- Australia

- /

- Specialty Stores

- /

- ASX:AX1

Shareholders May Not Be So Generous With Accent Group Limited's (ASX:AX1) CEO Compensation And Here's Why

Under the guidance of CEO Daniel Agostinelli, Accent Group Limited (ASX:AX1) has performed reasonably well recently. As shareholders go into the upcoming AGM on 19 November 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for Accent Group

Comparing Accent Group Limited's CEO Compensation With the industry

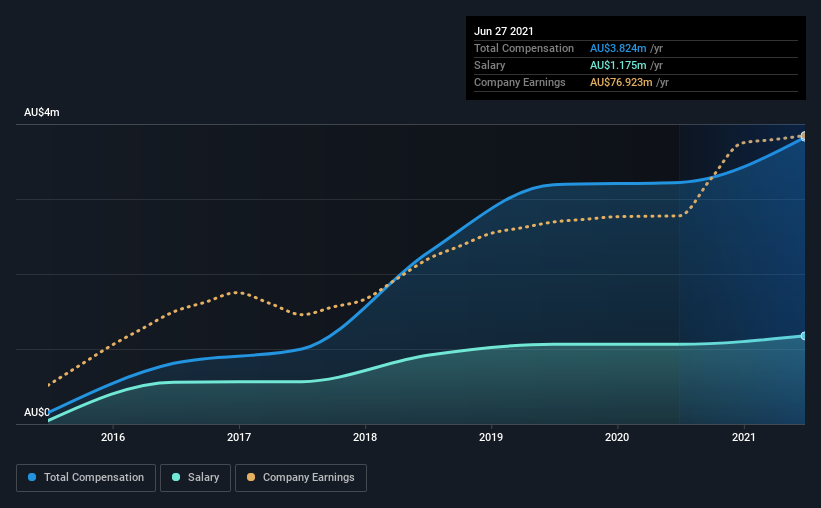

According to our data, Accent Group Limited has a market capitalization of AU$1.4b, and paid its CEO total annual compensation worth AU$3.8m over the year to June 2021. We note that's an increase of 19% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$1.2m.

In comparison with other companies in the industry with market capitalizations ranging from AU$548m to AU$2.2b, the reported median CEO total compensation was AU$1.8m. Hence, we can conclude that Daniel Agostinelli is remunerated higher than the industry median. Furthermore, Daniel Agostinelli directly owns AU$46m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$1.2m | AU$1.1m | 31% |

| Other | AU$2.6m | AU$2.2m | 69% |

| Total Compensation | AU$3.8m | AU$3.2m | 100% |

Speaking on an industry level, nearly 38% of total compensation represents salary, while the remainder of 62% is other remuneration. It's interesting to note that Accent Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Accent Group Limited's Growth Numbers

Accent Group Limited has seen its earnings per share (EPS) increase by 20% a year over the past three years. In the last year, its revenue is up 20%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Accent Group Limited Been A Good Investment?

Boasting a total shareholder return of 174% over three years, Accent Group Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 1 warning sign for Accent Group that investors should look into moving forward.

Important note: Accent Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)