Over the past year, the Australian market has shown robust growth, rising by 8.5%, with earnings projected to increase by 14% annually. In this dynamic environment, dividend stocks that demonstrate consistent payouts and potential for earnings growth stand out as particularly appealing options for investors.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 6.67% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.89% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.99% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.61% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.58% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.32% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.72% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 8.09% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.18% | ★★★★★☆ |

| Australian United Investment (ASX:AUI) | 3.59% | ★★★★☆☆ |

Click here to see the full list of 26 stocks from our Top ASX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Harvey Norman Holdings (ASX:HVN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Harvey Norman Holdings Limited operates in integrated retail, franchise, property, and digital system sectors with a market capitalization of approximately A$5.58 billion.

Operations: Harvey Norman Holdings Limited generates revenue from various international retail segments, including A$982.46 million from New Zealand, A$204.83 million from Slovenia & Croatia, A$691.09 million from Singapore & Malaysia, A$237.17 million from non-franchised retail, and A$676.83 million from Ireland & Northern Ireland.

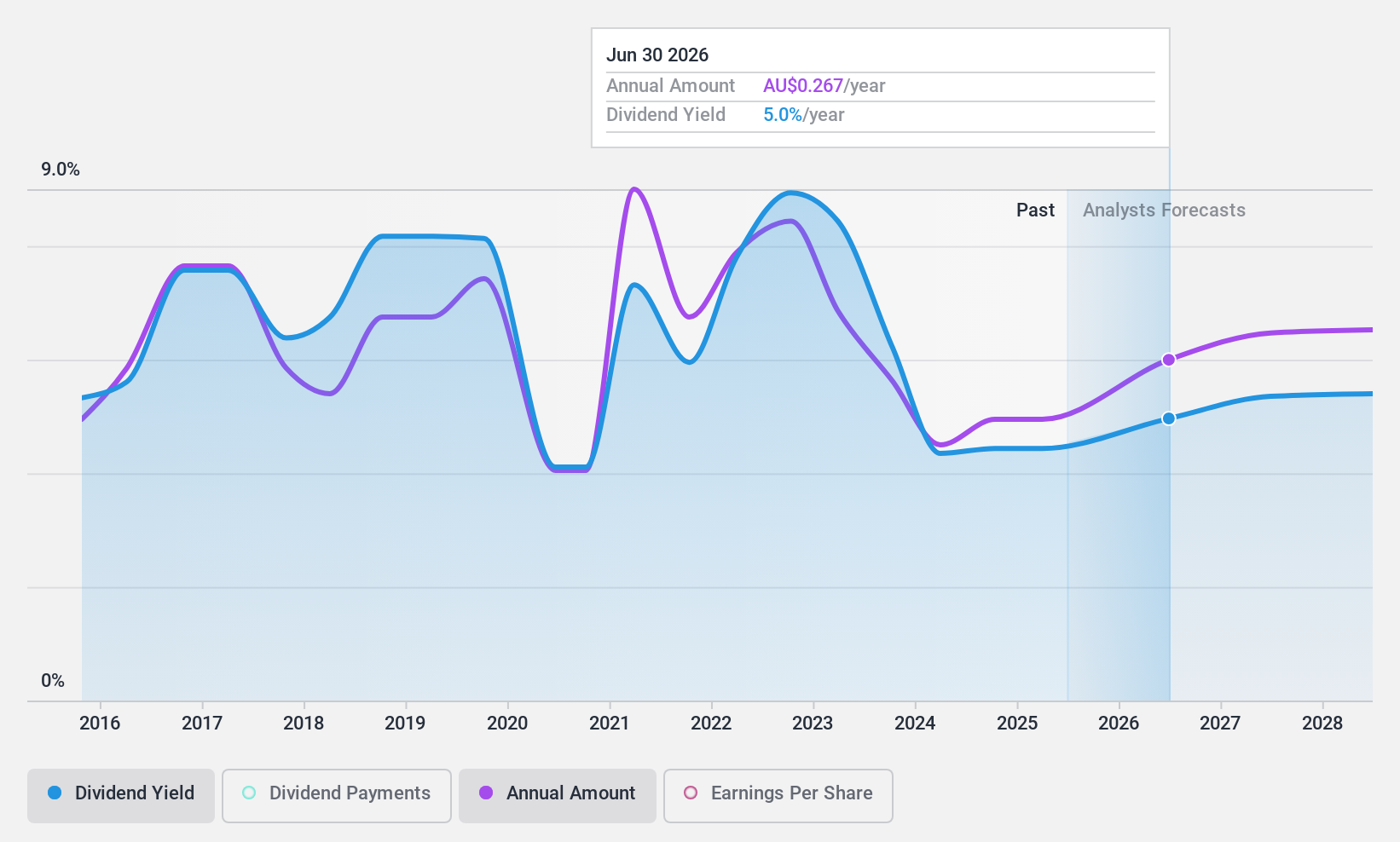

Dividend Yield: 4.5%

Harvey Norman Holdings has demonstrated a mixed track record in dividend stability, with significant fluctuations over the past decade. Despite this, its dividends are sustainably covered by earnings and cash flows, with payout ratios of 73.4% and 39.2% respectively. However, its dividend yield of 4.46% falls below the top quartile of Australian dividend stocks at 6.43%. Additionally, recent profit margins have declined to 13.4%, down from last year's 26.6%.

- Get an in-depth perspective on Harvey Norman Holdings' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Harvey Norman Holdings shares in the market.

JB Hi-Fi (ASX:JBH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Hi-Fi Limited operates a retail chain specializing in consumer electronics and home products, with a market capitalization of approximately A$6.39 billion.

Operations: JB Hi-Fi Limited generates revenue through its segments: JB Hi-Fi Australia (A$6.57 billion), The Good Guys (A$2.66 billion), and JB Hi-Fi New Zealand (A$0.28 billion).

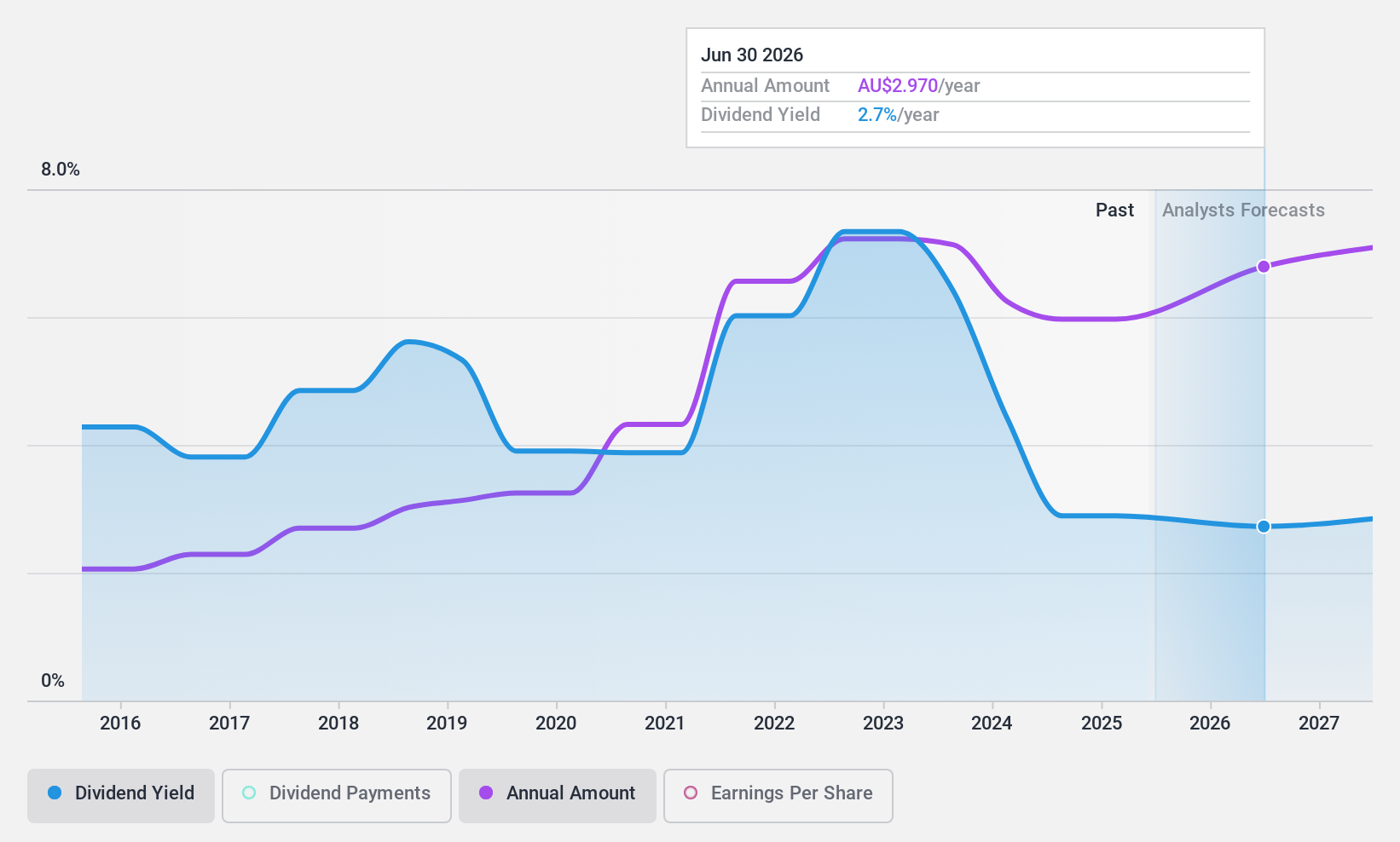

Dividend Yield: 4.7%

JB Hi-Fi has shown a mixed performance in dividend reliability, with unstable payments over the last decade despite a 10-year increase. Its dividends are supported by both earnings and cash flows, with payout ratios at 65% and 46.8% respectively. However, its current dividend yield of 4.67% is below the top quartile benchmark of 6.43% in Australia's market. Recent sales results indicate slight declines in JB Hi-Fi Australia and The Good Guys segments, contrasting with growth in JB Hi-Fi New Zealand.

- Click here to discover the nuances of JB Hi-Fi with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that JB Hi-Fi is trading beyond its estimated value.

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: nib holdings limited operates in Australia and New Zealand, providing private health insurance to residents, international students, and visitors, with a market capitalization of approximately A$3.65 billion.

Operations: nib holdings limited generates revenue primarily through its Australian Residents Health Insurance segment at A$2.55 billion, followed by New Zealand Insurance at A$351.90 million, with smaller contributions from NIB Travel and International (Inbound) Health Insurance segments at A$109.10 million and A$173.20 million respectively, along with Nib Thrive contributing A$38 million.

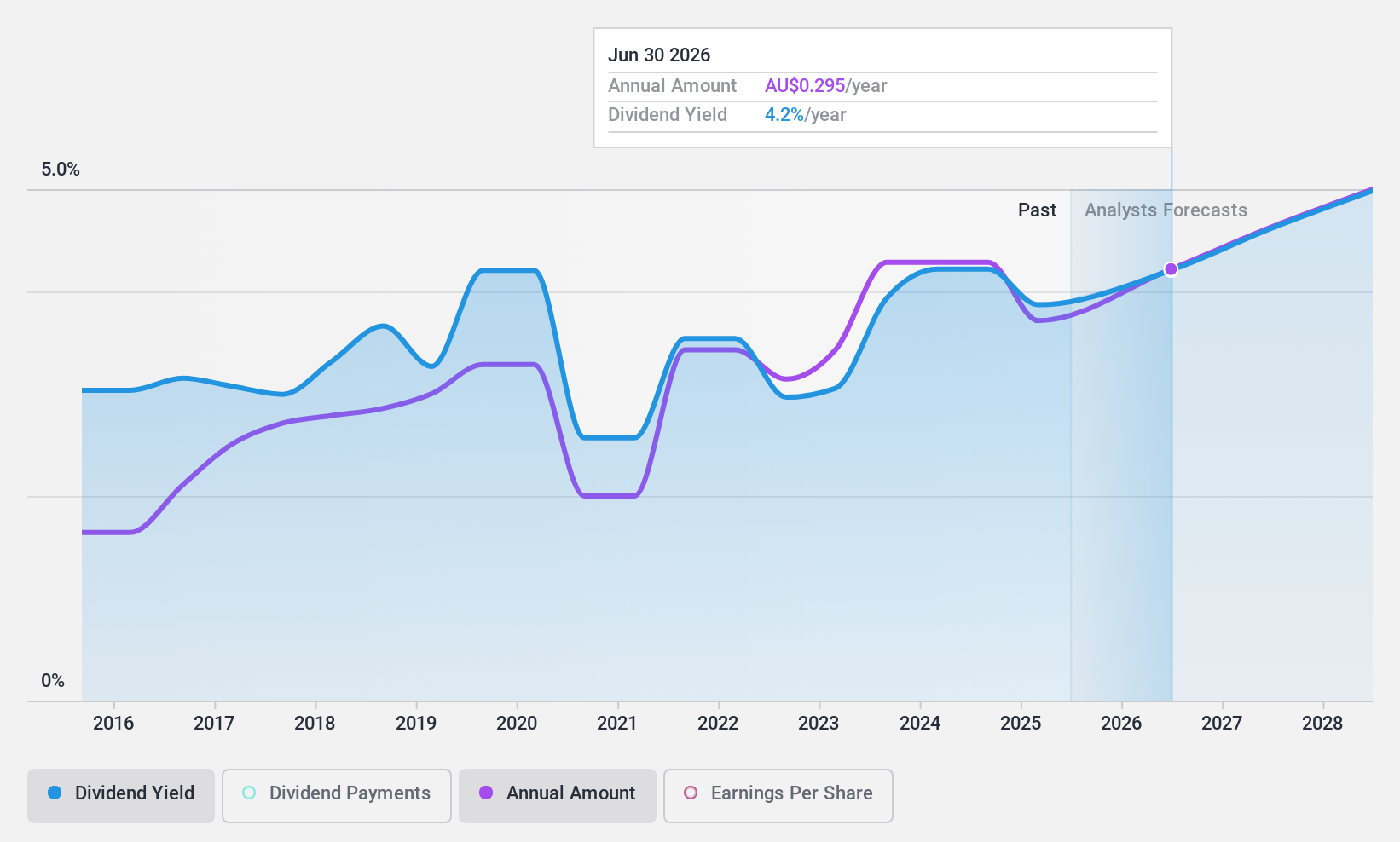

Dividend Yield: 4%

nib holdings has demonstrated a fluctuating dividend history, with significant drops in payments over the past decade. Despite this, the company's dividends are moderately covered by both earnings and cash flows, with payout ratios of 67.5% and 57.9% respectively. However, its current yield of 3.99% trails behind the top Australian dividend payers' average of 6.43%. Earnings have increased by an annual rate of 9.7% over five years, suggesting some underlying growth potential despite the dividend concerns.

- Click to explore a detailed breakdown of our findings in nib holdings' dividend report.

- In light of our recent valuation report, it seems possible that nib holdings is trading behind its estimated value.

Seize The Opportunity

- Embark on your investment journey to our 26 Top ASX Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NHF

nib holdings

Engages in the underwriting and distribution of private health, life, and living insurance to residents, international students, and visitors in Australia and New Zealand.

Flawless balance sheet with solid track record and pays a dividend.