Articore Group Limited's (ASX:ATG) Shares May Have Run Too Fast Too Soon

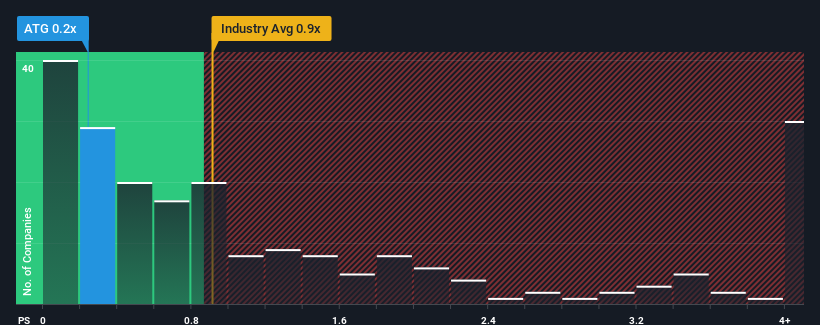

There wouldn't be many who think Articore Group Limited's (ASX:ATG) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Multiline Retail industry in Australia is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Articore Group

How Has Articore Group Performed Recently?

While the industry has experienced revenue growth lately, Articore Group's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Articore Group.How Is Articore Group's Revenue Growth Trending?

In order to justify its P/S ratio, Articore Group would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.2%. Still, the latest three year period has seen an excellent 33% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 1.1% per year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 4.1% growth per annum, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Articore Group's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Articore Group's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears that Articore Group currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Articore Group you should know about.

If these risks are making you reconsider your opinion on Articore Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ATG

Articore Group

Owns and operates online platforms that facilitates design and sale of products printed with the artwork in Australia, the United States, the United Kingdom, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives