Investors Who Bought IncentiaPay (ASX:INP) Shares Five Years Ago Are Now Down 98%

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held IncentiaPay Limited (ASX:INP) for five years would be nursing their metaphorical wounds since the share price dropped 98% in that time. And it's not just long term holders hurting, because the stock is down 86% in the last year. Furthermore, it's down 58% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for IncentiaPay

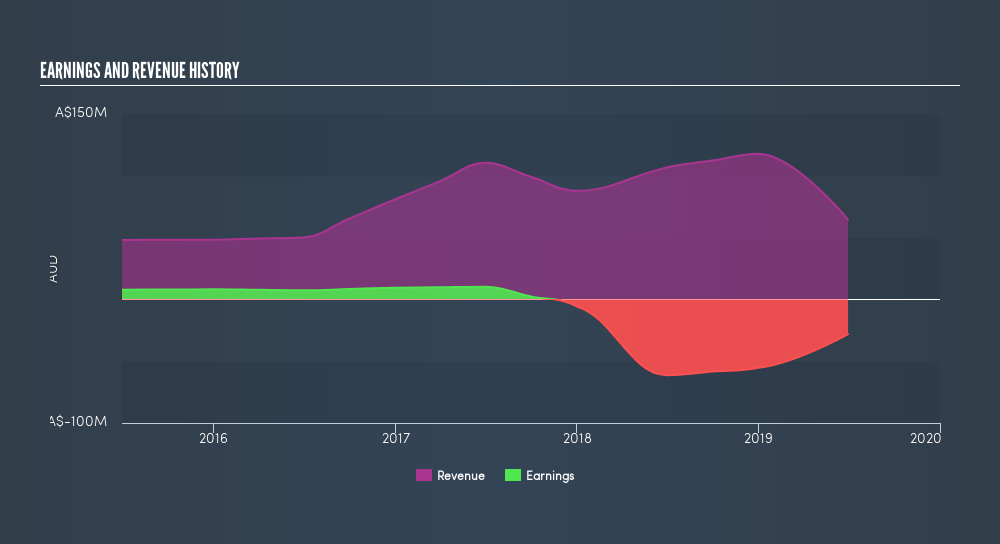

Because IncentiaPay is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on IncentiaPay's earnings, revenue and cash flow.

A Different Perspective

Investors in IncentiaPay had a tough year, with a total loss of 86%, against a market gain of about 8.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 51% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

IncentiaPay is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:EAT

Entertainment Rewards

Engages in the operation of an entertainment, lifestyles, and rewards platform in Australia and New Zealand.

Low and slightly overvalued.

Market Insights

Community Narratives