- Australia

- /

- Metals and Mining

- /

- ASX:CXO

BrainChip Holdings And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market is showing resilience, with ASX 200 futures indicating a slight gain despite global uncertainties such as Middle East tensions and U.S.-China trade discussions impacting Wall Street. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing opportunities for investors seeking growth at lower price points. These stocks can still present significant potential when supported by strong balance sheets and solid fundamentals, making them worth watching in the current market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.82 | A$85.86M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.64 | A$122.15M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.66 | A$410.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.63 | A$430.99M | ✅ 5 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$2.95 | A$695.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.30 | A$773.18M | ✅ 4 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.80 | A$1.08B | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.73 | A$231.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.33 | A$158.01M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,006 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

BrainChip Holdings (ASX:BRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BrainChip Holdings Ltd develops software and hardware solutions for artificial intelligence and machine learning across multiple regions, with a market cap of A$455.79 million.

Operations: The company generates revenue from the technological development of designs, amounting to $0.40 million.

Market Cap: A$455.79M

BrainChip Holdings Ltd, with a market cap of A$455.79 million, is pre-revenue and currently unprofitable, generating only US$0.40 million in revenue. Despite this, the company has no debt and a stable cash runway exceeding one year based on current free cash flow. Recent collaborations include an agreement with Chelpis Quantum Corp for post-quantum cryptographic security chips and a partnership with ARQUIMEA for AI-powered water safety solutions. However, significant insider selling over the past three months raises caution. The management team's average tenure is 1.5 years, indicating relatively new leadership.

- Dive into the specifics of BrainChip Holdings here with our thorough balance sheet health report.

- Assess BrainChip Holdings' future earnings estimates with our detailed growth reports.

Cettire (ASX:CTT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally with a market cap of A$177.28 million.

Operations: The company generates its revenue primarily through online retail sales, amounting to A$781.98 million.

Market Cap: A$177.28M

Cettire Limited, with a market cap of A$177.28 million, is trading significantly below its estimated fair value and operates debt-free, alleviating concerns about interest payments. The company has seen its weekly volatility decrease over the past year and maintains strong short-term liquidity with assets exceeding liabilities. However, Cettire's recent earnings growth has been negative at -88.4%, compounded by a decline in profit margins from 3.6% to 0.3%. Recent board changes include Steven Fisher as Chair and Daniel Agostinelli joining as an Independent Non-Executive Director, both bringing extensive retail experience to guide future strategies.

- Click here to discover the nuances of Cettire with our detailed analytical financial health report.

- Evaluate Cettire's prospects by accessing our earnings growth report.

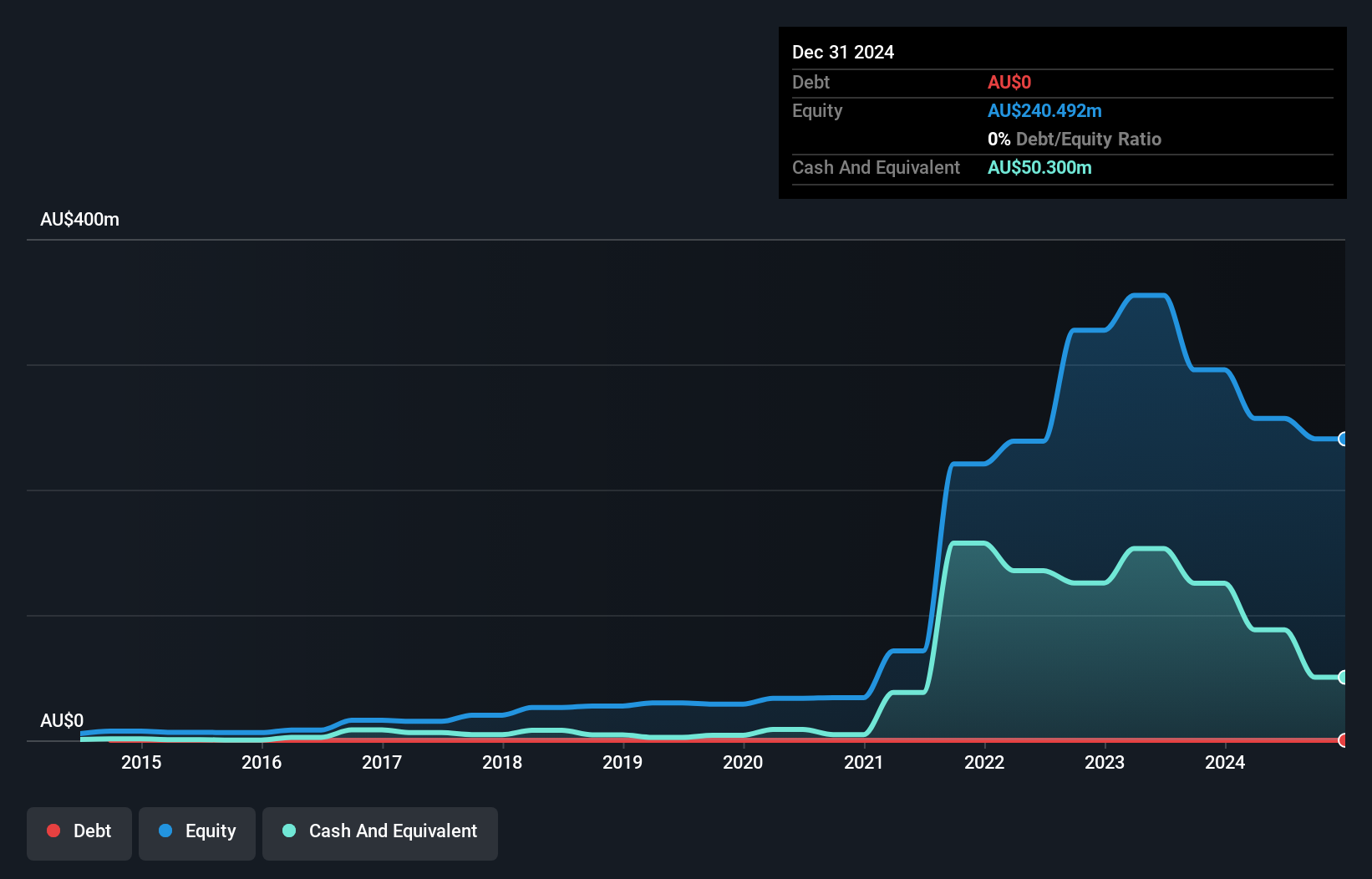

Core Lithium (ASX:CXO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Core Lithium Ltd focuses on the development of lithium and various metal deposits in Northern Territory and South Australia, with a market cap of A$195.01 million.

Operations: The company's revenue is primarily derived from the Finniss Lithium Project, which generated A$52.28 million.

Market Cap: A$195.01M

Core Lithium Ltd, with a market cap of A$195.01 million, is trading significantly below its estimated fair value and remains debt-free, which can be advantageous for financial flexibility. The company is currently unprofitable and faces less than a year of cash runway based on current free cash flow trends. Its short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. Recent updates on the Finniss Restart Study highlight efforts to optimize operations at its key lithium project to enhance productivity and reduce costs. However, profitability is not anticipated in the near term according to forecasts.

- Jump into the full analysis health report here for a deeper understanding of Core Lithium.

- Gain insights into Core Lithium's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Jump into our full catalog of 1,006 ASX Penny Stocks here.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CXO

Core Lithium

Engages in the development of lithium and various metal deposits in Northern Territory and South Australia.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives