- Australia

- /

- Hospitality

- /

- ASX:CKF

ASX Stocks Like Collins Foods That Could Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the ASX200 reaches a new all-time intra-day high of 9,054 points, investors are closely watching sector performances with Materials leading the charge and Financials lagging behind. In this context of fluctuating sector strengths, identifying undervalued stocks like Collins Foods becomes crucial for those seeking potential opportunities in Australia's vibrant market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Reckon (ASX:RKN) | A$0.615 | A$1.19 | 48.4% |

| ReadyTech Holdings (ASX:RDY) | A$2.70 | A$5.06 | 46.7% |

| Praemium (ASX:PPS) | A$0.715 | A$1.34 | 46.7% |

| PointsBet Holdings (ASX:PBH) | A$1.255 | A$2.12 | 40.9% |

| Kogan.com (ASX:KGN) | A$4.17 | A$7.60 | 45.1% |

| Hillgrove Resources (ASX:HGO) | A$0.038 | A$0.073 | 48.1% |

| Elders (ASX:ELD) | A$7.58 | A$14.04 | 46% |

| Credit Clear (ASX:CCR) | A$0.265 | A$0.47 | 43.6% |

| Collins Foods (ASX:CKF) | A$9.54 | A$16.17 | 41% |

| Austal (ASX:ASB) | A$6.95 | A$13.25 | 47.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Collins Foods (ASX:CKF)

Overview: Collins Foods Limited operates, manages, and administers restaurants in Australia and Europe with a market cap of A$1.13 billion.

Operations: The company's revenue is derived from its operations in Taco Bell Australia (A$53.02 million), KFC Restaurants Europe (A$312.27 million), and KFC Restaurants Australia (A$1.15 billion).

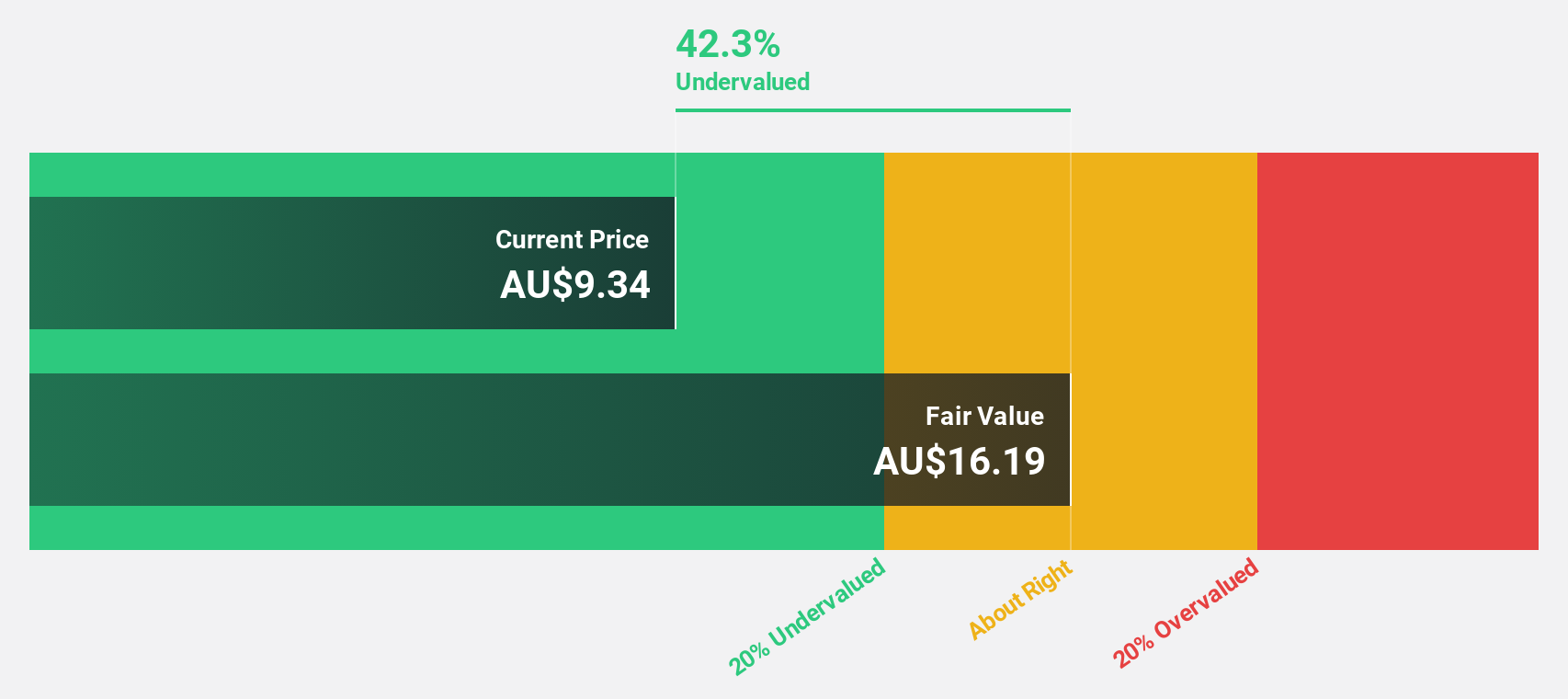

Estimated Discount To Fair Value: 41%

Collins Foods appears undervalued, trading at A$9.54 against a fair value estimate of A$16.17, suggesting potential upside based on cash flows. Despite a recent decline in net income to A$8.83 million from A$76.72 million, earnings are forecasted to grow significantly at 28.5% annually, outpacing the market's 10.7%. However, profit margins have decreased to 0.6%, and its dividend yield of 2.73% is not well-covered by earnings.

- The analysis detailed in our Collins Foods growth report hints at robust future financial performance.

- Take a closer look at Collins Foods' balance sheet health here in our report.

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited offers travel retailing services for both leisure and corporate clients across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and globally with a market cap of A$2.85 billion.

Operations: The company's revenue segments comprise A$1.38 billion from leisure travel services and A$1.13 billion from corporate travel services.

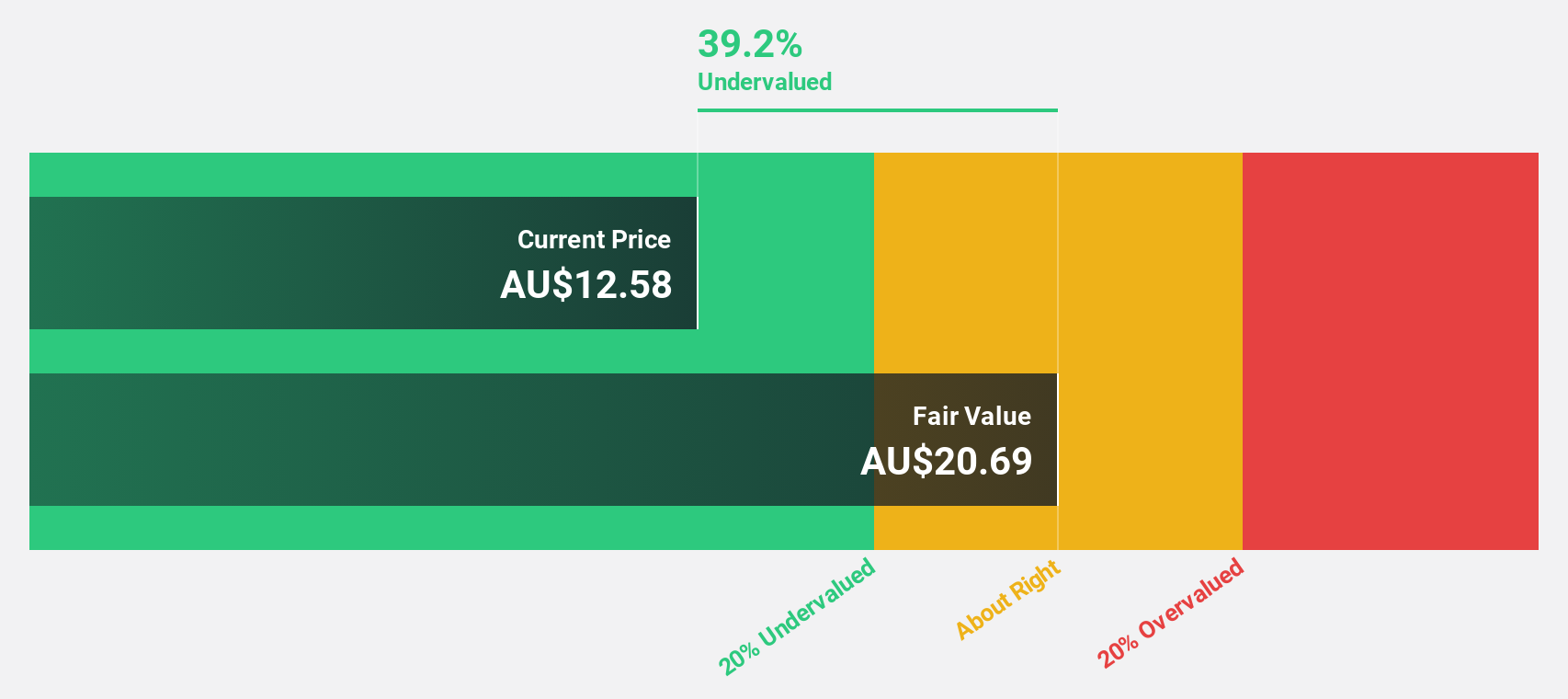

Estimated Discount To Fair Value: 37.4%

Flight Centre Travel Group is trading at A$13.13, significantly below its fair value estimate of A$20.98, highlighting its undervaluation based on cash flows. Earnings are projected to grow substantially at 20.7% annually, surpassing the Australian market's growth rate, although revenue growth remains modest at 5.5%. Recent collaboration with Serko Limited enhances its technology offerings. However, profit margins have declined to 4.1%, and the dividend yield of 4.57% is not adequately covered by free cash flows.

- According our earnings growth report, there's an indication that Flight Centre Travel Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Flight Centre Travel Group.

Kogan.com (ASX:KGN)

Overview: Kogan.com Ltd is an online retailer based in Australia with a market capitalization of A$415.42 million.

Operations: The company generates revenue through its online retail operations, with A$309.36 million from Kogan Parent in Australia, A$9.96 million from Mighty Ape in Australia, A$124.88 million from Mighty Ape in New Zealand, and A$40.02 million from Kogan Parent in New Zealand.

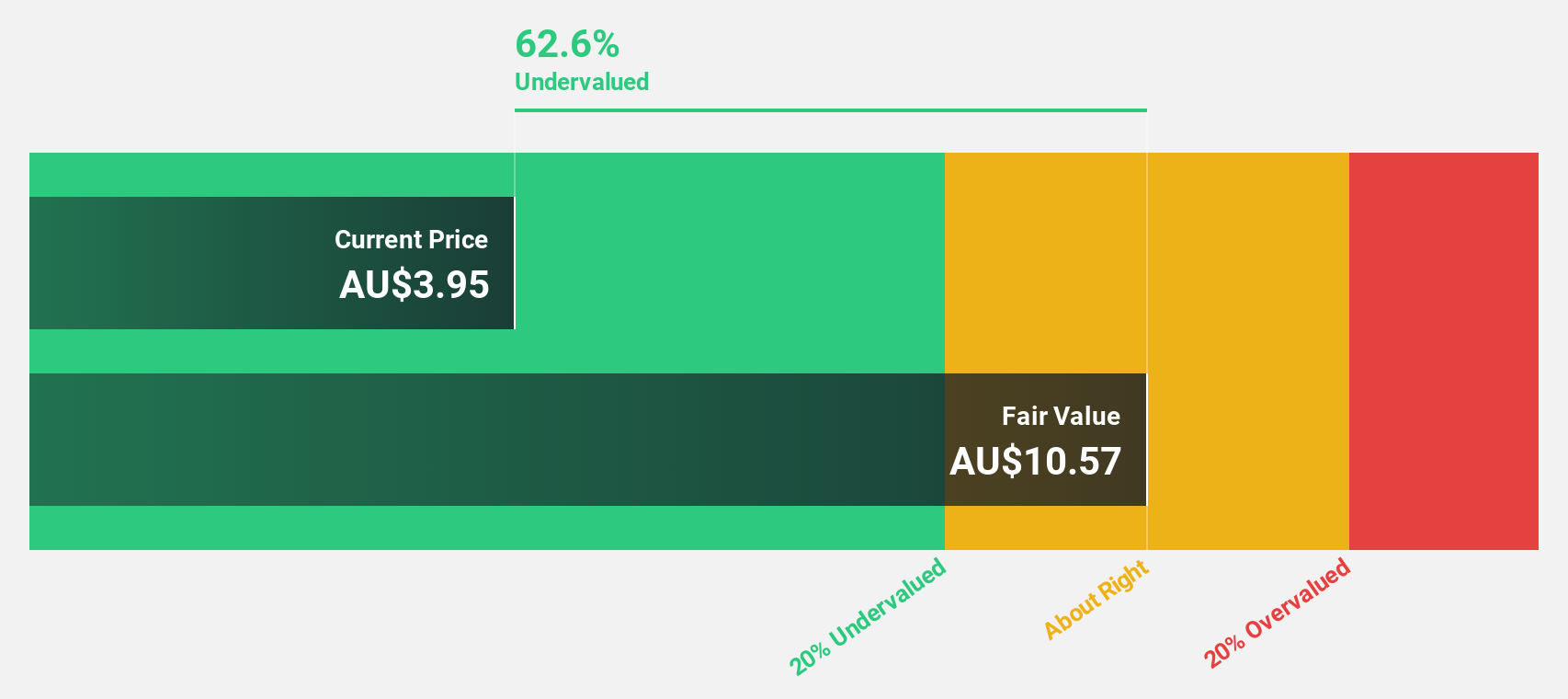

Estimated Discount To Fair Value: 45.1%

Kogan.com is trading at A$4.17, well below its fair value estimate of A$7.6, indicating significant undervaluation based on cash flows. Despite a net loss of A$39.47 million for the year ended June 30, 2025, earnings are expected to grow substantially at 36.3% annually over the next three years, outpacing the Australian market's growth rate. However, profit margins have decreased to 0.4%, and the dividend yield of 3.36% is not well covered by earnings.

- Insights from our recent growth report point to a promising forecast for Kogan.com's business outlook.

- Click to explore a detailed breakdown of our findings in Kogan.com's balance sheet health report.

Where To Now?

- Embark on your investment journey to our 34 Undervalued ASX Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CKF

Collins Foods

Engages in the operation, management, and administration of restaurants in Australia and Europe.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives