- Australia

- /

- Specialty Stores

- /

- ASX:SUL

With EPS Growth And More, Super Retail Group (ASX:SUL) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Super Retail Group (ASX:SUL). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Super Retail Group

How Quickly Is Super Retail Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Super Retail Group has managed to grow EPS by 27% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

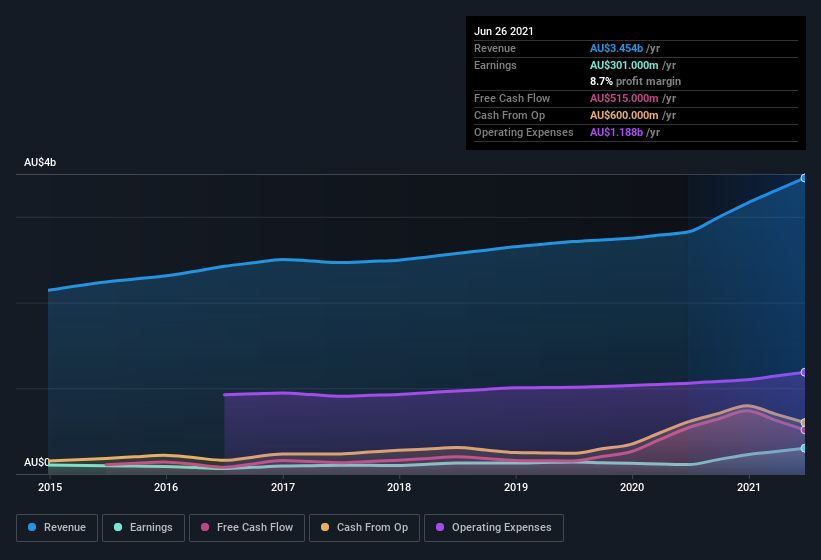

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Super Retail Group shareholders can take confidence from the fact that EBIT margins are up from 7.5% to 14%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Super Retail Group's future profits.

Are Super Retail Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Super Retail Group insiders walking the walk, by spending AU$315k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Group MD Anthony Heraghty for AU$266k worth of shares, at about AU$12.02 per share.

On top of the insider buying, it's good to see that Super Retail Group insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth AU$892m. That equates to 31% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Is Super Retail Group Worth Keeping An Eye On?

For growth investors like me, Super Retail Group's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Still, you should learn about the 2 warning signs we've spotted with Super Retail Group (including 1 which makes us a bit uncomfortable) .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Super Retail Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SUL

Super Retail Group

Engages in the retail of auto, sports, and outdoor leisure products in Australia and New Zealand.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.