- Australia

- /

- Professional Services

- /

- ASX:C79

ASX Growth Companies Insiders Are Investing In

Reviewed by Simply Wall St

As the ASX200 experiences a slight downturn, influenced by shifts in consumer discretionary stocks and banking shares, investors are closely monitoring sectors like Utilities and Materials, which have shown resilience. In this fluctuating market environment, growth companies with high insider ownership often capture attention as they can indicate confidence from those closest to the business's operations and prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medallion Metals (ASX:MM8) | 13.8% | 67.5% |

| Acrux (ASX:ACR) | 15.5% | 91.8% |

| IperionX (ASX:IPX) | 18.6% | 67% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.8% | 77.3% |

| Pointerra (ASX:3DP) | 23.8% | 126.4% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Let's uncover some gems from our specialized screener.

Accent Group (ASX:AX1)

Simply Wall St Growth Rating: ★★★★☆☆

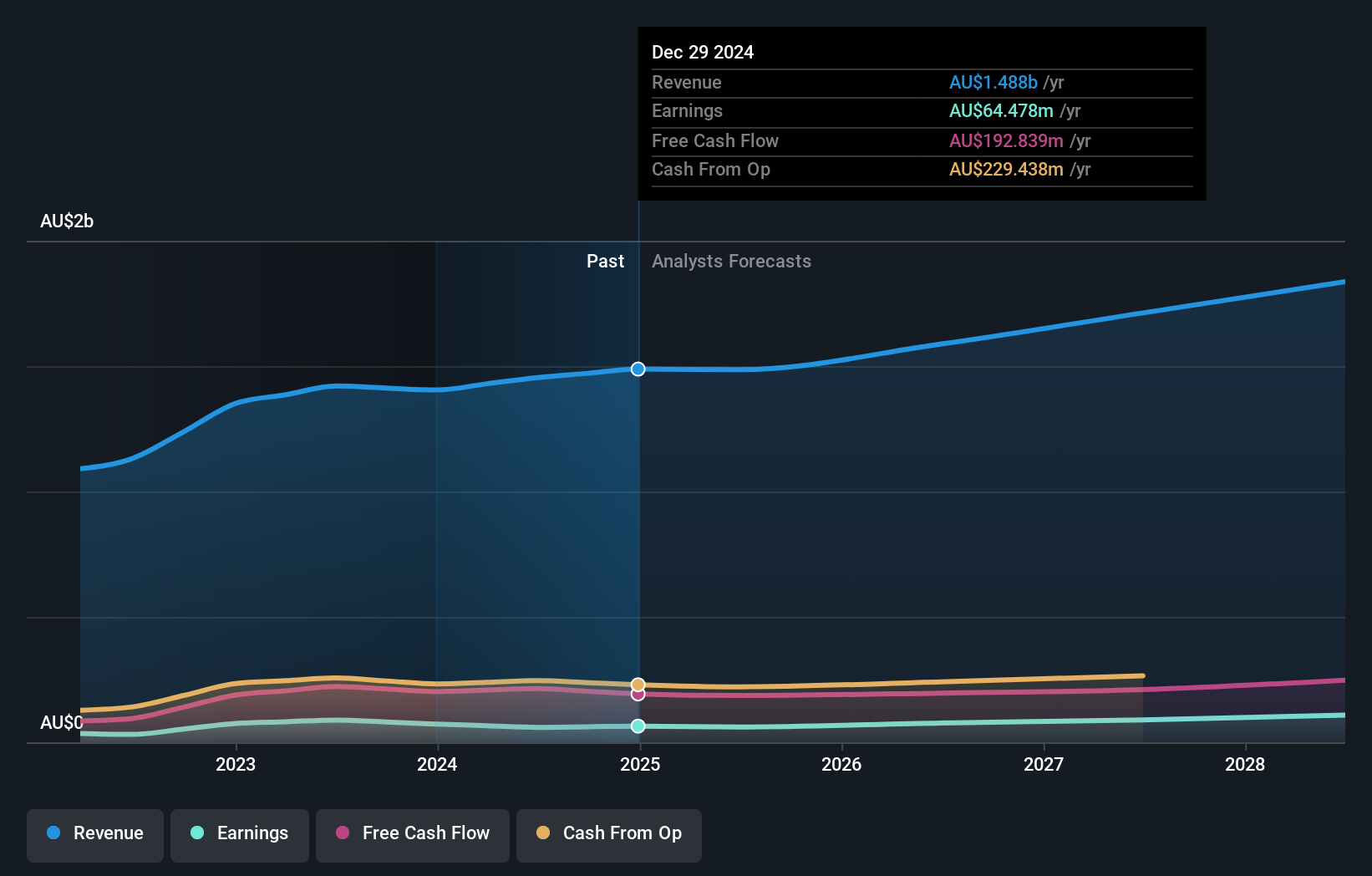

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market cap of A$1.19 billion.

Operations: The company's revenue is primarily derived from its retail segment, which generated A$1.27 billion, and its wholesale segment, contributing A$463.20 million.

Insider Ownership: 14.8%

Accent Group demonstrates growth potential with insider ownership, despite challenges. Recent earnings show a sales increase to A$775.96 million and net income rise to A$47.18 million, indicating steady performance. However, profit margins have decreased from 6.2% to 4.1%. Revenue growth is projected at 5.8% annually, slightly above the market average of 5.7%. The company trades significantly below estimated fair value and anticipates a strong return on equity of 23.7% in three years.

- Click here and access our complete growth analysis report to understand the dynamics of Accent Group.

- The valuation report we've compiled suggests that Accent Group's current price could be quite moderate.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

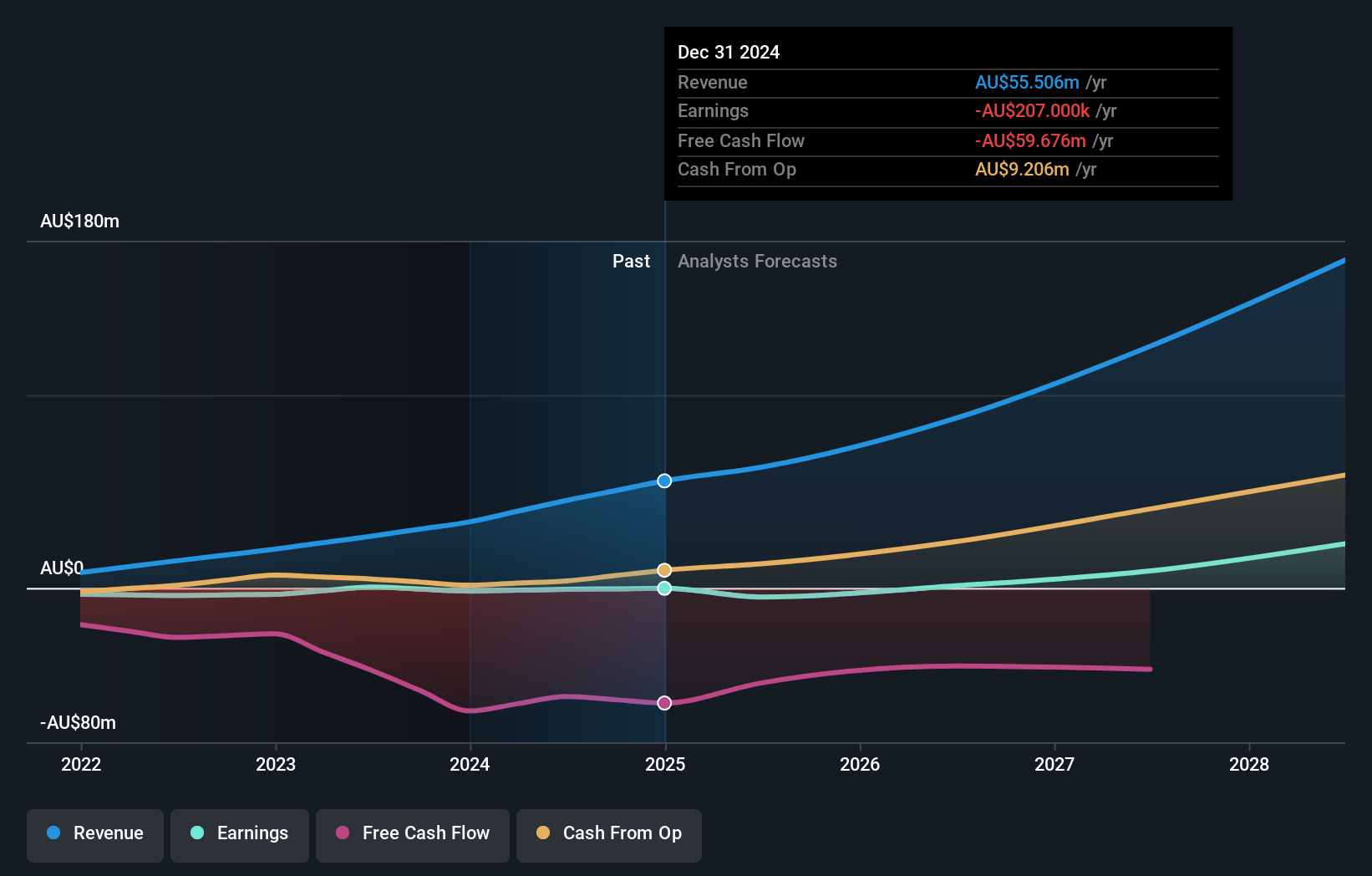

Overview: Chrysos Corporation Limited develops and supplies mining technology, with a market cap of A$576.11 million.

Operations: The company generates revenue primarily from its Mining Services segment, which amounts to A$45.36 million.

Insider Ownership: 20.1%

Chrysos shows strong growth potential with high insider ownership. Revenue is forecast to grow at 28.2% annually, significantly outpacing the Australian market's 6% growth rate. The company is expected to become profitable within three years, marking above-average market profit growth. Analysts agree on a potential stock price increase of 29%. Recent earnings calls indicate proactive financial communication, although no substantial insider trading activity was noted in the past three months.

- Click here to discover the nuances of Chrysos with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Chrysos is trading beyond its estimated value.

Cettire (ASX:CTT)

Simply Wall St Growth Rating: ★★★★★☆

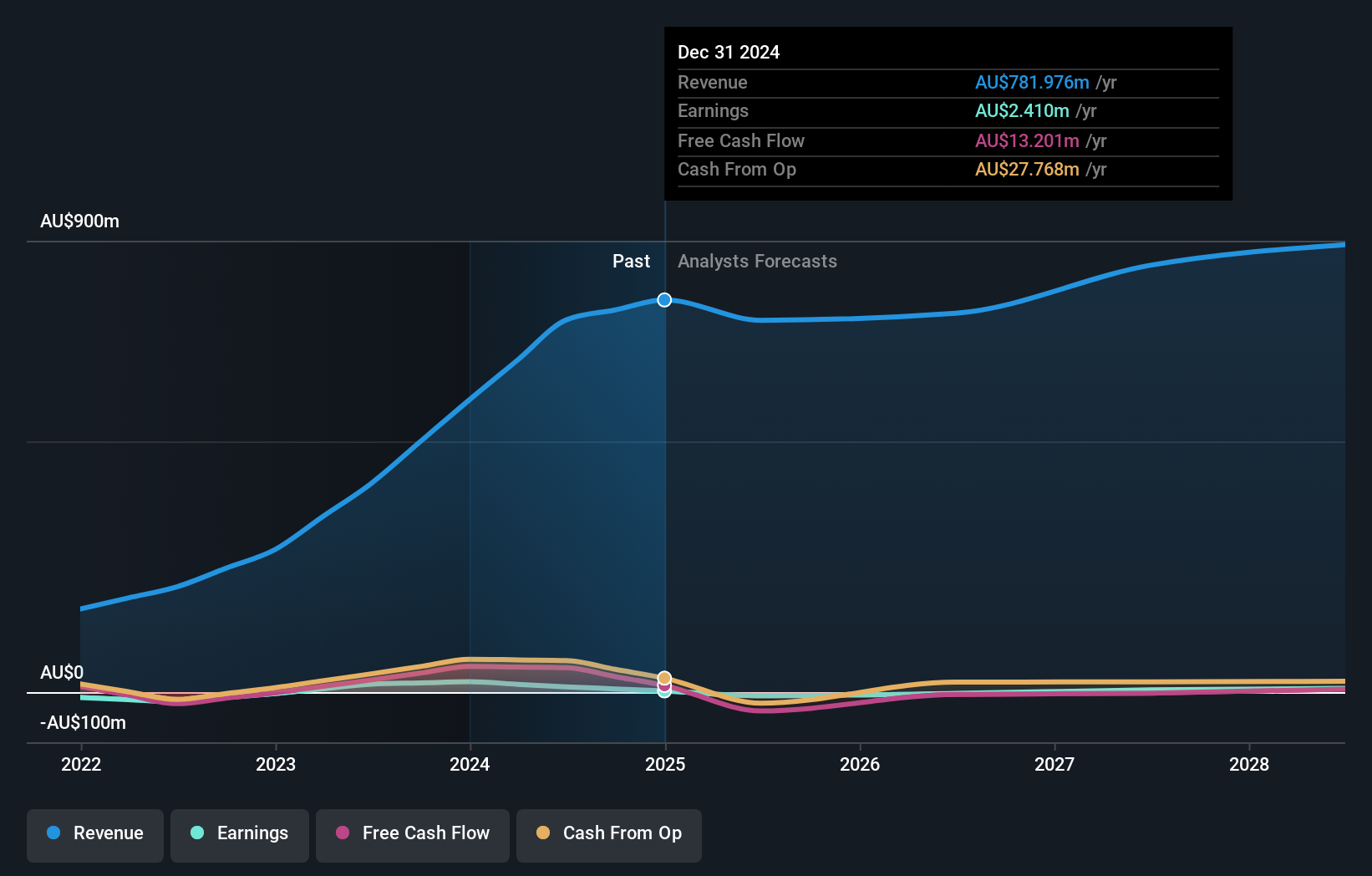

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally, with a market cap of A$459.39 million.

Operations: The company's revenue is primarily generated from online retail sales, amounting to A$742.26 million.

Insider Ownership: 33.5%

Cettire demonstrates robust growth prospects with significant insider ownership. Its earnings are expected to grow substantially at 31.7% annually, outpacing the Australian market's 11.4%. Despite a decline in profit margins from last year, Cettire trades at a substantial discount of 54.1% below its estimated fair value, suggesting potential upside. Revenue is forecast to grow by 14.6% per year, surpassing the broader market's growth rate but not reaching high-growth benchmarks of over 20%.

- Get an in-depth perspective on Cettire's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Cettire shares in the market.

Make It Happen

- Access the full spectrum of 95 Fast Growing ASX Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:C79

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives