- Australia

- /

- Specialty Stores

- /

- ASX:TPW

Despite lower earnings than five years ago, Temple & Webster Group (ASX:TPW) investors are up 536% since then

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. To wit, the Temple & Webster Group Ltd (ASX:TPW) share price has soared 536% over five years. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 40% over the last quarter. Anyone who held for that rewarding ride would probably be keen to talk about it.

In light of the stock dropping 6.2% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

View our latest analysis for Temple & Webster Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Temple & Webster Group's earnings per share are down 15% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 24% per year is probably viewed as evidence that Temple & Webster Group is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

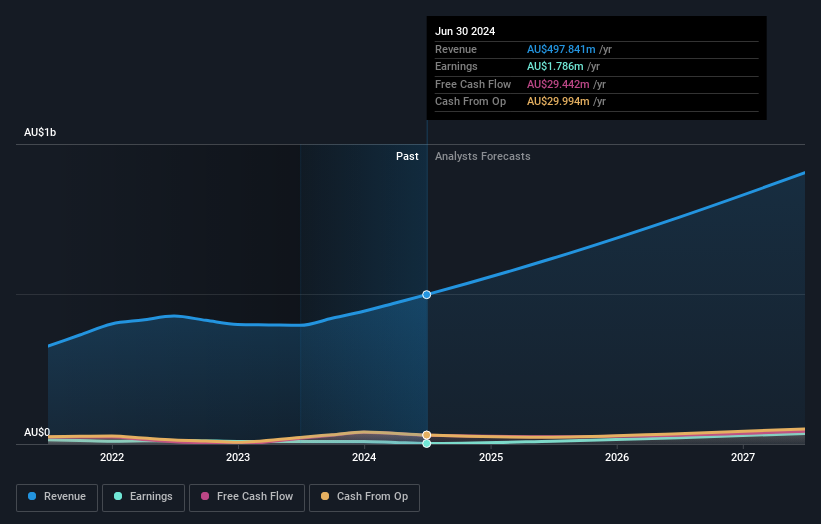

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Temple & Webster Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Temple & Webster Group will earn in the future (free analyst consensus estimates)

A Different Perspective

It's nice to see that Temple & Webster Group shareholders have received a total shareholder return of 114% over the last year. That gain is better than the annual TSR over five years, which is 45%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Temple & Webster Group .

We will like Temple & Webster Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Temple & Webster Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TPW

Temple & Webster Group

Engages in the online retail of furniture, homewares, and home improvement products in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives