary, bringing significant resource sector experience. GWR's board has limited tenure experience, suggesting recent restructuring efforts to enhance governance as it navigates its mining project developments in Australia.

- Navigate through the intricacies of GWR Group with our comprehensive balance sheet health report here.

- Explore historical data to track GWR Group's performance over time in our past results report.

Seize The Opportunity

- Take a closer look at our ASX Penny Stocks list of 1,025 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APW

Aims Property Securities Fund

A close-ended fund of funds launched by MacArthurCook Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives