ASX Growth Stocks With Insider Ownership And 22% Earnings Growth

Reviewed by Simply Wall St

The Australian market has been experiencing a surge in sentiment, with the ASX200 nearing the 9,000-point milestone following recent interest rate cuts by the Reserve Bank of Australia. In this environment of optimism and strategic monetary policy adjustments, growth companies with high insider ownership stand out as potentially robust investments due to their alignment of interests and commitment to long-term success.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IperionX (ASX:IPX) | 18.7% | 76.5% |

| Image Resources (ASX:IMA) | 22.3% | 79.8% |

| Gratifii (ASX:GTI) | 17.8% | 114.0% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.9% |

| Echo IQ (ASX:EIQ) | 18% | 51.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Acrux (ASX:ACR) | 15.5% | 106.9% |

Let's review some notable picks from our screened stocks.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited operates and franchises quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$2.96 billion.

Operations: The company's revenue segment includes A$413.26 million from its restaurant operations.

Insider Ownership: 14.9%

Earnings Growth Forecast: 39.2% p.a.

Guzman y Gomez is forecast to achieve revenue growth of 16.8% annually, outpacing the broader Australian market's 5.5%. Earnings are projected to increase by 39.19% per year, with profitability anticipated within three years—an above-average market growth rate. Despite a low forecasted Return on Equity of 14.4%, no significant insider trading activity has been reported recently, indicating stable insider confidence in the company's long-term potential.

- Click here to discover the nuances of Guzman y Gomez with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Guzman y Gomez's share price might be too optimistic.

Kogan.com (ASX:KGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kogan.com Ltd is an online retailer based in Australia with a market capitalization of A$392.29 million.

Operations: The company generates revenue from its operations in Australia and New Zealand, with A$309.36 million from Kogan Parent-Australia, A$9.96 million from Mighty Ape-Australia, A$124.88 million from Mighty Ape-New Zealand, and A$40.02 million from Kogan Parent-New Zealand.

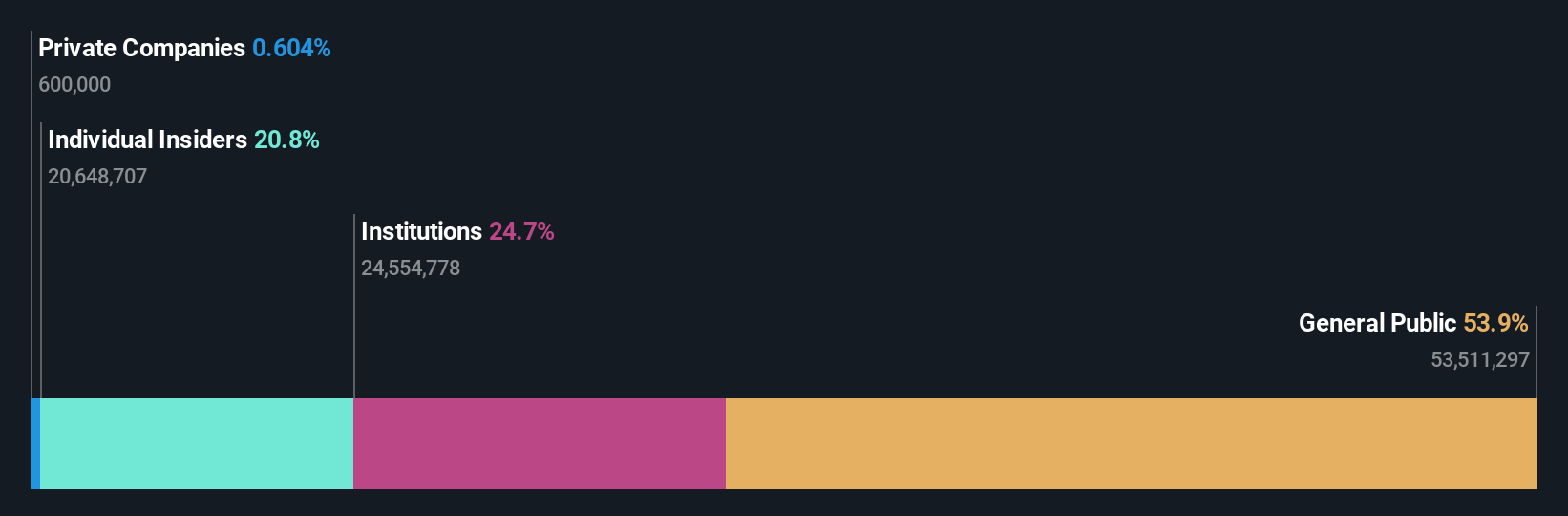

Insider Ownership: 20.8%

Earnings Growth Forecast: 34.5% p.a.

Kogan.com is trading at a significant discount to its estimated fair value and is expected to experience substantial earnings growth of 34.52% annually, outpacing the broader Australian market. Despite this, profit margins have declined from 1.4% to 0.4%. The company's revenue growth forecast of 6.8% per year exceeds the market average but remains below high-growth benchmarks. Recent management changes include Belinda Cleminson's appointment as Company Secretary, reflecting strategic governance enhancements without notable insider trading activity reported recently.

- Delve into the full analysis future growth report here for a deeper understanding of Kogan.com.

- Our valuation report here indicates Kogan.com may be undervalued.

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is a global infection prevention company with a market capitalization of A$1.19 billion.

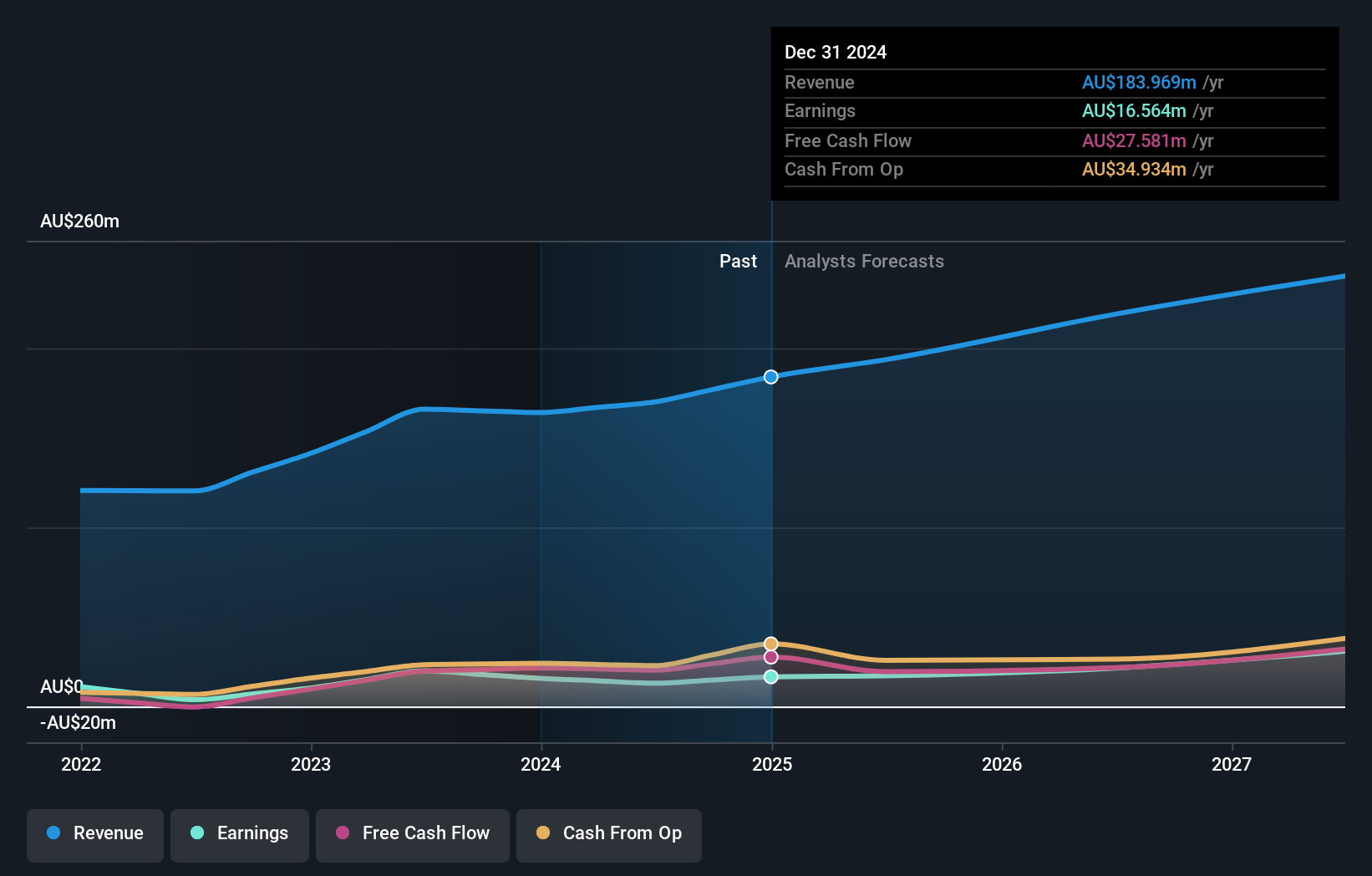

Operations: The company's revenue is derived from its Healthcare Equipment segment, which amounts to A$183.97 million.

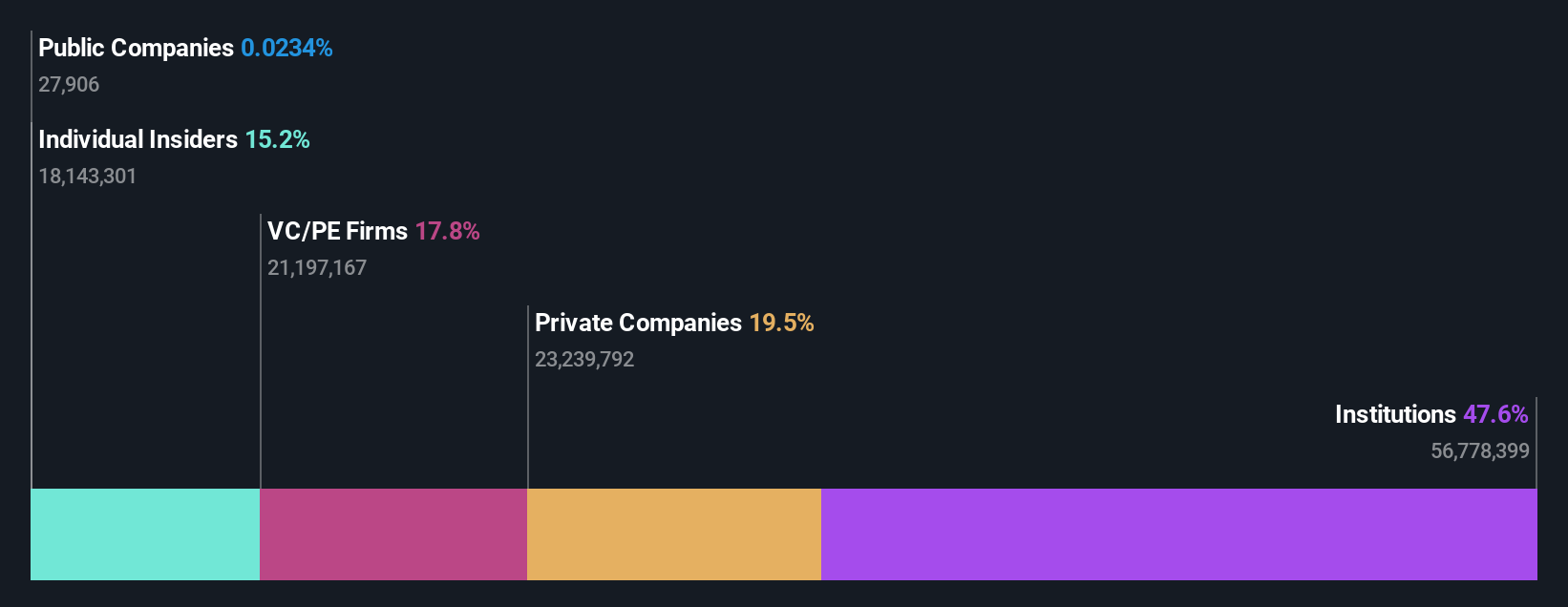

Insider Ownership: 15.4%

Earnings Growth Forecast: 22.9% p.a.

Nanosonics is trading at 24% below its estimated fair value, with earnings projected to grow significantly at 22.9% annually, surpassing the Australian market's average growth rate. Despite slower revenue growth of 9.6% per year compared to high-growth benchmarks, it still exceeds the market average. The company's Return on Equity is expected to remain low at 13.9%. No substantial insider trading activity has been reported in the past three months.

- Dive into the specifics of Nanosonics here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Nanosonics is priced lower than what may be justified by its financials.

Seize The Opportunity

- Discover the full array of 99 Fast Growing ASX Companies With High Insider Ownership right here.

- Interested In Other Possibilities? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kogan.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KGN

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives