- Australia

- /

- Retail REITs

- /

- ASX:RGN

How Investors May Respond To Region Group (ASX:RGN) Net Income Surge and Share Buyback

Reviewed by Simply Wall St

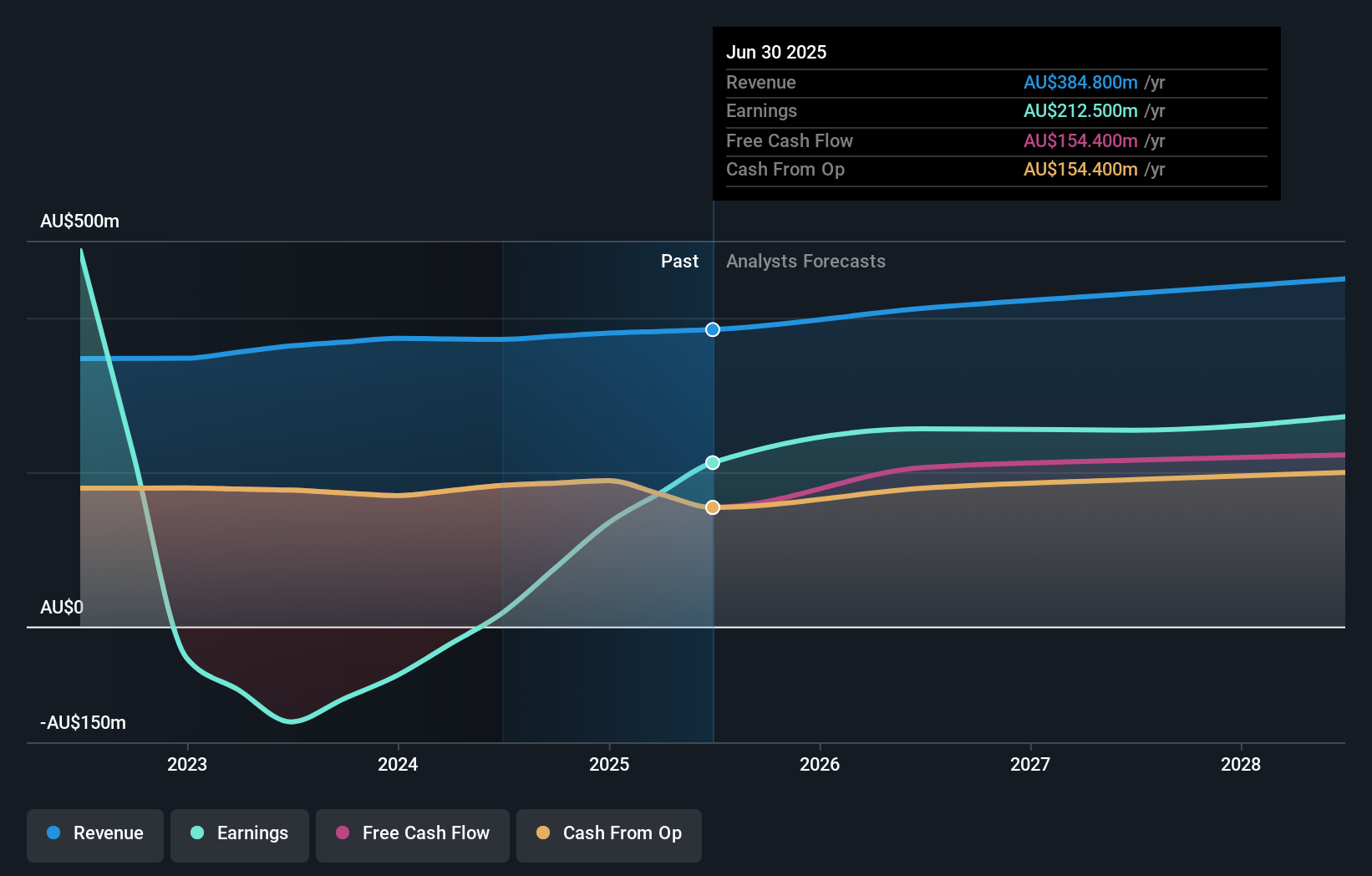

- Region Group recently reported its full-year results for the period ended June 30, 2025, with revenue rising to A$382.6 million and net income reaching A$212.5 million, alongside the completion of a 2.2 million share buyback and reaffirmation of its shareholder distribution strategy.

- This marked an exceptional increase in net income compared with the previous year, supported by continued confidence from management through buybacks and updated payout guidance.

- We'll look at how Region Group's earnings surge adds further weight to its investment narrative focused on resilient retail income streams.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Region Group Investment Narrative Recap

To be a shareholder in Region Group, you need to believe in its ability to generate resilient retail income streams while managing operational costs and tenant mix. The recent surge in net income, underpinned by updated payout guidance and an active share buyback, supports the primary catalyst of steady earnings but does not materially change the most pressing risk: elevated property expenses could still pressure margins if not carefully controlled.

The company's announcement of a 2.2 million share buyback completion stands out in this context, reinforcing its commitment to shareholder returns. While this move provides short-term confidence, investors will remain focused on whether recurring operating performance, not just one-off gains, can sustain improved profitability in the coming year.

Yet investors should be aware, by contrast, of the persistent risk from higher property-level expenses, as ...

Read the full narrative on Region Group (it's free!)

Region Group's outlook projects A$456.2 million in revenue and A$217.2 million in earnings by 2028. This assumes a 6.3% annual revenue growth rate and an A$83.1 million increase in earnings from the current A$134.1 million.

Uncover how Region Group's forecasts yield a A$2.42 fair value, in line with its current price.

Exploring Other Perspectives

Two recent fair value estimates from the Simply Wall St Community range from A$2.42 to A$2.65 per share. With many market participants focused on Region Group's drive for more stable retail income and efficiency gains, investor opinions can differ widely and you can explore several views.

Explore 2 other fair value estimates on Region Group - why the stock might be worth just A$2.42!

Build Your Own Region Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Region Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Region Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Region Group's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RGN

Region Group

An internally managed real estate investment trust (REIT) with 87 convenience-based retail properties, valued at $4,374 million.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives