The Australian market has stayed flat over the past week but is up 11% over the past year, with earnings forecast to grow by 12% annually. In this environment, identifying good stocks often means finding companies with strong growth potential that have yet to be widely recognized.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Bailador Technology Investments | NA | 11.17% | 10.16% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.38% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

We'll examine a selection from our screener results.

DroneShield (ASX:DRO)

Simply Wall St Value Rating: ★★★★★★

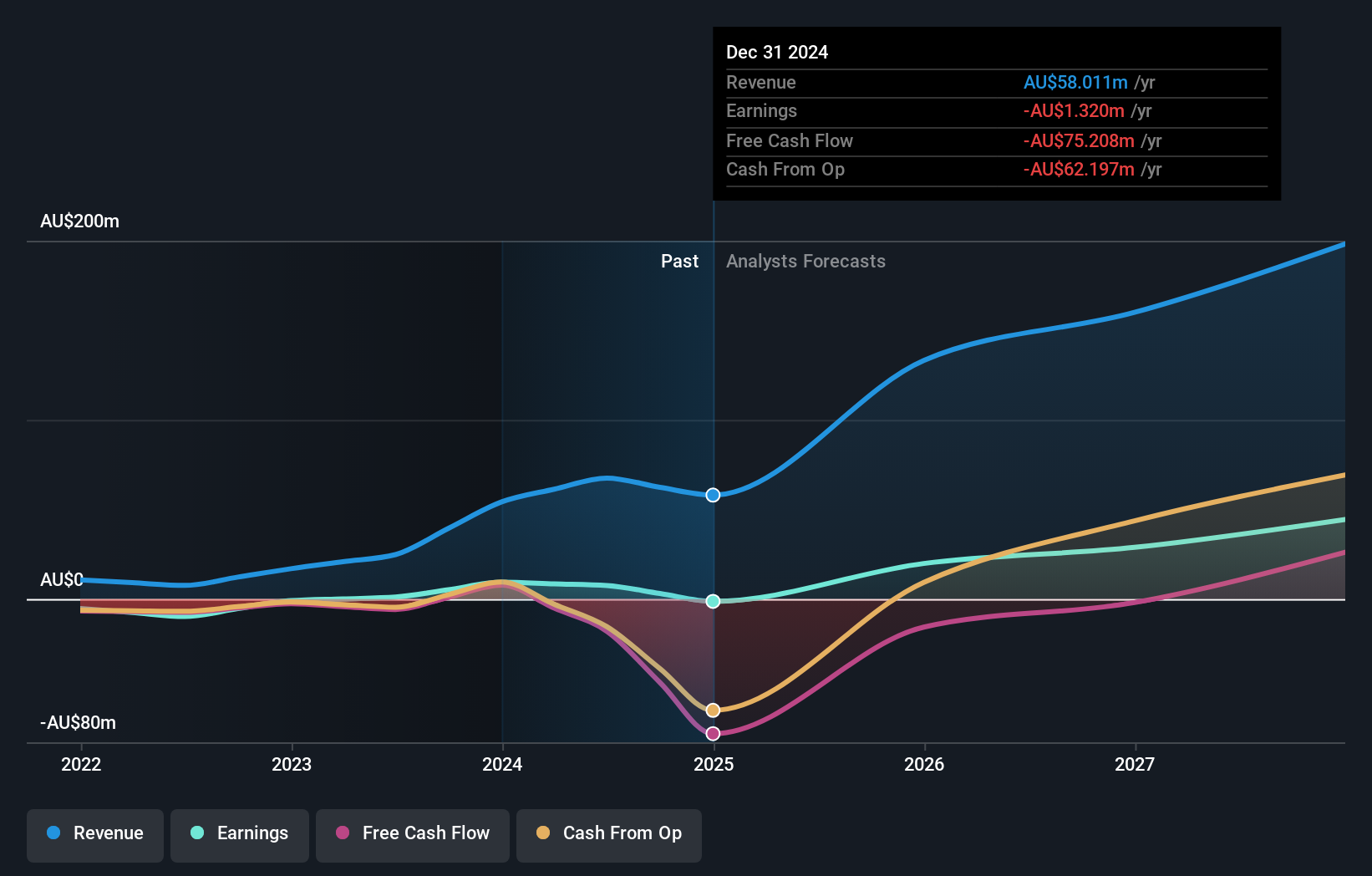

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$1.28 billion.

Operations: DroneShield Limited generates revenue primarily from its Aerospace & Defense segment, amounting to A$67.52 million. The company's market cap stands at approximately A$1.28 billion.

DroneShield, a standout in Australia's tech sector, has seen its earnings surge by 612.7% over the past year, far outpacing the Aerospace & Defense industry's 15.3%. The company remains debt-free today compared to a debt-to-equity ratio of 41.5% five years ago. Despite recent volatility in its share price and shareholder dilution over the past year, DroneShield trades at 45.8% below estimated fair value and forecasts suggest annual earnings growth of 45.19%.

- Click here and access our complete health analysis report to understand the dynamics of DroneShield.

Examine DroneShield's past performance report to understand how it has performed in the past.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Value Rating: ★★★★★★

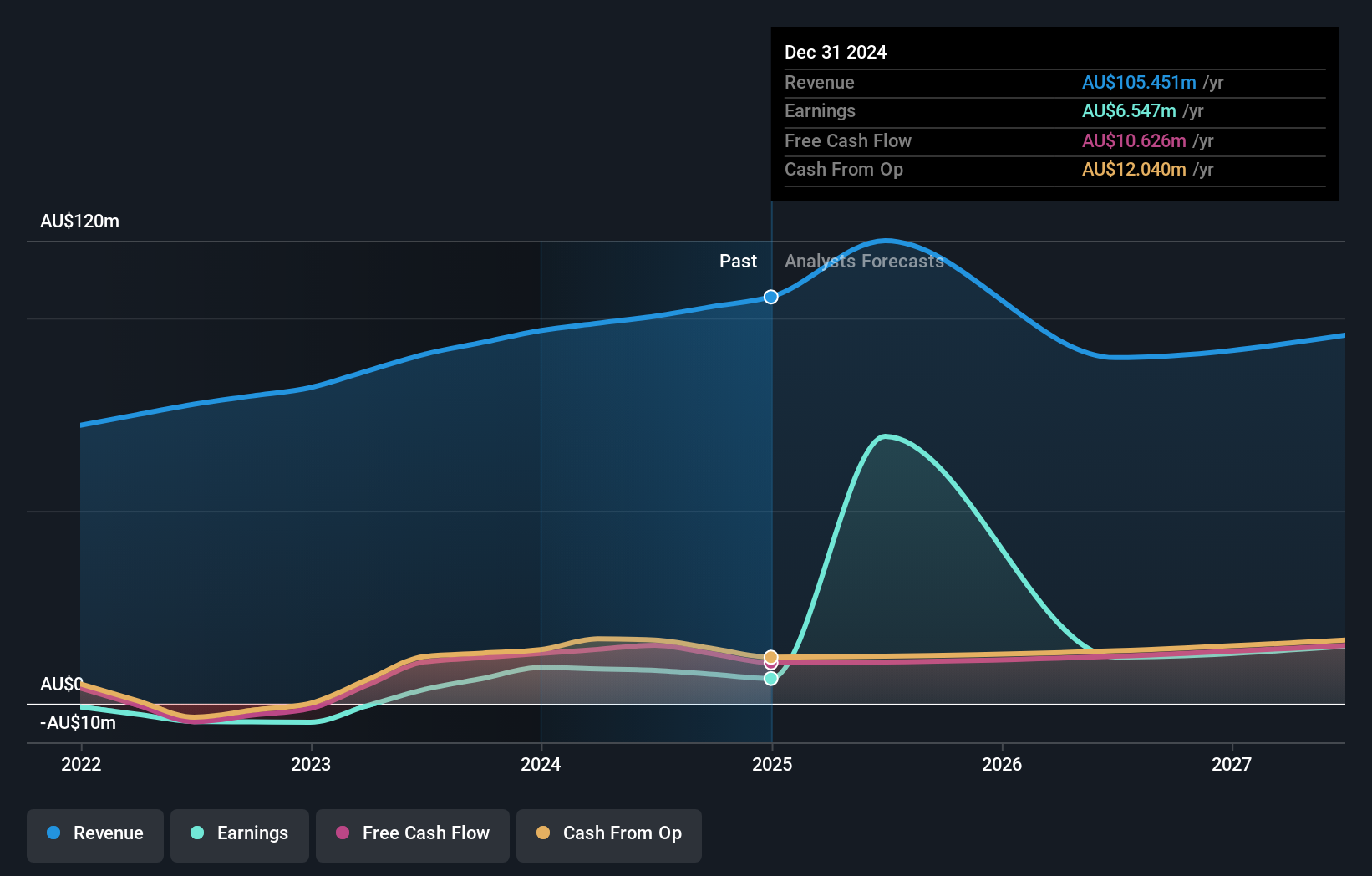

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$575.89 million.

Operations: Revenue for RPMGlobal Holdings Limited primarily comes from its software segment (A$72.67 million) and advisory services (A$31.41 million).

RPMGlobal Holdings has shown impressive growth, with earnings surging 134.6% over the past year, far outpacing the Software industry average of 6.7%. The company reported A$104.19 million in revenue for the fiscal year ending June 30, 2024, up from A$91.56 million last year. Net income also rose to A$8.66 million from A$3.69 million previously. Notably, RPMGlobal is debt-free and maintains a price-to-earnings ratio of 66.5x, slightly below the industry average of 67.8x.

Supply Network (ASX:SNL)

Simply Wall St Value Rating: ★★★★★★

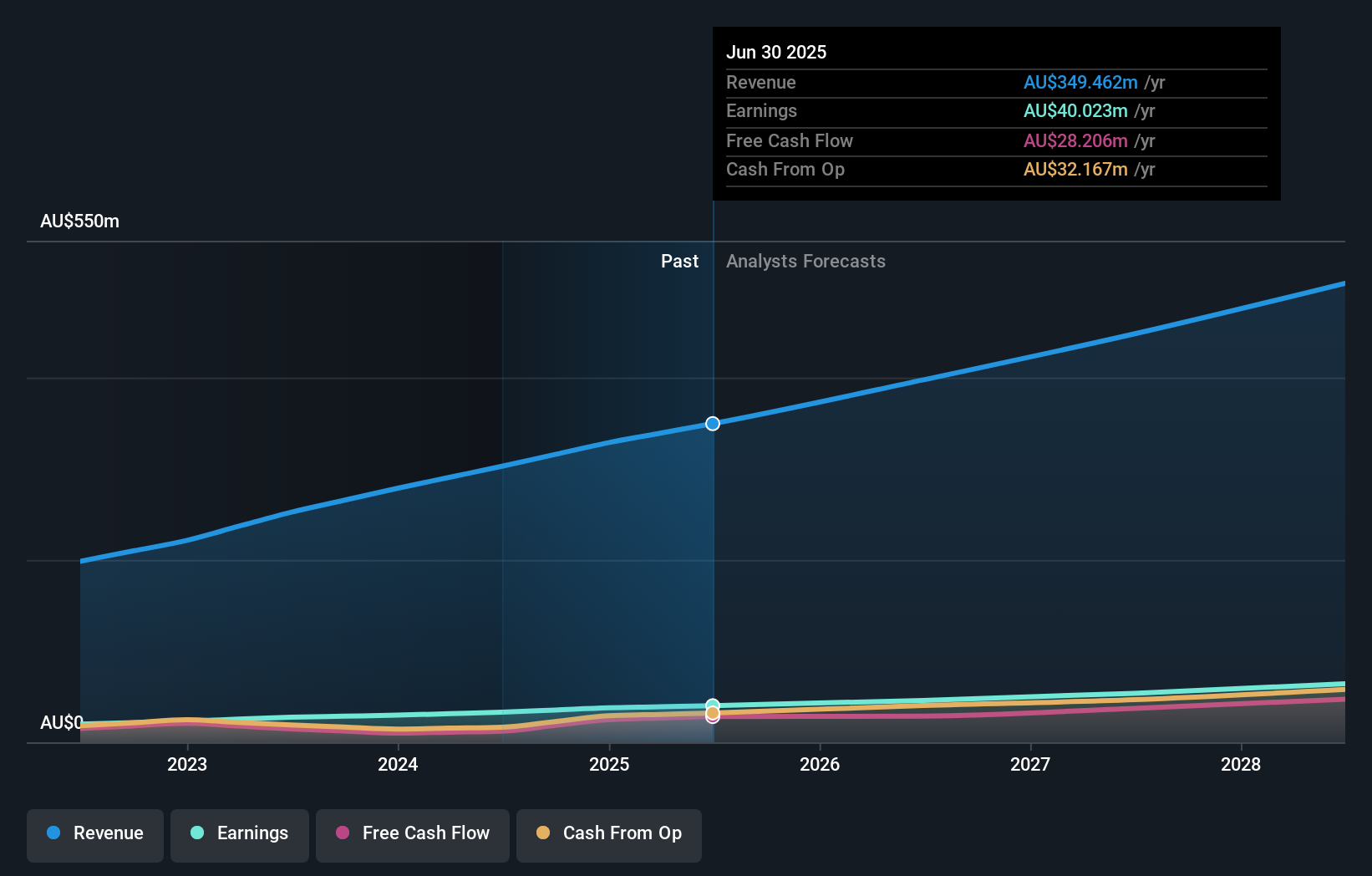

Overview: Supply Network Limited supplies aftermarket parts to the commercial vehicle industry in Australia and New Zealand, with a market cap of A$1.27 billion.

Operations: Supply Network Limited generated A$302.72 million in revenue from its aftermarket parts business for the commercial vehicle market in Australia and New Zealand.

Supply Network has shown impressive growth, with earnings rising 20.5% over the past year, surpassing the Retail Distributors industry average of 2.3%. The company’s debt to equity ratio has improved significantly, dropping from 24.6% to 9.3% in five years. For the fiscal year ending June 30, 2024, Supply Network reported sales of A$302.6 million and net income of A$33.03 million, and it expects revenue growth around its long-term average of 14%.

- Dive into the specifics of Supply Network here with our thorough health report.

Evaluate Supply Network's historical performance by accessing our past performance report.

Key Takeaways

- Embark on your investment journey to our 53 ASX Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RUL

RPMGlobal Holdings

Develops and provides mining software solutions in Australia, Asia, the Americas, Africa, and Europe.

Flawless balance sheet with solid track record.