- Australia

- /

- Metals and Mining

- /

- ASX:VHM

ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

In the last week, the Australian market has been flat, but over the past 12 months, it has risen by 16%, with earnings forecasted to grow annually by 13%. Although 'penny stock' might sound like a term from a bygone era, these stocks still represent significant opportunities when backed by strong financials. In this article, we focus on three penny stocks that combine balance sheet strength with potential for substantial growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.6675 | A$92.24M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.695 | A$830.68M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.82 | A$233.81M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$222.46M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.94 | A$109.1M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Delta Lithium (ASX:DLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Delta Lithium Limited focuses on exploring and developing lithium and gold properties in Western Australia, with a market capitalization of A$132.56 million.

Operations: Delta Lithium Limited has not reported any revenue segments.

Market Cap: A$132.56M

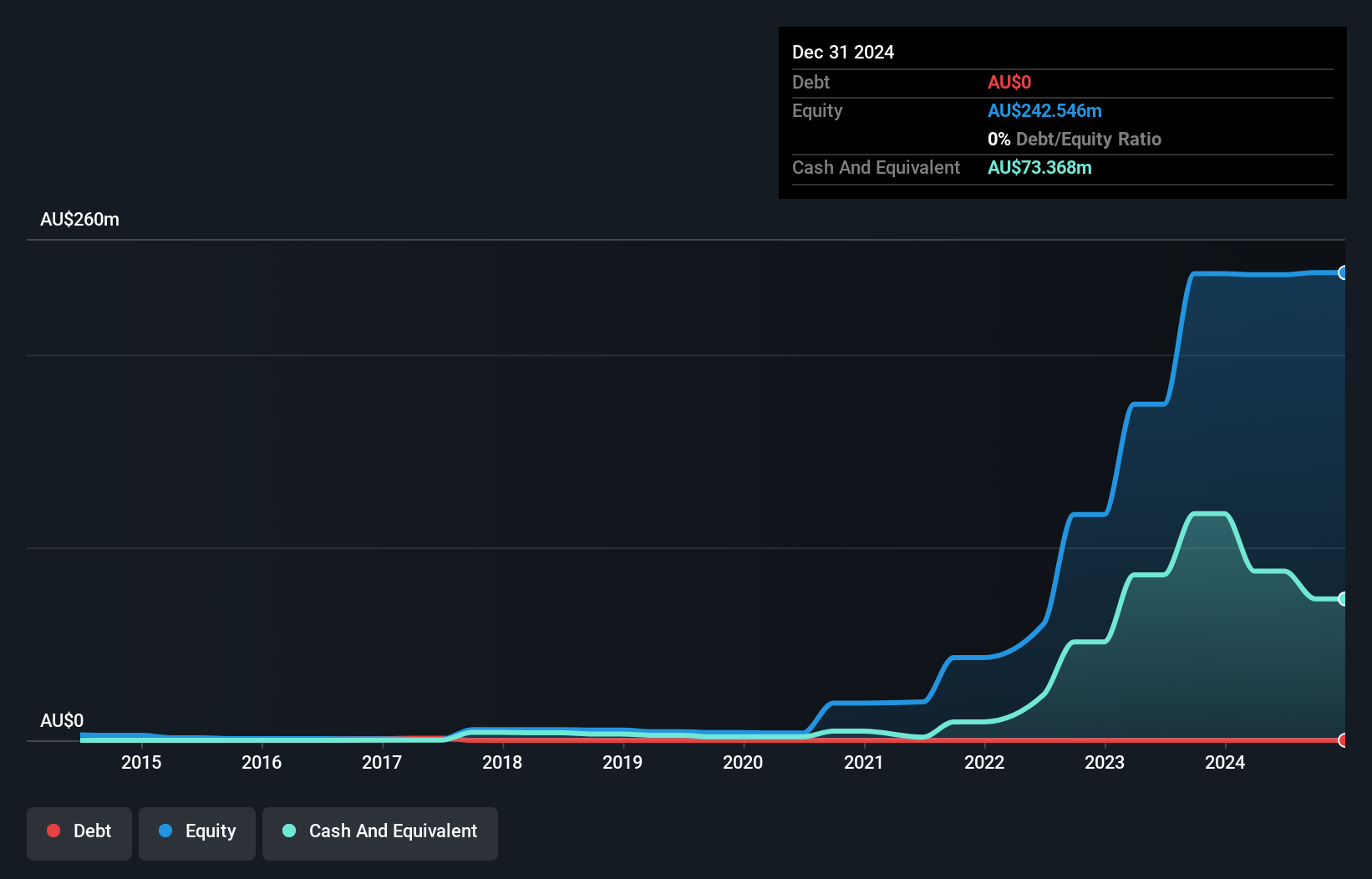

Delta Lithium Limited, with a market capitalization of A$132.56 million, is pre-revenue and unprofitable, having reported a net loss of A$12.49 million for the year ended June 2024. Despite its financial challenges, the company maintains a strong balance sheet with short-term assets of A$89.8 million exceeding both short- and long-term liabilities significantly. Recent management changes include Mr. Chris Ellison's resignation as Chairman, replaced by Mr. Nader El Sayed as Non-Executive Chairman. The company has experienced shareholder dilution over the past year but remains debt-free with sufficient cash runway for over a year under stable conditions.

- Click to explore a detailed breakdown of our findings in Delta Lithium's financial health report.

- Gain insights into Delta Lithium's outlook and expected performance with our report on the company's earnings estimates.

Shaver Shop Group (ASX:SSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shaver Shop Group Limited is a retailer of personal care and grooming products operating in Australia and New Zealand, with a market cap of A$171.63 million.

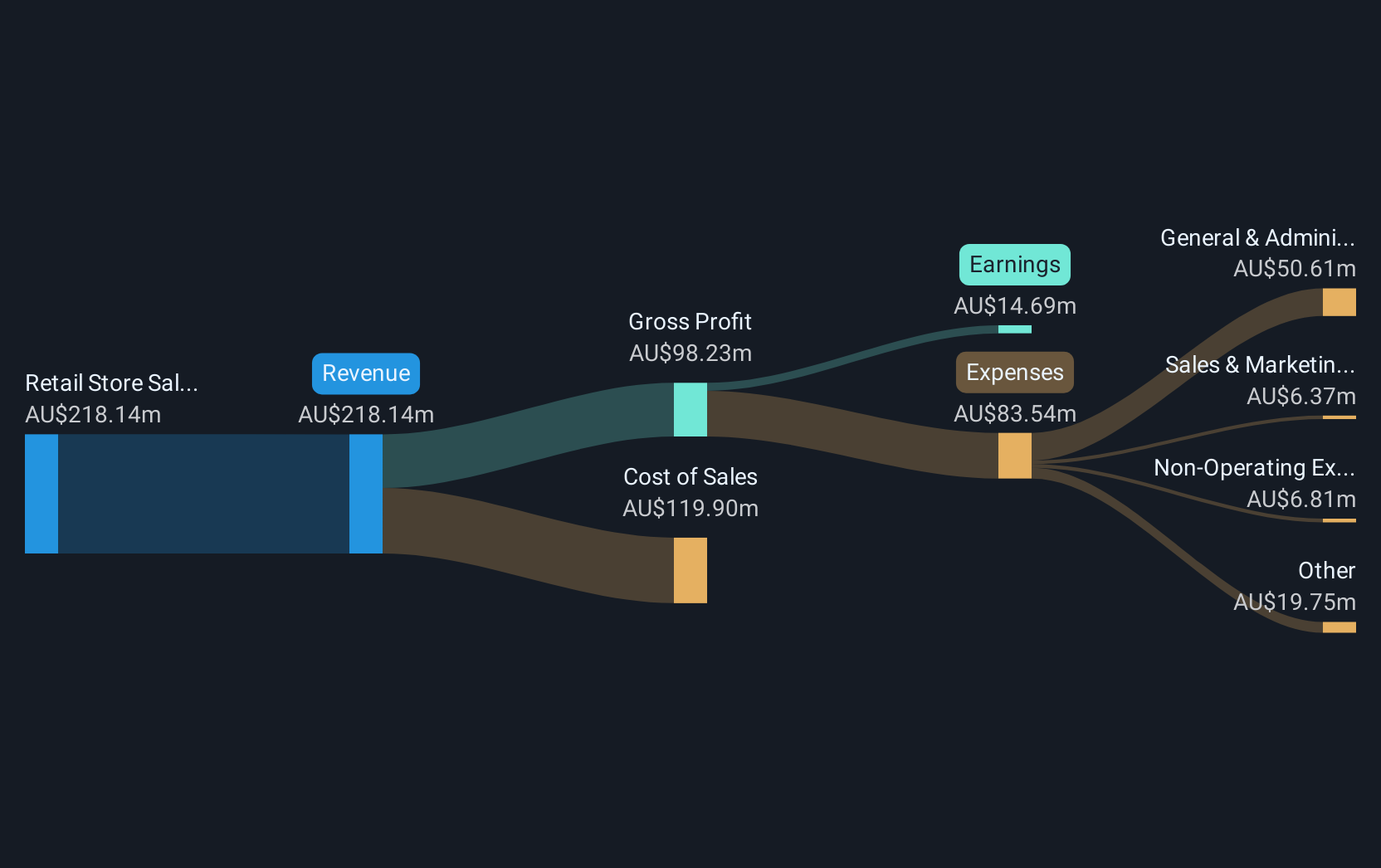

Operations: The company generates revenue primarily through retail store sales of specialist personal grooming products, amounting to A$219.37 million.

Market Cap: A$171.63M

Shaver Shop Group Limited, with a market cap of A$171.63 million, is debt-free and trades significantly below its estimated fair value. Despite experiencing negative earnings growth over the past year and a slight decline in net profit margins from 7.5% to 6.9%, the company maintains strong financial health with short-term assets exceeding liabilities. The management team is highly experienced, averaging 10.5 years in tenure, while the board averages 8.5 years, indicating stability in leadership. However, recent significant insider selling may raise concerns about future prospects despite forecasts for moderate earnings growth of 7.58% annually.

- Unlock comprehensive insights into our analysis of Shaver Shop Group stock in this financial health report.

- Evaluate Shaver Shop Group's prospects by accessing our earnings growth report.

VHM (ASX:VHM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: VHM Limited is involved in the exploration and development of mineral properties in Australia, with a market capitalization of approximately A$96.32 million.

