- Australia

- /

- Retail Distributors

- /

- ASX:SNL

Undiscovered Gems in Australia to Watch This August 2024

Reviewed by Simply Wall St

The Australian market has shown mixed performance recently, with the ASX200 closing up a modest 0.17%, reflecting cautious investor sentiment amid varied sector outcomes and slowing job market indicators. Despite these broader trends, there are still promising opportunities for discerning investors willing to explore lesser-known stocks that may offer substantial growth potential in this evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.00% | ★★★★★★ |

| Lycopodium | NA | 15.62% | 29.55% | ★★★★★★ |

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| Hearts and Minds Investments | NA | 18.39% | -3.93% | ★★★★★★ |

| SKS Technologies Group | NA | 31.29% | 43.27% | ★★★★★★ |

| BSP Financial Group | 4.92% | 6.74% | 5.29% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Paragon Care | 340.88% | 28.05% | 68.37% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

DroneShield (ASX:DRO)

Simply Wall St Value Rating: ★★★★★★

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$1.00 billion.

Operations: DroneShield generates revenue primarily from its Aerospace & Defense segment, amounting to A$55.08 million. The company has a market cap of approximately A$1 billion.

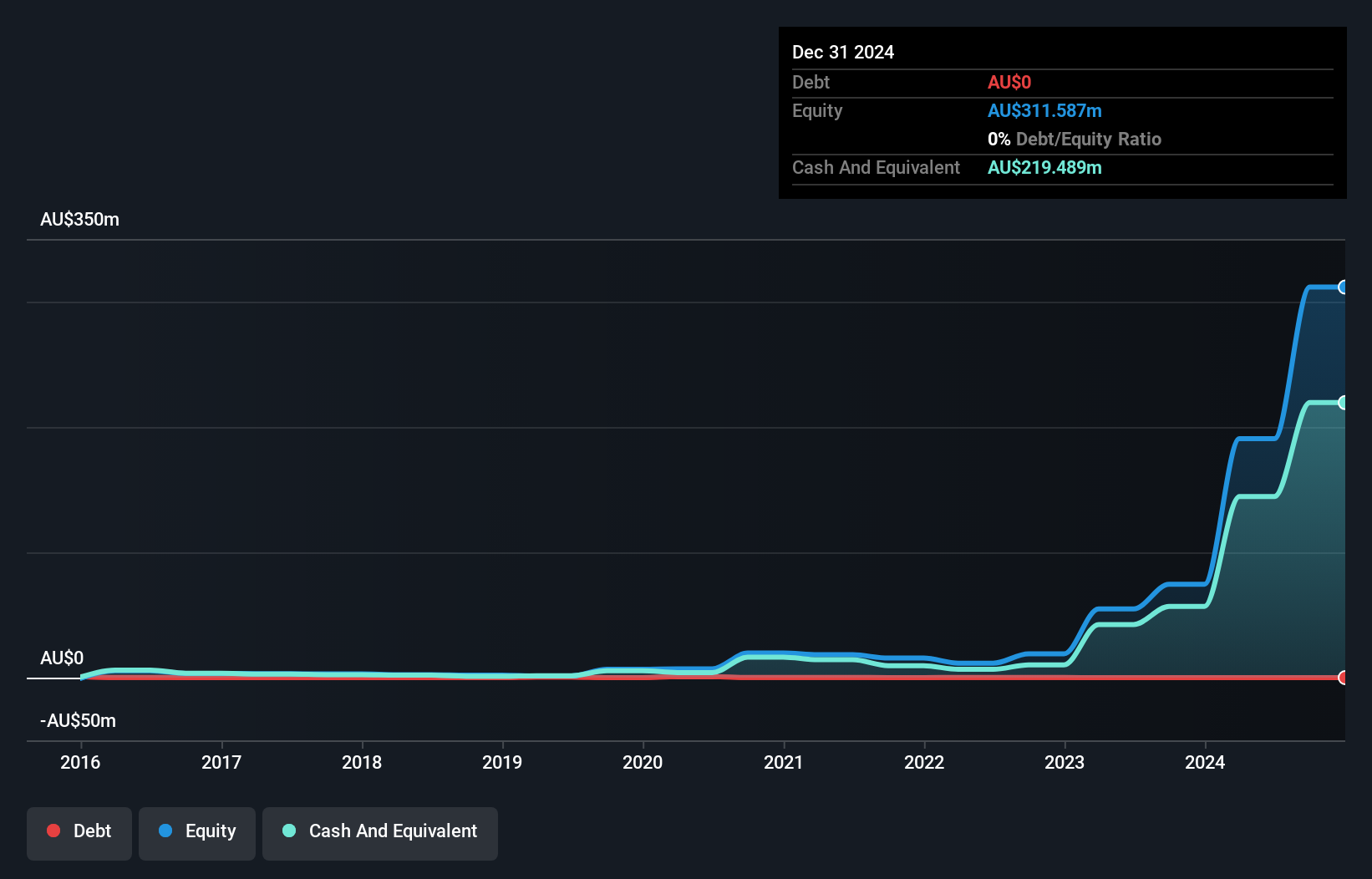

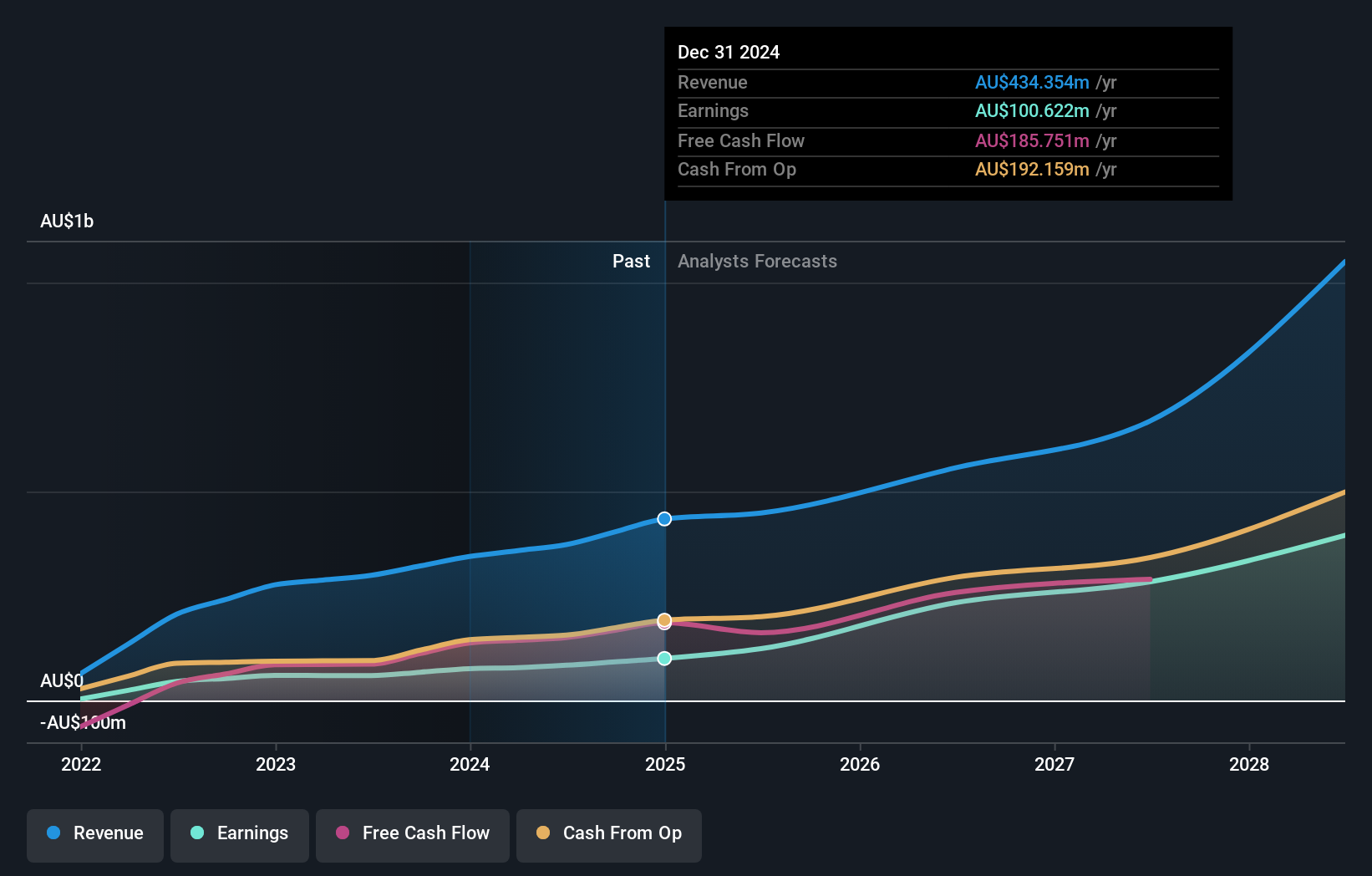

DroneShield, a promising player in the Aerospace & Defense sector, became profitable this year and has no debt. Despite high volatility in its share price over the past three months, earnings are forecast to grow 40.21% annually. The company recently completed a follow-on equity offering worth A$120 million at A$1.15 per share, which could bolster its financial position further. With high-quality earnings and positive free cash flow, DroneShield seems well-positioned for future growth.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL engages in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.40 billion.

Operations: Emerald Resources NL generates revenue primarily from mine operations, amounting to A$339.32 million. The company also has a smaller revenue stream of A$3.24 million from other sources.

Emerald Resources, a smaller player in the Australian mining sector, has shown impressive performance with a 53% earnings growth over the past year, outpacing the industry’s -22%. Its debt to equity ratio rose from 0% to 14.5% in five years but remains manageable as EBIT covers interest payments by 14 times. Forecasted earnings growth of nearly 20% per year and high-quality past earnings further highlight its potential.

- Click here to discover the nuances of Emerald Resources with our detailed analytical health report.

Explore historical data to track Emerald Resources' performance over time in our Past section.

Supply Network (ASX:SNL)

Simply Wall St Value Rating: ★★★★★★

Overview: Supply Network Limited supplies aftermarket parts to the commercial vehicle industry in Australia and New Zealand, with a market cap of A$1.12 billion.

Operations: Supply Network Limited generates revenue primarily from the provision of aftermarket parts for the commercial vehicle market, amounting to A$278.41 million.

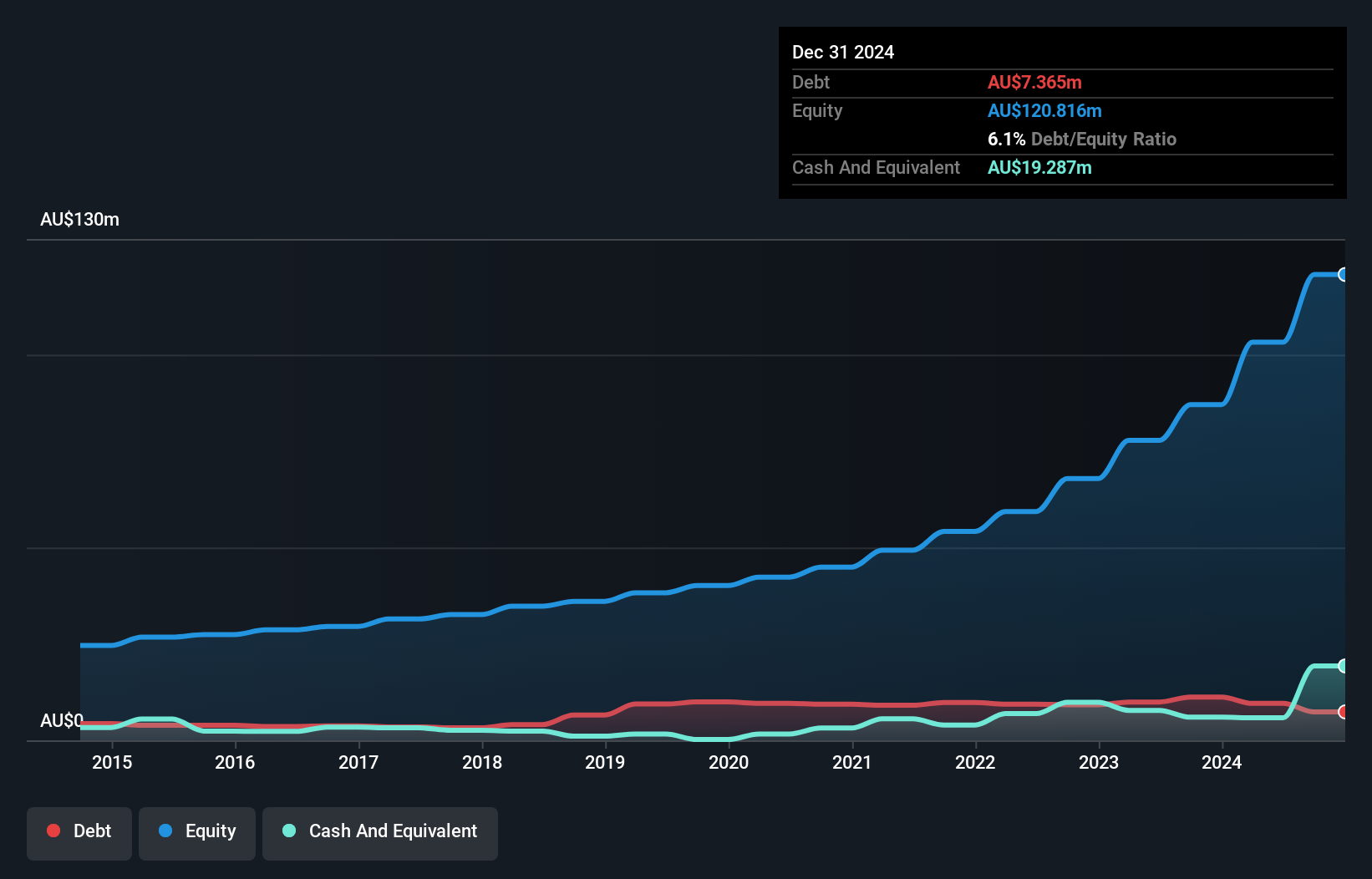

Supply Network has shown robust performance with earnings growing 27.9% over the past year, outpacing its industry peers. The company's net debt to equity ratio stands at a satisfactory 6%, down from 18.1% five years ago, indicating prudent financial management. Recent forecasts predict consolidated sales revenue of A$302.6 million and a profit after tax of A$33.1 million for FY2024. Additionally, Supply Network announced an increased final dividend of 33 cents per share, reflecting confidence in future prospects.

- Take a closer look at Supply Network's potential here in our health report.

Understand Supply Network's track record by examining our Past report.

Taking Advantage

- Unlock our comprehensive list of 54 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SNL

Supply Network

Provides aftermarket parts to the commercial vehicle industry in Australia and New Zealand.

Flawless balance sheet with reasonable growth potential.