- Australia

- /

- Semiconductors

- /

- ASX:4DS

ASX Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

The Australian market is experiencing cautious sentiment, with ASX 200 futures indicating a slight downturn following a strong rise, reflecting global trends and upcoming economic reports. For investors interested in exploring opportunities beyond the major indices, penny stocks—though an older term—remain relevant for their potential to offer affordability and growth. These smaller or newer companies can provide value when backed by solid financials, making them an intriguing consideration for those seeking hidden gems in the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.88M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.98 | A$247.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.05 | A$65.38M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.995 | A$324.82M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.21 | A$342.3M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$246.55M | ★★★★★★ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

4DS Memory (ASX:4DS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 4DS Memory Limited is a semiconductor technology company based in Australia that specializes in providing non-volatile memory technology services, with a market capitalization of A$61.72 million.

Operations: The company generates its revenue from the Computer Storage Devices segment, amounting to A$0.00805 million.

Market Cap: A$61.72M

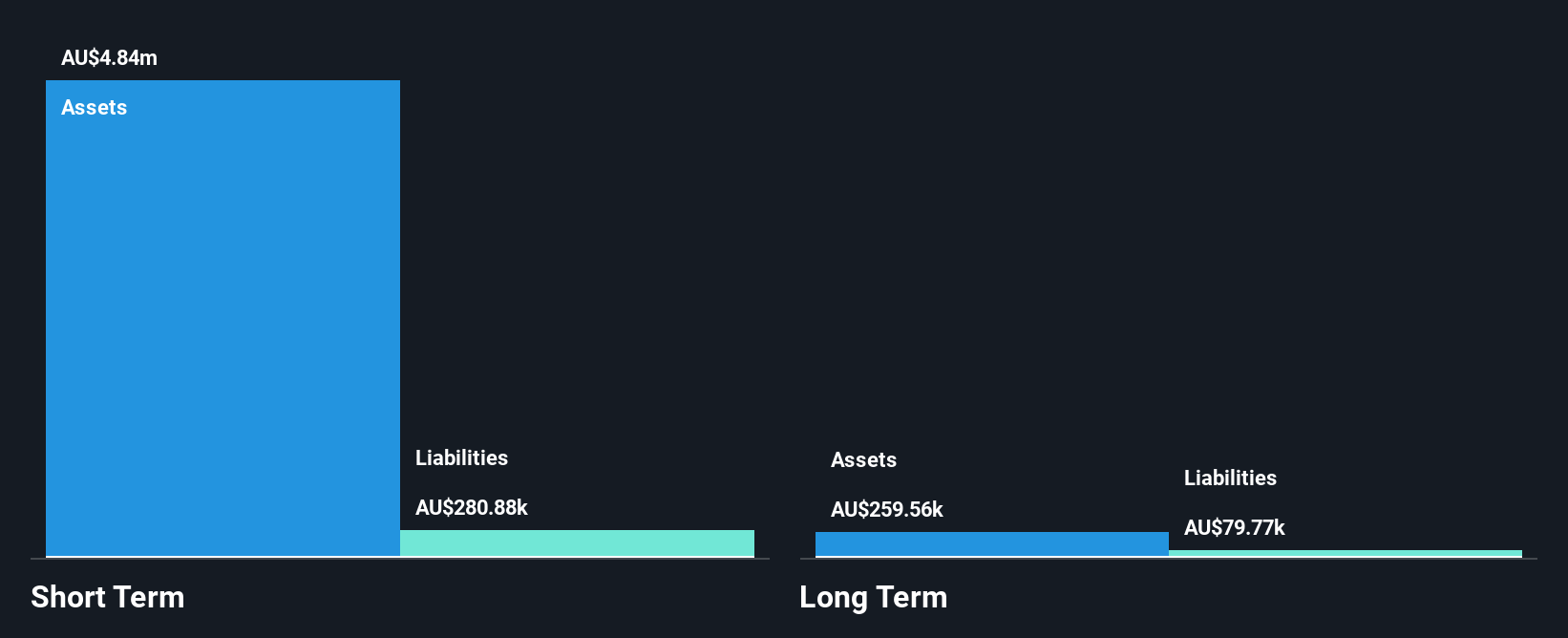

4DS Memory Limited, with a market cap of A$61.72 million, is pre-revenue, generating minimal income from its Computer Storage Devices segment. The company has no debt and sufficient cash runway for over a year based on current free cash flow levels. Despite being unprofitable, it has reduced losses by 1.8% annually over the past five years and maintains stable weekly volatility at 11%. Recent activities include completing a follow-on equity offering raising A$6 million to bolster its financial position without significant shareholder dilution in the past year.

- Dive into the specifics of 4DS Memory here with our thorough balance sheet health report.

- Gain insights into 4DS Memory's historical outcomes by reviewing our past performance report.

Pacific Smiles Group (ASX:PSQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pacific Smiles Group Limited operates dental centers in Australia under the Pacific Smiles Dental Centres and Nib Dental Care Centres names, with a market cap of A$319.21 million.

Operations: The company generates revenue of A$180.30 million from its dental sector operations in Australia.

Market Cap: A$319.21M

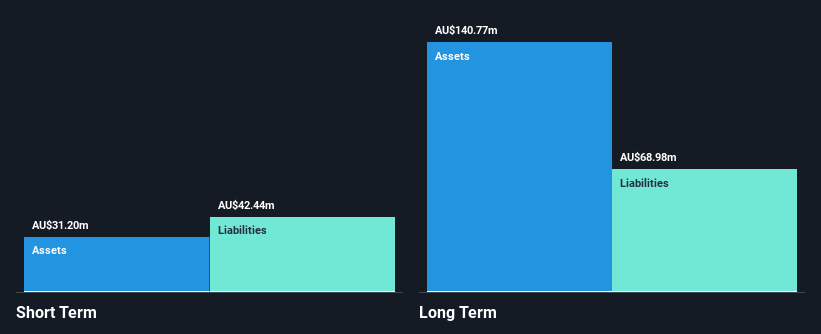

Pacific Smiles Group, with a market cap of A$319.21 million, operates in the dental sector and has shown significant earnings growth of 232.1% over the past year, outperforming the healthcare industry. Despite being debt-free and trading at a substantial discount to its estimated fair value, it faces challenges with short-term assets not covering liabilities and an inexperienced management team averaging 1.1 years in tenure. Recent board changes include new appointments following resignations, coinciding with its removal from key indices like S&P/ASX All Ordinaries Index, which may impact investor perception and stock volatility.

- Unlock comprehensive insights into our analysis of Pacific Smiles Group stock in this financial health report.

- Examine Pacific Smiles Group's earnings growth report to understand how analysts expect it to perform.

Shaver Shop Group (ASX:SSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shaver Shop Group Limited operates as a retailer of personal care and grooming products in Australia and New Zealand, with a market cap of A$174.90 million.

Operations: The company's revenue is primarily generated from retail store sales of specialist personal grooming products, amounting to A$219.37 million.

Market Cap: A$174.9M

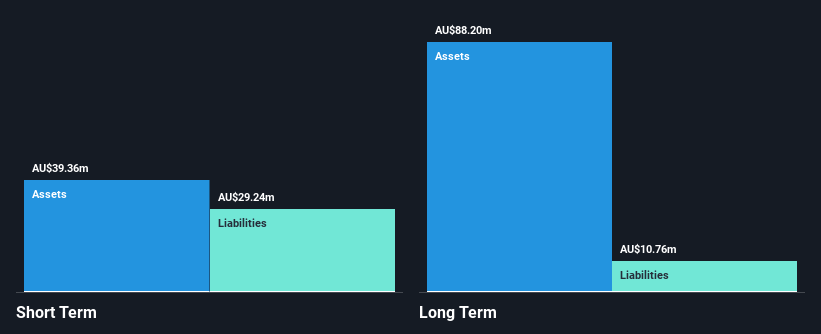

Shaver Shop Group, with a market cap of A$174.90 million, generates substantial revenue from retail sales of personal grooming products in Australia and New Zealand. The company is debt-free, reflecting financial stability and eliminating concerns over interest payments. Despite experiencing negative earnings growth over the past year, its earnings have grown by 11.4% annually over the past five years. The board and management team are experienced with average tenures of 8.7 and 10.7 years respectively, providing seasoned leadership during challenging periods. However, significant insider selling recently raises questions about internal confidence in future performance prospects.

- Click here to discover the nuances of Shaver Shop Group with our detailed analytical financial health report.

- Evaluate Shaver Shop Group's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Take a closer look at our ASX Penny Stocks list of 1,032 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:4DS

4DS Memory

A semiconductor technology company, provides non-volatile memory technology services in Australia.

Flawless balance sheet slight.

Market Insights

Community Narratives