Operations: The company generates revenue from its Metals & Mining - Miscellaneous segment, amounting to A$0.023 million.

Market Cap: A$96.32M

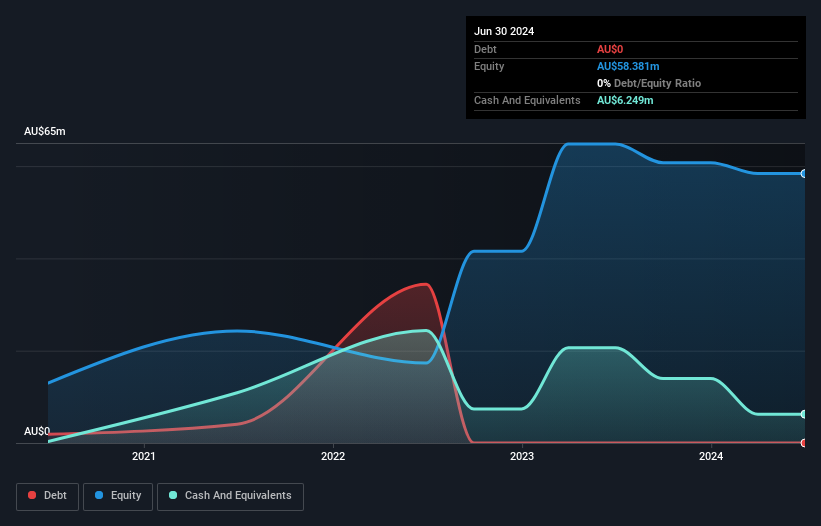

VHM Limited, with a market cap of A$96.32 million, is a pre-revenue company in the exploration and development sector. Despite being debt-free, VHM faces challenges with short-term assets of A$6.4 million not covering long-term liabilities of A$8.2 million. The company's cash runway is limited to 5 months based on current free cash flow estimates, though recent capital raises may provide some relief. Shareholder dilution has occurred over the past year with shares outstanding increasing by 6.5%. The management team and board are relatively inexperienced, averaging tenures of 1.6 years and 1.3 years respectively, which may impact strategic direction moving forward.

- Click here to discover the nuances of VHM with our detailed analytical financial health report.

- Gain insights into VHM's future direction by reviewing our growth report.

Summing It All Up

- Click through to start exploring the rest of the 1,044 ASX Penny Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VHM

VHM

Engages in the exploration and development of mineral properties in Australia.

Excellent balance sheet slight.