3 Promising ASX Penny Stocks With At Least A$100M Market Cap

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX 200 closing Christmas week on a positive note, marking a third consecutive win around the festive season. In such an environment, investors often look for stocks that combine value and growth potential, traits that can be found in penny stocks despite their somewhat outdated label. These smaller or newer companies can present unique opportunities when backed by strong financials and fundamentals, making them intriguing options for those seeking under-the-radar investments with potential upside.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.555 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.83 | A$236.3M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$317.49M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$823.33M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.10 | A$146.32M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$199.48M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.90 | A$105.46M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.85 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Ai-Media Technologies (ASX:AIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ai-Media Technologies Limited offers technology-driven captioning, transcription, and translation services across several regions including Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom with a market cap of A$193.15 million.

Operations: The company generates A$66.24 million in revenue from its Internet Software & Services segment.

Market Cap: A$193.15M

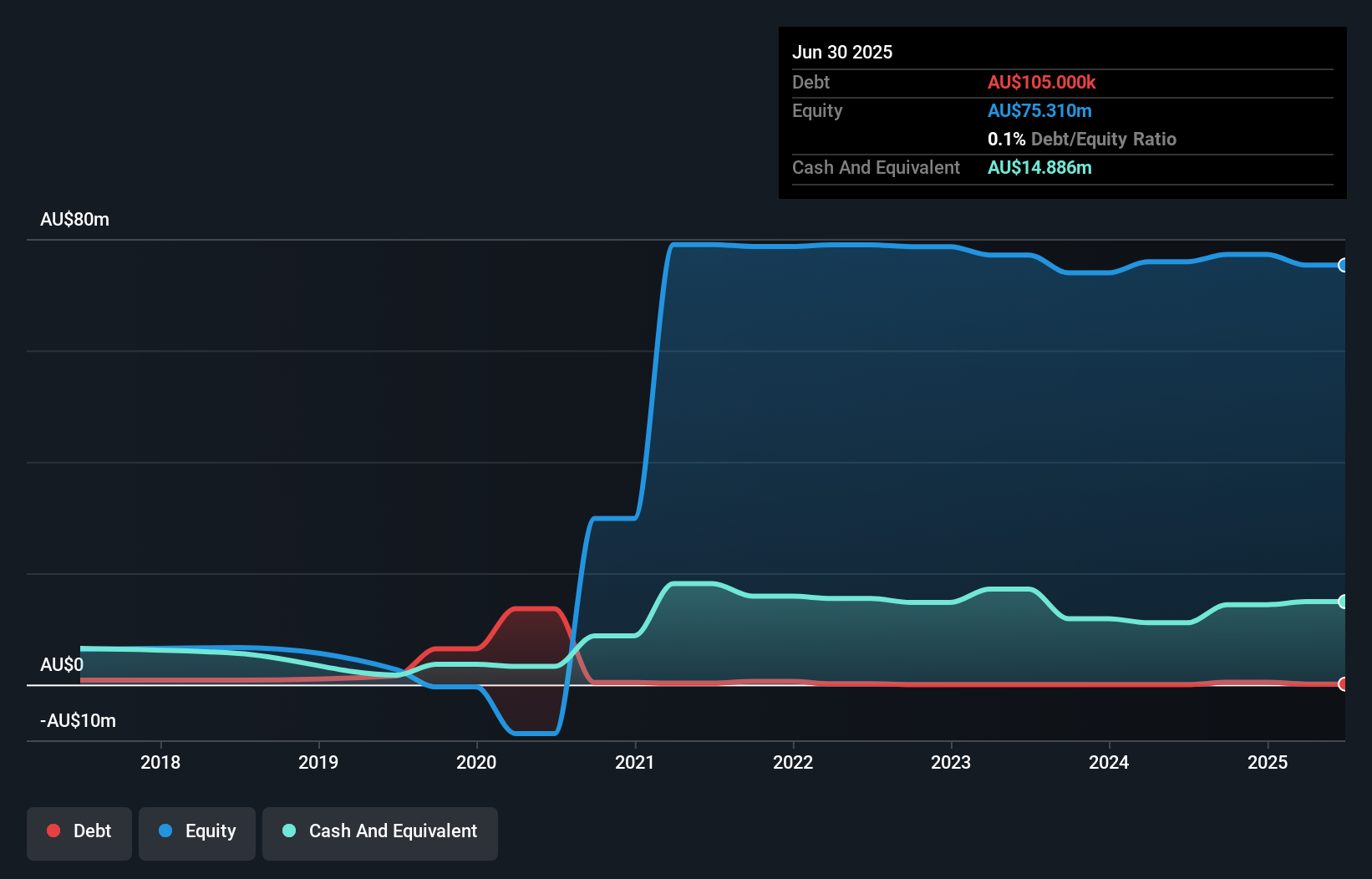

Ai-Media Technologies, with a market cap of A$193.15 million, operates in the Internet Software & Services segment generating A$66.24 million in revenue. Despite being unprofitable with a negative return on equity of -1.77%, the company has managed to reduce its losses by 23.3% annually over five years and forecasts significant earnings growth of 99.26% per year. The company is debt-free and maintains a strong cash position, covering both short-term (A$14.1M) and long-term liabilities (A$3.1M) with assets totaling A$26.8M, ensuring a cash runway exceeding three years if current free cash flow levels persist.

- Get an in-depth perspective on Ai-Media Technologies' performance by reading our balance sheet health report here.

- Understand Ai-Media Technologies' earnings outlook by examining our growth report.

Michael Hill International (ASX:MHJ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Michael Hill International Limited operates jewelry stores and provides related services in Australia, New Zealand, and Canada with a market cap of A$223.16 million.

Operations: The company generated A$646.60 million in revenue from its jewelry retail operations across Australia, New Zealand, and Canada.

Market Cap: A$223.16M

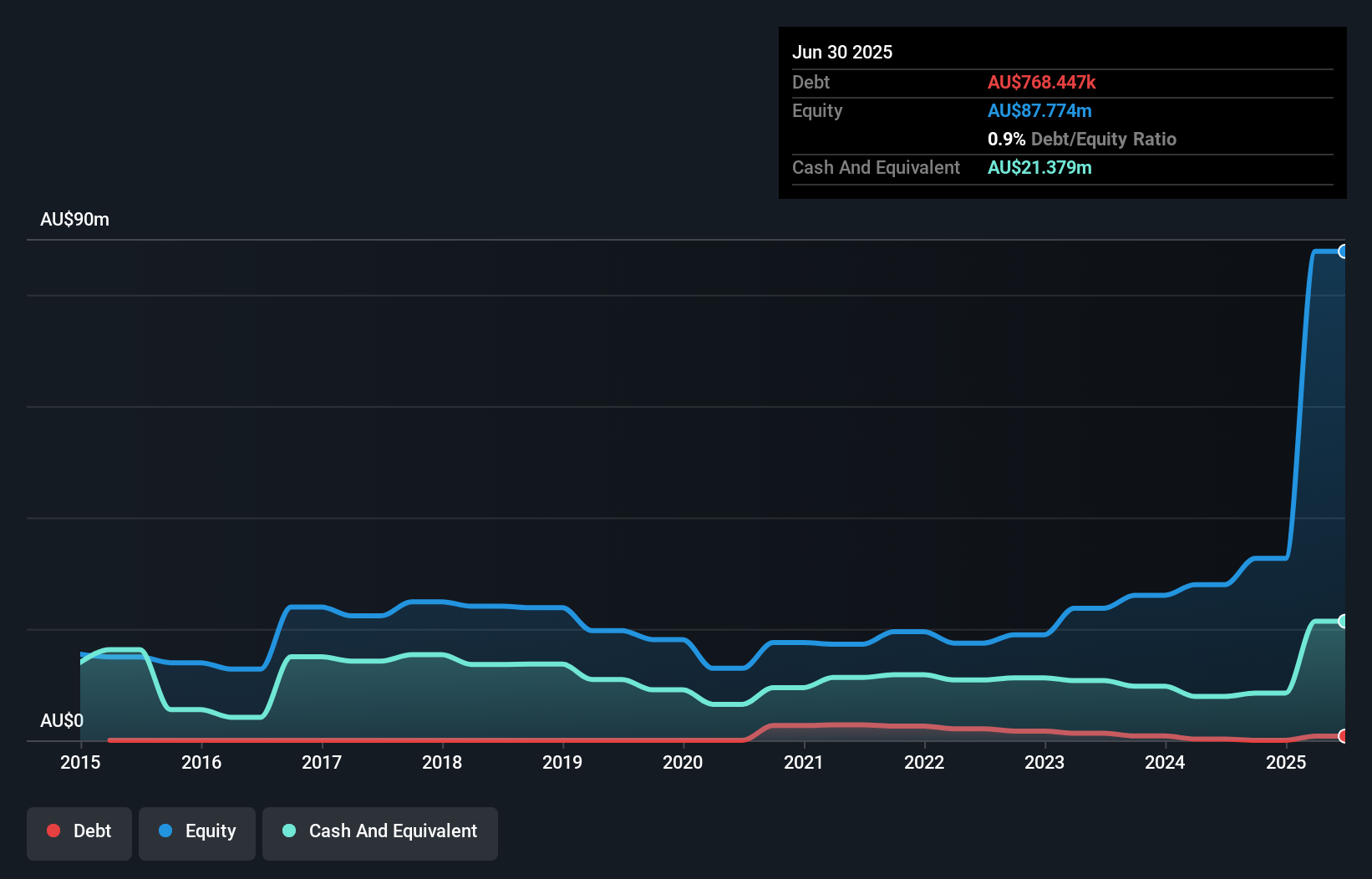

Michael Hill International, with a market cap of A$223.16 million, operates in the jewelry retail sector across Australia, New Zealand, and Canada. Despite being unprofitable and having a negative return on equity of -0.29%, it has reduced losses over five years by 5.3% annually and forecasts earnings growth of 37.42% per year. The company's debt is well covered by operating cash flow at 64.1%, though interest payments are not well covered by EBIT (1.3x). Recent sales announcements show group sales up 4.3% year-on-year for fiscal year 2025's first fourteen weeks, indicating potential recovery momentum.

- Click here and access our complete financial health analysis report to understand the dynamics of Michael Hill International.

- Evaluate Michael Hill International's prospects by accessing our earnings growth report.

Smart Parking (ASX:SPZ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Smart Parking Limited, with a market cap of A$302.97 million, designs, develops, and manages parking management solutions across New Zealand, Australia, Germany, and the United Kingdom.

Operations: The company's revenue is derived from its Technology Division, and Parking Management operations in Denmark (A$0.11 million), Germany (A$2.79 million), Australia (A$0.07 million), New Zealand (A$4.57 million), and the United Kingdom (A$43.99 million).

Market Cap: A$302.97M

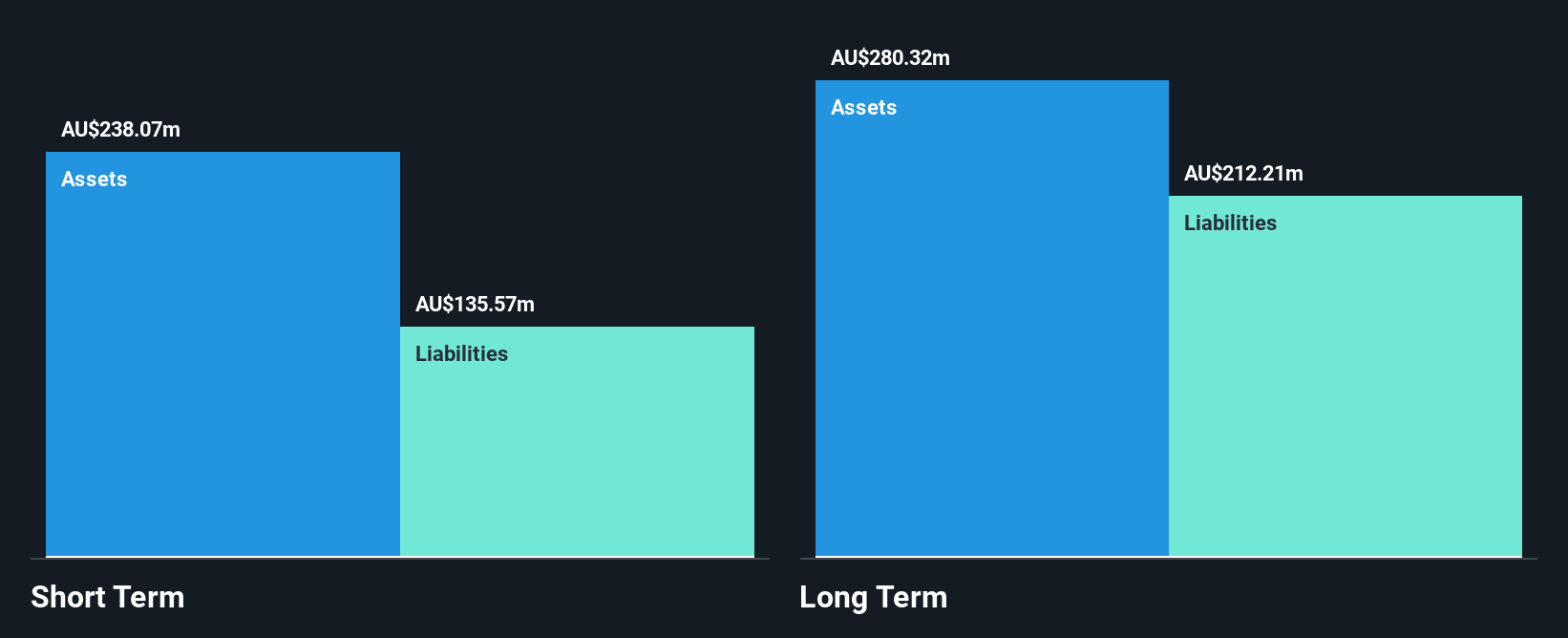

Smart Parking Limited, with a market cap of A$302.97 million, is actively seeking mergers and acquisitions to strategically expand its operations. The company has a strong financial foundation, with short-term assets (A$24.7M) exceeding both short-term (A$20.3M) and long-term liabilities (A$9.4M). Its interest payments are well covered by EBIT at 11.3x, and it holds more cash than total debt, indicating prudent financial management despite recent negative earnings growth of -42.2%. Although the return on equity is low at 13.2%, Smart Parking's seasoned board and stable weekly volatility suggest resilience in navigating market challenges.

- Jump into the full analysis health report here for a deeper understanding of Smart Parking.

- Learn about Smart Parking's future growth trajectory here.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1,053 ASX Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AIM

Ai-Media Technologies

Provides captioning, transcription, and translation products and services in Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026